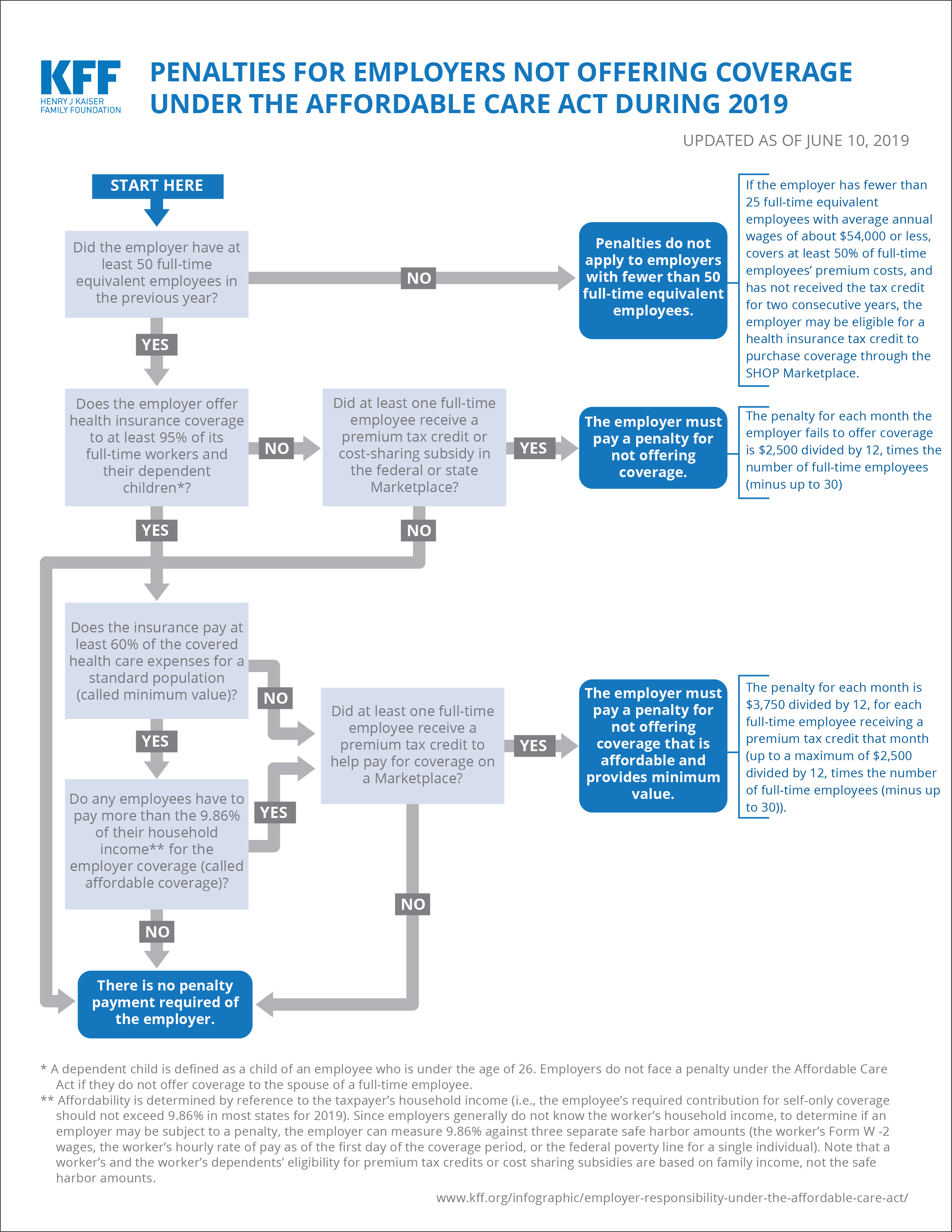

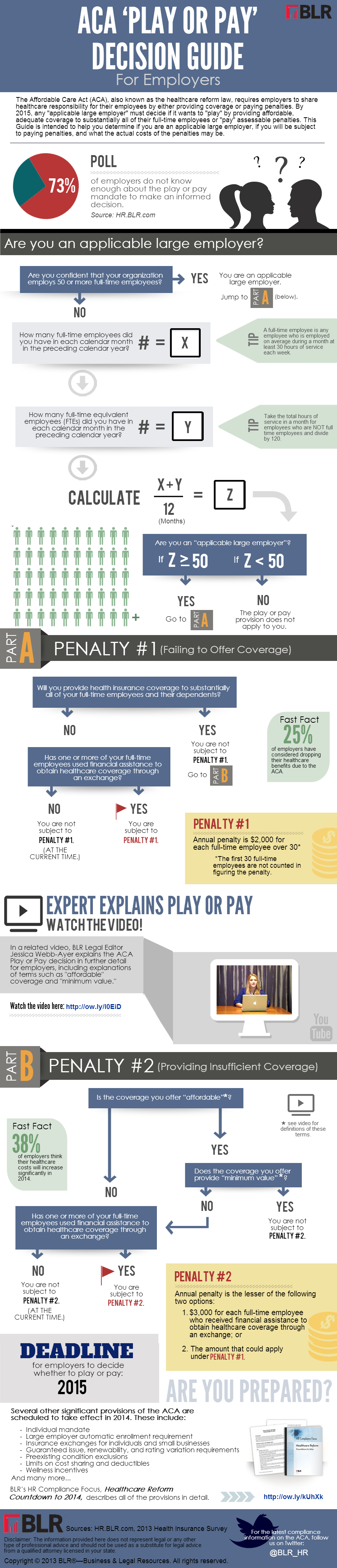

If you determine that your company is indeed an ALE then you are subject to the Employer Shared Responsibility Section 4980H of the Internal Revenue Code provision. In general the employer penalty rules apply to.

Aca Play Or Pay Decision Guide Infographic Hr Daily Advisor

Aca Play Or Pay Decision Guide Infographic Hr Daily Advisor

Upload your Data Securely using Excel or CSV file format.

