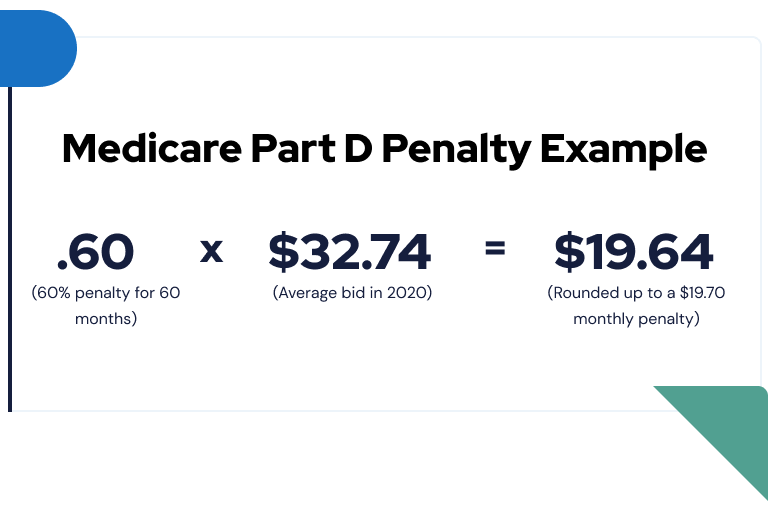

Currently the late enrollment penalty is calculated by multiplying 1 of the national base beneficiary premium 3274 in 2020 by the number of full uncovered months that you were eligible but didnt enroll in Medicare drug coverage and went without other creditable prescription drug coverage. It is calculated by multiplying 1 of the national base premium which is 41 by the number of uncovered months without creditable coverage.

