For example under CIGNA HealthCare and Aetna plans that cover elective abortion Mifeprex is covered along with related medically necessary services such as office visits ultrasounds and misoprostol. Health insurance policies cover many womens health services.

Does Health Insurance Pay For An Abortion Quotewizard

Does Health Insurance Pay For An Abortion Quotewizard

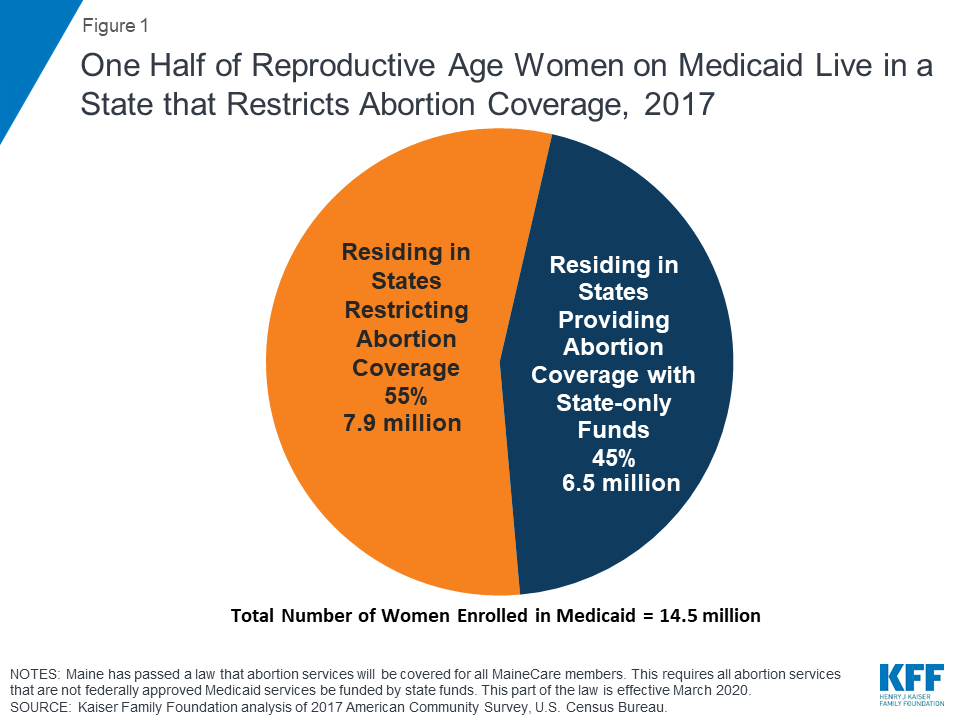

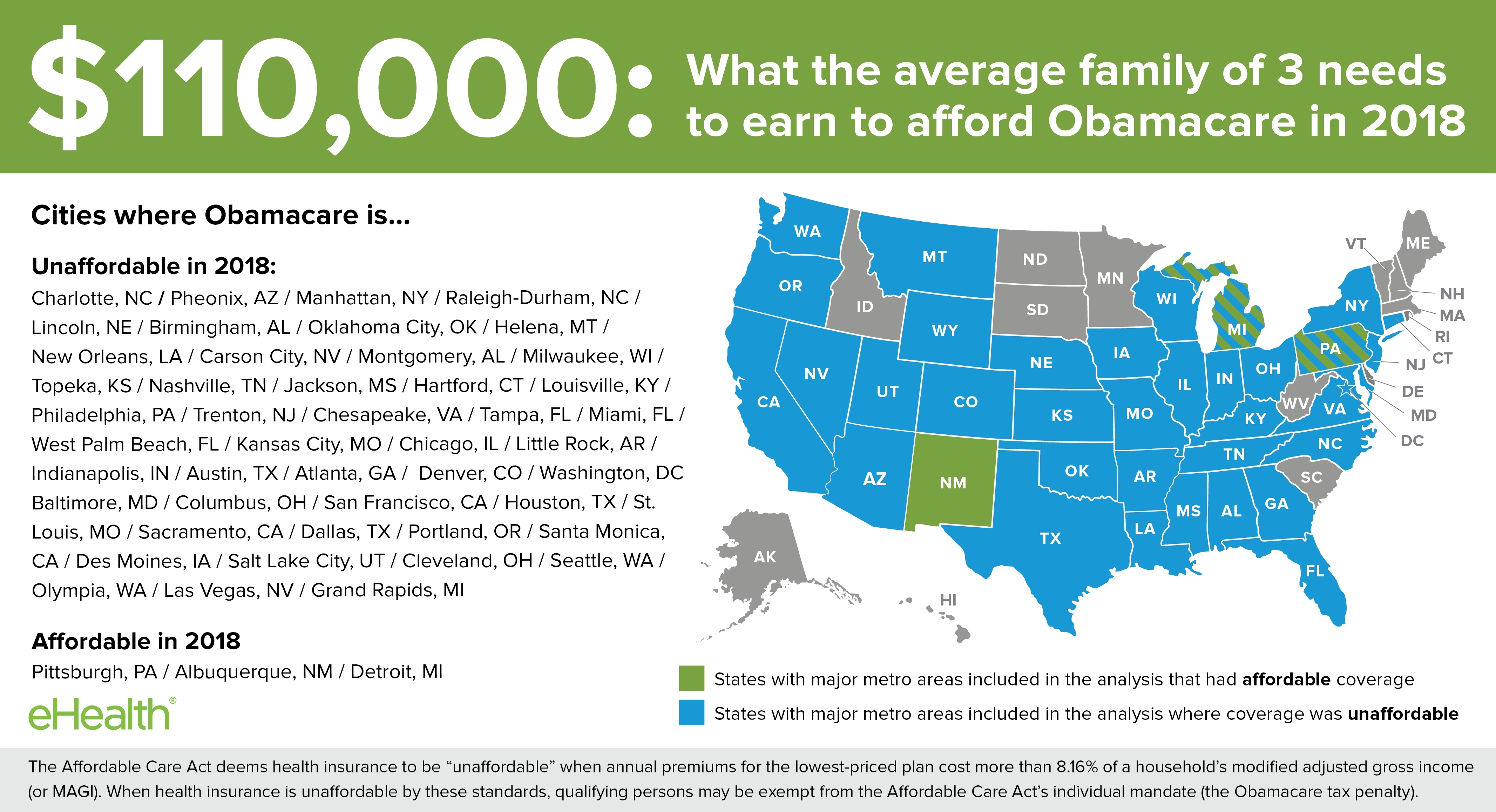

Abortion coverage varies based on health insurancewhether a person has insurance through Medicaid the Affordable Care Act ACA marketplaces a private employer-sponsored plan or another source.

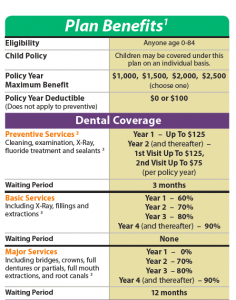

Does my health insurance cover abortion. However that is precisely what abortion does. The average cost of an abortion is 400- 800 and the cost may vary greatly depending on which state you live in and whether you qualify for a lower payment based on an income scale. State or government insurance is called Medicaid.

Where you live and how you are covered determine whether your health insurance will cover an abortion procedure. By requiring insurers to cover abortion the state set the standard that abortion is healthcare and insurers have to cover it accordingly. Some government health insurance plans like Medicaid in certain states cover abortion while others do not.

Will private insurance cover an abortion in Florida. Some insurance plans dont cover abortions. In Florida the Medicaid health insurance program does not cover abortion costs.

If abortion does not kill an innocent human being then it should be covered by health insurance. Or In the case where a woman suffers from a physical disorder physical injury or physical illness including a life-endangering. Medicaid is a government-run insurance program funded together by both the federal and state governments.

3 states require abortion coverage with no copayments. Your parents health insurance plan may not cover a dependent pregnancy or abortion. Bans on Insurance Coverage of Abortion.

However 11 states have laws that limit abortion coverage. While abortion is legal in the United States each state is permitted to have its own laws or restrictions regarding insurance plans and what they can or cannot cover. Most employer-based health insurance plans provide coverage for abortion but how much youll end up paying will vary more on that below.

