Drugs are listed by common categories or class. Food and Drug Administration FDA.

My Drug Tier List 2020 Youtube

My Drug Tier List 2020 Youtube

By law a Medicare drug formulary is required to include a certain number of options to treat specific conditions.

What tier is my drug. Use Tier 2 drugs instead of Tier 3 to help reduce your out-of-pocket costs. Tier 1 Lowest-cost prescription generic and some over-the-counter OTC drugs. Some of these are generic versions of brand-name drugs.

However there may be instances when only a Tier 3 drug is appropriate which will require a. Preferred Generic Tier 1 Non- Preferred Generic Tier 2 Preferred Brand Tier 3 Non-Preferred Brand Tier 4 Preferred Specialty Tier 5 and Non-Preferred Specialty Tier 6. Your physician may have the option to write you a prescription for a Tier 1 Tier 2 or Tier 3 drug as defined below.

Böhmische Liebe Tatjana Steinwachs Steirische Harmonika. Generally each drug is placed into one of up to six member payment tiers. All covered drugs are placed into one of three tiers.

Each covered drug is in 1 of 5 drug tiers. Humana is a Medicare Advantage HMO PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. However there may be instances when only a Tier 3 drug is appropriate which will require a higher copayment.

Brand-name drugs may also be included. Preferred Generic Tier 1 Non-Preferred Generic Tier 2 Preferred Brand Tier 3 Non-Preferred Brand Tier 4 Preferred Specialty Tier 5 and Non-Preferred Specialty Tier 6. A mix of brand-name and generic drugs.

Also may include higher-priced generics that have more costeffective - options at lower tiers. These drugs are considered specialty drugs. These drugs offer a medium co-payment and are often brand name drugs that are usually more affordable.

Please noteWhere differences are noted between this PDL and your benefit plan documents the benefit plan documents will rule. It includes both brand and generic prescription medications approved by the US. Your medicines may be split up into 3-tier 4-tier or 5-tier groupings according to your insurance plan.

Tier 2 Mid-range cost Medications that provide good overall value. Generic drugs are just as safe as brand-name drugs the only difference is the name and how much money youre saving. Drugs may also be on this tier because they are preferred among other drugs that treat the same.

If you need help or have any questions about your drug costs please review your Evidence of Coverage or call UnitedHealthcare Customer Service. 6 Zeilen The easiest way to find out what tier your drugs are in is by using your plans drug list. View your PDL to learn whats covered by your plan.

Tier 3 Highest-cost Medications that provide the lowest. These drugs have the highest co-payment and are often brand-name drugs that have a generic version available. What if my medicine is not on the Drug List.

You can access the drug search tool Drug Pricing Tool under Tools Resources at the bottom of the page. My Drug Tier List - YouTube. This list shows prescription drug products in tiers.

The chart below shows the differences between the tiers. They are placed into cost levels known as tiers. A Prescription Drug List PDL also called a formulary is a list of commonly used medications organized into cost levels called tiers.

Check your PDL to stay updated on your pharmacy coverage. These drugs offer the lowest co-payment and are often generic version of brand name drugs. The formulary is divided into levels called tiers The tiers are based on the cost of the medicine.

Tier 1 The cheapest prescription drugs available to you typically limited to generic drugs. Medicines are typically placed into 1 of 5 tiersfrom Tier 1 generics to Tier 5 highest-cost medicinesdepending on their strength type or purpose. Your physician may have the option to write you a prescription for a Tier 1 Tier 2 or Tier 3 drug as defined below.

Generally each drug is placed into one of up to six member payment tiers. Each tier has a copay or coinsurance amount. Your health care provider can also ask Humana to make an exception.

If playback doesnt begin shortly try. The guidelines below will help give you a general overview of drug tiers typically work. The amount you pay each time you fill a prescription depends on the tier the medicine is in.

Humana is the brand name for plans products and services provided by one or more of the subsidiaries and affiliate companies of Humana Inc. TIER 1 Lower copayment Drugs that offer the greatest value compared to others that treat the same conditions. Enrollment in any Humana plan depends on contract renewal.

Our contact information is on the cover. These costs are decided by your employer or health plan. TIER 2 Medium copayment Brand-name drugs that are generally more affordable.

Tier 2 Prescription generic and some OTC drugs. Tier 3 Brand drugs that dont have a generic available. Use Tier 1 drugs for the lowest out-of-pocket costs.

All covered drugs are placed into one of three tiers.

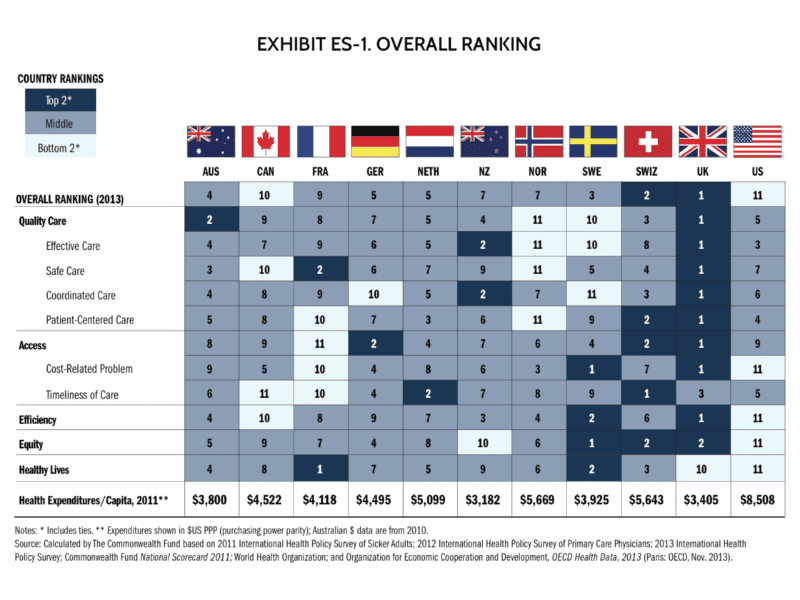

Ranking Best Health Care Systems In The World By Country

Ranking Best Health Care Systems In The World By Country /GettyImages-488335473-56fb22633df78c7841a13e95.jpg)