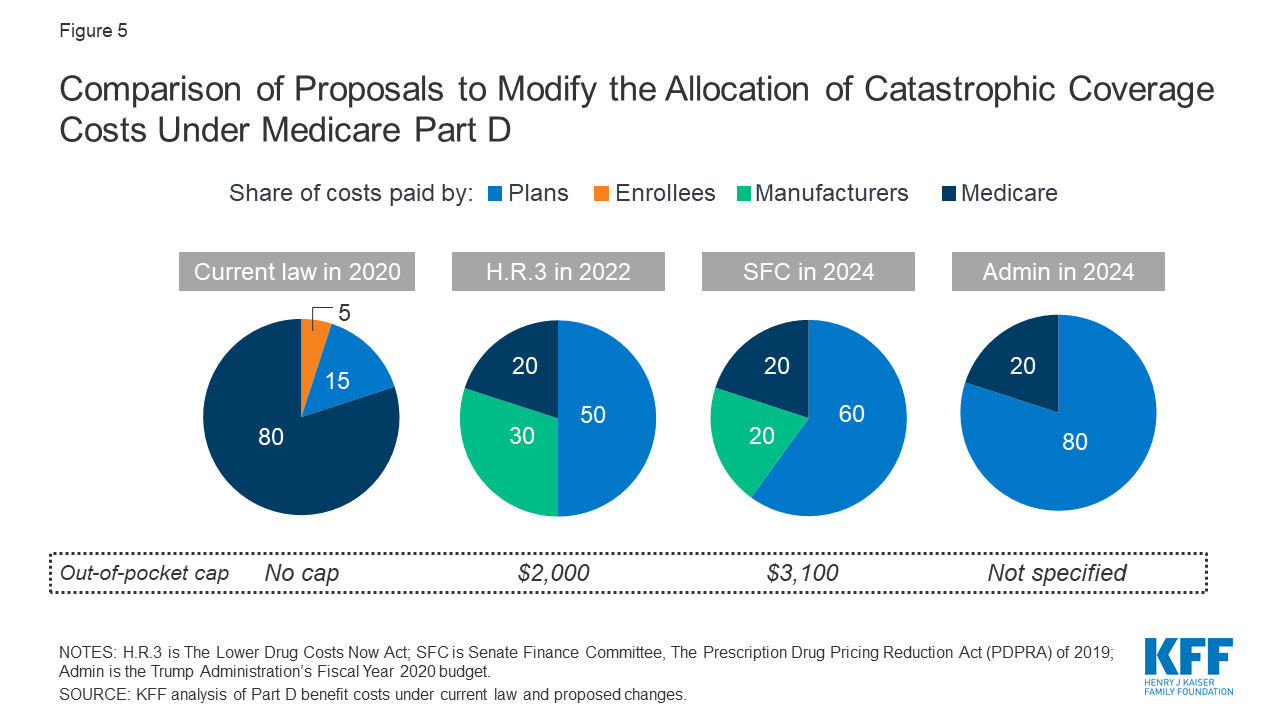

How Will The Medicare Part D Benefit Change Under Current Law And Leading Proposals Kff

How Will The Medicare Part D Benefit Change Under Current Law And Leading Proposals Kff

And the penalty increases the longer you go.

Penalty for not having medicare part d. How much is the Part D penalty. 3274 x 114 3732. In general youll have to pay this penalty for as long as you have a Medicare drug plan.

Learn how the Part D late enrollment penalty is calculated and more about the ways to avoid the penalty. The Medicare Part D penalty is based on the number of months you went without PDP coverage. If you were without Part D or creditable drug coverage for more than 63 days while eligible for Medicare you may face a Part D late enrollment penalty LEPThe purpose of the LEP is to encourage Medicare beneficiaries to maintain adequate drug coverage.

The national base beneficiary premium for 2020 is 3274. The penalty is 1 of the national base beneficiary premium 3306 in 2021 for every month you did not have Part D or certain other types. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage.

The penalty is rounded to 970 which youll pay along with your premium each month. You decided not to get Medicare Part when you turned 65 which was in February of 2011. For each month you delay enrollment in Medicare Part D you will have to pay a 1 Part D late enrollment penalty LEP unless you.

That means you havent had Part D drug coverage for 114 months. If you didnt get Part B when youre first eligible your monthly premium may go up 10 for each 12-month period you couldve had Part B but didnt sign up. This fee is 1 percent of the.

Visit our new httpspartdshopperco. Ron doesnt enroll in Part D because he isnt currently prescribed any medications. For each month without coverage you will pay an additional premium of 1 percent of the current national base beneficiary premium.

How long youve gone without creditable drug coverage The national base beneficiary premium for that year. The penalty is again added to your Part D monthly premium and is lifelong. If you wait past this window to enroll a late enrollment penalty for Medicare Part D will be added to your monthly premium.

In most cases youll have to pay this penalty each time you pay your premiums for as long as you have Part B. Ray joined a Medicare drug plan before the end of his Part D Initial Enrollment. He goes 48 months without Part D coverage.

Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. For 2021 the average beneficiary premium is 3306. The late enrollment penalty is added to your monthly Part D premium for as long as you have Medicare.

The Medicare Part D penalty is calculated using two different factors. Heres your Part D penalty calculation. For every month you dont have Part D or creditable coverage youre assessed a penalty of 1 of the national base beneficiary premium.

The penalty equals 1 of the national base beneficiary premium 3563 in 2017 times the number of months you didnt have Part D or creditable coverage. This is not a one-time penalty. Medicare calculates the late-enrollment penalty by multiplying the 1 penalty rate of the national base beneficiary premium 3306 in 2021 by the number of full uncovered months you were eligible to enroll in a Medicare Prescription Drug Plan but did not assuming.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Part B late enrollment penalty. Once you enroll in Part D youll pay this penalty.

Have creditable drug coverage Qualify for the Extra Help program Prove that you received inadequate information about whether your drug coverage was creditable. For each full uncovered month that the person didnt have Part D or other creditable coverage. The monthly penalty is rounded to the nearest 010 and added to the monthly Part D premium.