The Medicare Modernization Act requires all employers to provide written notice to Medicare-eligible individuals to notify those individuals on whether their plan provides prescription drug coverage that is creditable or as good as Medicare Part D coverage. This notice has information about your current prescription drug coverage with Employer Group and about your options under Medicares prescription drug coverage.

Model Creditable Coverage Disclosure Notice 071211

Model Creditable Coverage Disclosure Notice 071211

2020 Notice of Creditable Coverage Southern California IBEW-NECA Health Trust Fund September 20 2019 Page 2 FREQUENTLY ASKED QUESTIONS 1 If I am a retired Fund participant with prescription drug coverage through Kaiser Senior Advantage UnitedHealthcare Medicare Advantage HMO or UnitedHealthcare.

Medicare creditable coverage notice 2020. Protect the best years ahead. December 31 2019 for an effective date of January 1 2020. Archives - Creditable Coverage Guidance and Notices The Medicare Modernization Act MMA requires entities whose policies include prescription drug coverage to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug coverage.

You should receive it. Because you have creditable coverage under the GBP the Social Security Administration SSA has said that you will not have to pay a penalty if you join a private Medicare prescription drug plan later. This notice has information about your current prescription drug coverage with the City of Wisconsin Rapids and about your options under Medicares prescription drug coverage.

Medicare Part D Notice. This is called the notice of creditable coverage. Shop 2020 Medicare plans.

This allows individuals to make an informed decision about. Shop 2020 Medicare plans. If it is the employers coverage is creditable.

What should I do if I get this notice. Anzeige Find your best rate from over 4700 Medicare plans nationwide. 2020 Medicare Part D Notice of Creditable Coverage Important Notice from Your Employer About Your Prescription Drug Coverage and Medicare Please read this notice carefully and keep it where you can find it.

Entities that provide prescription drug coverage to Medicare Part D eligible individuals must notify these individuals whether the drug coverage they have is creditable or non-creditable. Creditable Coverage Model Notice Letters. Youll get this notice each year if you have drug coverage from an employerunion or other group health plan.

Protect the best years ahead. Creditable Coverage Letter Template for Employers 2020 Important Notice from Employer Group About Your Prescription Drug Coverage and Medicare Please read this notice carefully and keep it where you can find it. Medicare Part D Creditable Coverage Notice Reminder Due by October 14 2020 Posted on October 1 2020 A Medicare Part D plan provides prescription drug coverage under Medicare.

Each year there is an enrollment period that allows people with Medicare to enroll in private Medicare Prescription Drug Coverage. This notice will let you know whether or not your drug coverage is creditable When should I get it. Entities may modify the Model Disclosure Notices provided on this page under Downloads to notify affected individuals.

If you have an employer or union plan that provides prescription drug coverage the Medicare Modernization Act requires your insurance carrier to notify you whether you have creditable coverage. Medicare enrollment in the Medicare Part D Prescription Drug Plan was from October 2019 through December 2019. In simple terms the actuarial equivalence determination measures whether the employers coverage is on average at least as good as standard Medicare prescription drug coverage.