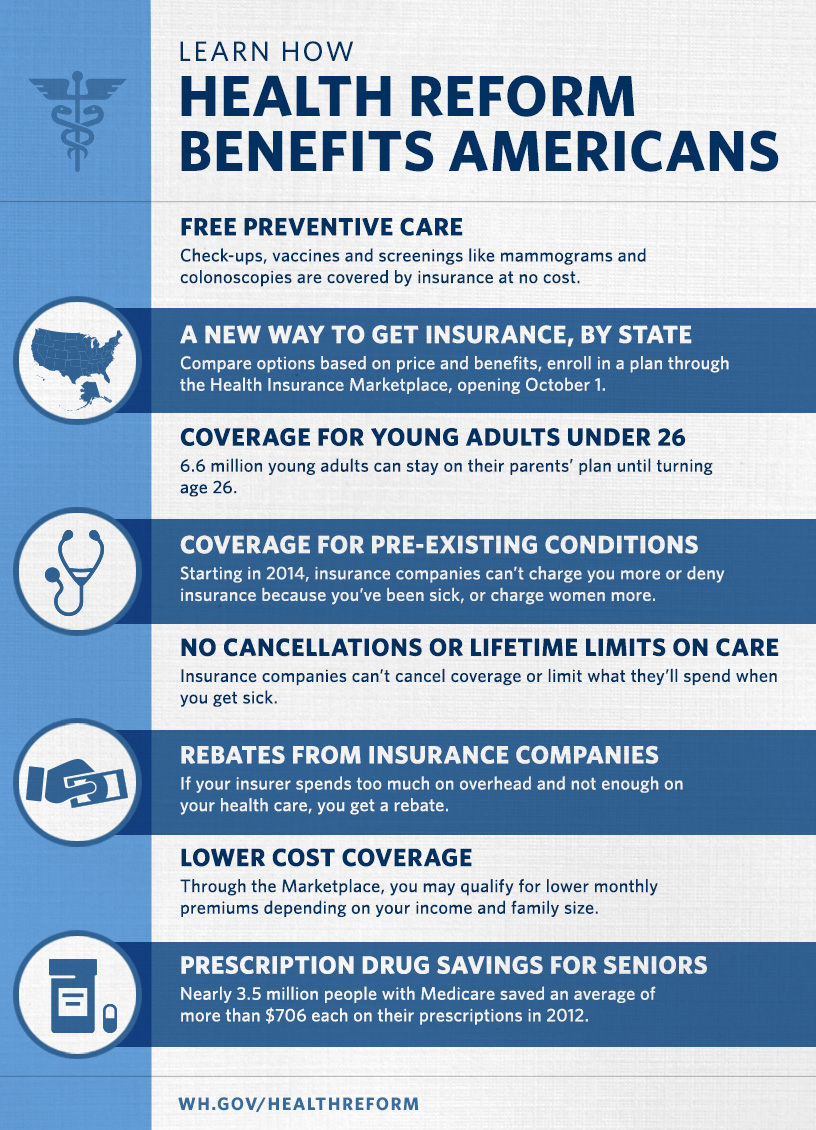

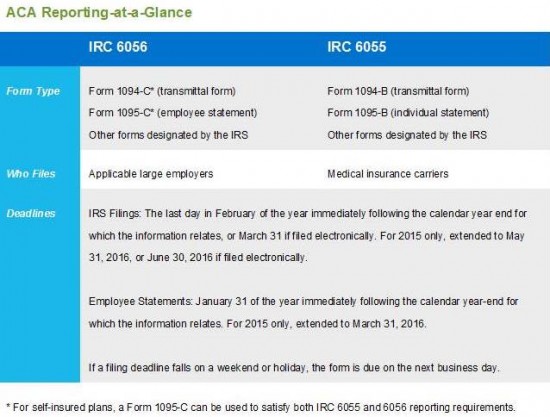

Aca requirements for large employers. Employers had until March 2 2020extended from January 31 2020to provide employees with copies of their Forms 1095-B or 1095-C. Individuals enrolled in the marketplace employers who sponsor self-insured coverage and applicable large employers must file with the IRS. Employers must offer health insurance that is affordable and provides minimum value to 95 of their full-time employees and their children up to the end of the month in which they turn age 26 or be subject to penalties.

ALEs must offer Minimum Essential Coverage MEC that meets ACA requirements to at least 95 of full time employees and their eligible dependent children. The IRS Section 6056 states that Applicable Large Employers must provide minimum essential coverage to their full-time employees and report that to the IRS and furnish statements to their employees. There are specific considerations with this 50-or-more employee calculation which is covered below.

Many employers distributed these forms in conjunction with. The ACA requires that large employers defined as those with 100 or more full-time or full time equivalent FTE employees must offer health insurance or coverage beginning January 1 2015. That total number is calculated as follows.

ACAwise will perform data validations to prevent errors. More In Affordable Care Act. States on your behalf.

For example applicable large employers have annual reporting. This is known as the employer mandate. ALEs must use Forms 1094-C and 1095-C to report their health coverage information offered to their employees under section.

The Affordable Care Act or health care law contains benefits and responsibilities for employers. A Simplified ACA 1094 and 1095-B 1095-C ReportingProcess for Employers. A full-time employee under the ACA is one that works 30 hours per week or a total of 130 hours per month.

