Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file. What does the Form 1095-C look like.

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

What is Form 1095-B used for.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

What does a 1095 a form look like. Insurance companies in health care exchanges provide you with the 1095-A form. FAQ for IRS Tax Form 1095-B. The information on the form verifies that a person had minimum essential coverage as required by the Affordable Care Act.

The form helps the IRS administer premium tax credits if applicable for any employees who qualified and enrolled for coverage at a Health Insurance Marketplace rather than enrolling in their employer plan. By Webmaster Published January 27 2016. Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers gains and losses during a tax year.

About Form 1095-C Employer-Provided Health Insurance Offer and Coverage. You can view the Form 1095-C here. What does Form 1095-B look like.

A few months ago I wrote a piece on understanding the basics of the 1095 that has introduced people to what form 1095-C is. ALE members must report that information for all twelve months of the calendar year for each employee. The form will.

When filing taxes most people are required to report if they had M inimum. If you are new to the 1095 form Id encourage you to take a look. What does Form 1095-B look like.

Like the other forms this is filed by your insurer or employer. 1099-R RRB-1099 RRB-1099-R SSA-1099 - Distributions from pensions annuities retirement IRAs Social Security etc. Form 1095-B Health Coverage.

For your protection the form you receive may only show the last four digits of your SSN. Form 1095-B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year. What does Form 1095-C look like.

This form is furnished to those who had non-marketplace coverage or more than one coverage source. See a sample IRS Form 1095-B. The form does not.

1095-B forms are not required to be sent until 2016. You may see what this form looks like by visiting the website below. That means an employer with 50 or more full-time employees.

Form 1095-C is filed and furnished to any employee of an Applicable Large Employers ALE member who is a full-time employee for one or more months of the calendar. Like-Kind Exchanges Form 8824 Like-Kind Exchanges with cash or boot received For Form 1040 filers the 1099-S related income along with any other amounts required on these forms for other purposes will flow through Form 1040 based on the instructions for these forms and for Form 1040 found in the instructions for the respective forms. Your plan included benefits in addition to the essential health benefits required by the health care law like adult dental or vision benefits.

Form 1095-C is sent to those who worked full-time in 2018 for what the IRS calls an applicable larger employer. The amount of coverage you have. This form is needed to prepare for filing a federal tax return.

Line 2 is your Social Security number SSN. All kinds of people can get a 1099 form for different reasons. Box 5 shows the net amount of benefits paid for the year.

This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage. The monthly enrollment premium on Form 1095-A Part III Column A may be different from the monthly premium you paid. This doesnt always mean there are errors because.

PART I Lines 1 6 report information about you the employee. A 1099 form is a record of income. The information on Form 1095-B is used to complete your federal tax returns for 2015.

Employees will see this form by February each year. Form SSA-1099 is used to report any Social Security benefits that you may have collected during the year. Look for Form 1095-A If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February.

You could get the. What is IRS Form 1095-B. IRS Form 1095-B shows the months that HUSKY Health beneficiaries were enrolled in Medicaid or the Childrens Health Insurance Program CHIP.

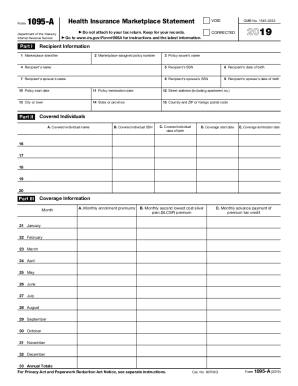

A copy of the 1095-B forms will be available in your PEAK account in the Mail Center for you or anyone in your household who was enrolled in Child Health Plan Plus CHP or a Health First Colorado program. What information is included on the three different parts of the form. The form provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy.

For example freelancers and independent contractors often get a 1099-MISC or 1099-NEC from their. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace. Form 1095-A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier.

It comes from the Marketplace not the IRS.