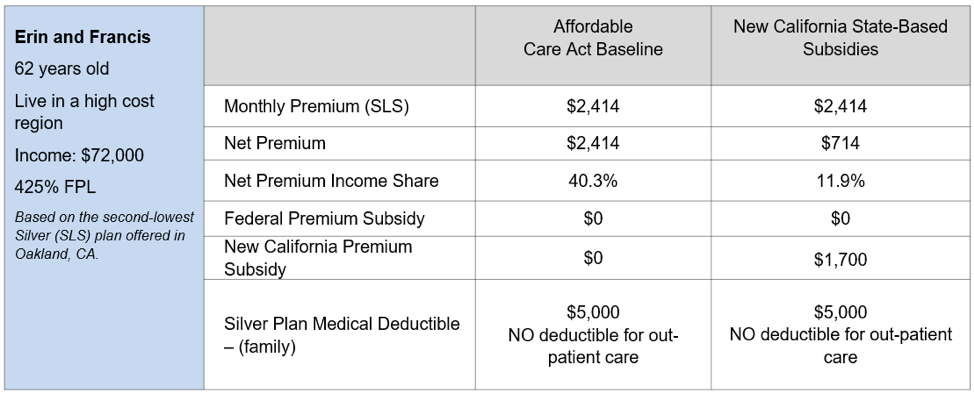

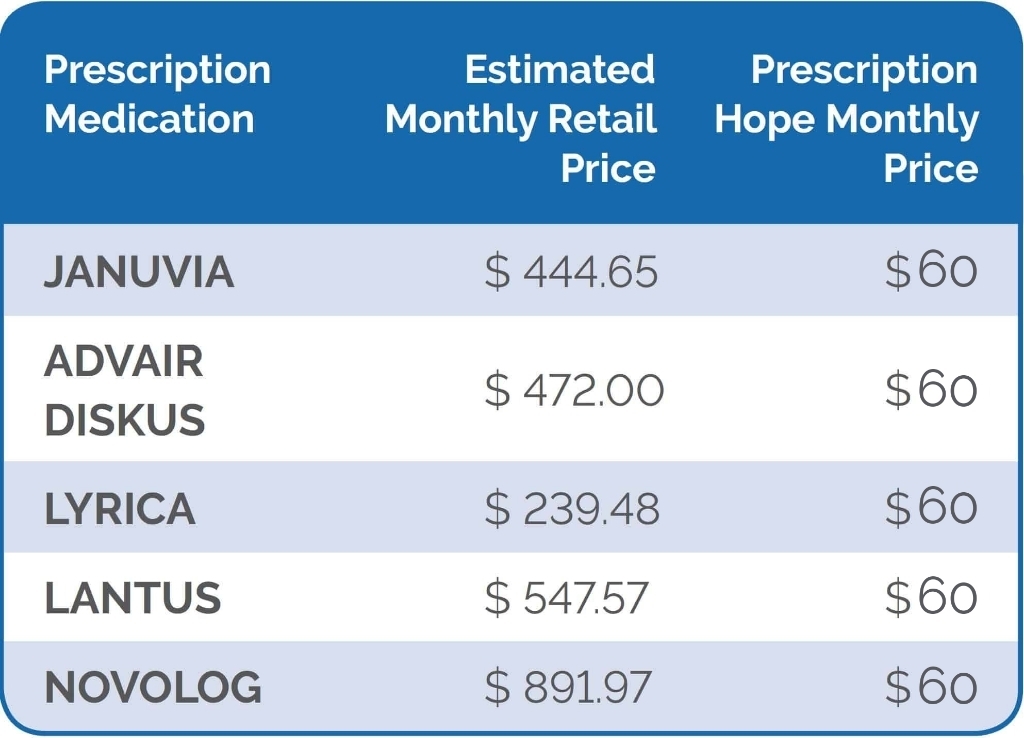

Creditable coverage means that the prescription drug coverage offered to you by the healthcare plan is on average as good as Medicare Part D coverage. 2020 Notice of Creditable Coverage Your Prescription Drug Coverage and Medicare Please read this notice carefully and keep it where you can find it. CMS has released the following 2020 parameters for the defined standard Medicare Part D prescription drug benefit.

This notice has information about your current prescription drug coverage with your employer and about your options under Medicares. Anzeige Find your best rate from over 4700 Medicare plans nationwide. PLEASE KEEP THIS NOTICE NOTICE OF CREDITABLE COVERAGE FOR PERSONS WITH MEDICARE WHO ARE COVERED BY THE NEW YORK STATE HEALTH INSURANCE PROGRAM NYSHIP This important notice is being sent to all NYSHIP enrollees to fulfill the annual creditable coverage notice requirements of the Medicare Prescription Drug Plan.

Although you will have a chance to enroll every year normally you. 14 Deadline Nears for 2020 Medicare Part D Coverage Notices Employers must provide notices to Medicare-eligible individuals offered a drug plan. About Your Prescription Drug Coverage and Medicare 2020 Notice of Creditable Coverage Please read this notice carefully and keep it where you can find it This notice has information about your current prescription drug coverage with the Wells Fargo Company Health Plan and your options under Medicares prescription drug coverage.