The size and structure of your workforce determines what applies to you. ACA Requirements for Employers The requirements of the ACA apply based on the number of employees a business had in the prior calendar year. Large employers with 100 or more employees about 2 percent of employers.

The ACA does not require employers to offer health benefits to their employees. For help with determining the size of your workforce each year see our page on. Company X employs 40 workers who work 40 hours per week or a total of 160 hours per month.

However ACA 1095 reporting requirements vary depending on the type of coverage offered. Number of full-time employees The number of employees who provide services an average of 30 hours or more per week or 130 hours or more per calendar month. ACA Reporting Requirements under Section 6056.

ACA Reporting for Applicable Large Employers ALEs The biggest impact with the ACA reporting requirements is with applicable large employers ALEs with 50 or more full-time or full-time equivalent employees. ALEs with 100 or more full-time employees including FTEs starting in 2015. All employers that employ at least 50 full-time employees including FTEs are subject to the ACAs pay or play rules including for-profit nonprofit and government employers.

What is the definition of full-time equivalent. Some of the provisions of the Affordable Care Act or health care law apply only to applicable large employers generally those with 50 or more full-time employees including full-time equivalent employees. Study With an ICAEW Partner In Learning.

This company employs 40 full time employees therefore it does not qualify as an ALE. At ACAwise we take care of preparing your ACA Forms 1095-B and 1095-C with codes for each employee and e-file them with the IRS and the. The employer shared responsibility requirements are applicable.

ACA Requirements and ALEs. An employers size is determined by the number of its full-time employees including full-time equivalents. Ad Learn From Qualified Accountants With Academic Industry Experience.

Affordable Care Act Tax Provisions for Large Employers.