A free ultrasound provides the positive proof of pregnancy needed to enroll in Medicaid for those who fall into any of these four coverage gaps. Your abortion may be free or low-cost with health insurance. The best way to find out if you have coverage for abortion services is to contact your health insurance provider.

The map below illustrates abortion insurance bans throughout the country. 11 states have laws in effect restricting insurance coverage of abortion in all private insurance plans written in the state including those offered through health insurance exchanges established under the ACA. If youve discovered that your health plan doesnt cover abortion youre likely to pay for it out-of-pocket.

Most Americans with employer-based heath insurance currently have coverage for abortion care. Abortion is covered when Medicare coverage criteria are met. But some plans do cover abortion.

Medicaid covers all or most medically necessary abortion in 16 states in the US. If the pregnancy is the result of an act of rape or incest. Furthermore depending on the state that you live in there may be laws that regulate whether abortion services are covered through Obamacare health insurance Medicaid or under a private health care policy.

However abortion coverage can vary based on your health plan. You can call your insurance provider directly to find out their policies. If you live in one of the states below click on the state name to be taken to the states MedicaidHealth and Human Services website for some instructions about how to enroll in Medicaid quickly.

Abortion is covered only under the following circumstances. You are too old to remain on your parents plan. Abortion is falsely referred to as healthcare in the media and in the culture.

We are told this vital procedure is necessary for womens health and should be covered by medical insurance. The ACA does not require health insurance plans to cover abortion services like in-clinic abortion and the abortion pill. 8 states limit coverage.

Unfortunately politicians across the country have been busy trying to take away this coverage. Most health insurers that cover abortion will also cover Mifeprex.

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)