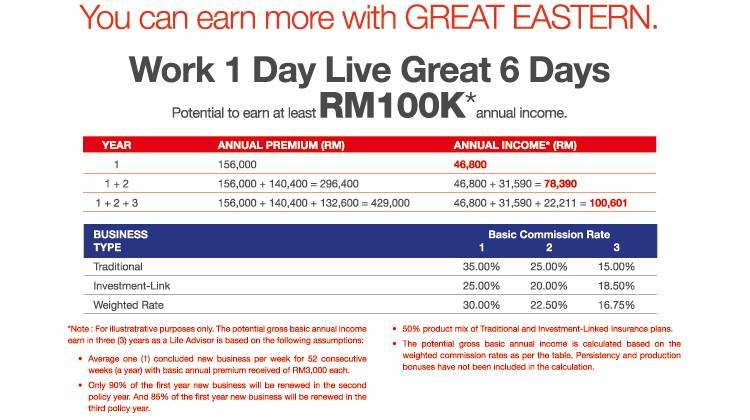

Override is a percentage of base commission and varies by how much volume an advisor does. HOW MUCH WOULD YOU LIKE TO EARN.

Close More Sales For Higher Commission Using The Wise Investment Calculator Elifetools Web Marketing And Lead Generation Tips Insurance Agents

Close More Sales For Higher Commission Using The Wise Investment Calculator Elifetools Web Marketing And Lead Generation Tips Insurance Agents

Commission calculation for benefits brokers can be complex.

Life insurance commission calculator. Consumers have the right to know how their agent is compensated for the. Turn on the advanced mode and youll see what happens to the base price when you either add or subtract the commission. Then click calculate to see a comparison of your current revenue and expected retirement value versus what it could be if you were on board with IOA.

Add the two together. You can calculator your commission by multiplying the sale amount by the commission percentage. You work with multiple insurance carriers and each of them pays a commission.

However for life insurance company the investable amount is less. In case of pension plans the commission is limited to 75 per cent of the first years premium and 2 per cent there on. The amount paid and the split percentage can be based on many variables.

Life insurance commissions have been a recent hot topic in the Canadian personal finance community. Renewal commissions average about 5 of the base whole life premium paid. Then only it is meant that your IRR the way returns are calculated will be 7.

The payment is then split between the agency and the producer. Every company is different but life insurance agents may make 40 to 90 percent in commission of the first year premium on term life insurance. For instance if you earn 50000 a year you would require about 500000 worth of life insurance benefits in the event of death.

Base commission is fixed per product per company and is effectively a percentage of 1st years annual premium. The calculator will automatically tabulate your commission for each policy type as well as an overall total at the bottom of the page. Overrides typically range between 100 to 180.

Life insurance commissions have two tiers the base commission and the override. Currently most of the policies are very much paying these kind of commissions. Commissions vary by policy and.

Let us quickly look some of the facts on Life Insurance. Micro Insurance Agent Revised Working Hours of All Offices of LIC Of India from 10052021 pursuant to Notification SO1630E Dated 15th April 2021 wherein the CENTRAL GOVERNMENT has Declared Every Saturday as a Public Holiday for Life Insurance. Whole life insurance policies do pay renewal commission to life insurance agents.

23 Zeilen How insurance commissions work. Therefore for life insurance company to generate 7 return to YOU it has to generate more than 7. MONTHLY TARGET INCOME RM Select your monthly target income from the options below.

How to Simplify Commission Calculation for Insurance. Enter a premium amount in the appropriate box for one or more of the three policy type sections. Because they have to pay to agents forget about other expenses.

Calculate your commission. Commission calculator does a very simple calculation for you - it calculates the percentage-based remuneration. This is a percentage of the base whole life premium that the insured pays each year.

However this method is very simplistic and assumes a one-size-fits-all approach. Agents will receive a large upfront commission based. As with any Omni calculator it can calculate either way - start filling in any fields and the other ones will be calculated for you.

Here are some real life. The commission paid is limited to 2 per cent in case of single premium policies. 2500 3500 5000 7500 10000 15000 20000.

Take the premium paid on an insurance policy and multiply it by your base commission amount. Many life insurance agents receive sales commissions for the products or services they sell to clients. Then take the premium and multiply it by your override amount.

To use the calculator enter your current book of business in the top left boxes and enter an estimate of where you expect to be at retirement in the fields on the bottom left side. This calculator will help you calculate your commission on insurance policies sold through The Standard. Theres nothing to worry about.

Top ranking producers may even get 100 of the full premium in the first year as commission and often 2 to 5 commission from the second to the fourth year. But then it starts to get interesting and oftentimes unmanageable. A quick rule of thumb for measuring your life insurance needs is to multiply your current annual income by a factor between 10 and 15.

Certain types of policies pay more first year commission FYC than others and this creates the potential for some unscrupulous advisors to give bad advice to their unassuming clients. In other words if you make a sale for 200 and your commission is 3 your commission would be 200 03 6.