A deductible is the portion of an insurance claim that the insured pays out of. Contribution Calculator Annual HSA Contribution Calculator.

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

The deductible is the amount of money a plan member must spend from hisher pocket before coverage kicks in.

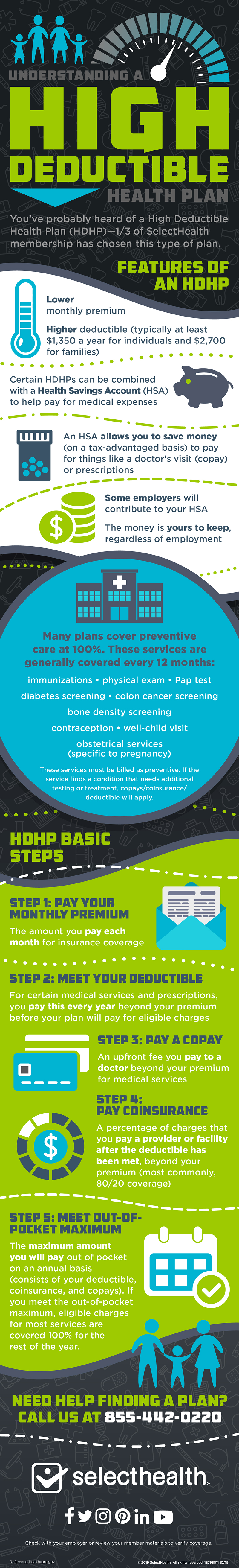

What is hdhp coverage. High-deductible insurance is considered a type of consumer-driven health plan so you may hear the term CDHP used in conjunction with these plans. HDHPs are any healthcare plan which requires an individual deductible of 1350 or more or 2700 for a family. High Deductible Health Plan HDHP A plan with a higher deductible than a traditional insurance plan.

An HDHP is a high deductible health plan A CDHP can be an HDHP but an HDHP is not always a CDHP. HDHPs are a relatively new approach to health coverage but theyre becoming more popular every year both as an employee benefit and for the self-employed. The annual out-of-pocket maximum cant exceed 7000 for individual coverage or 14000 for family plans.

To contain spiraling health care costs across the board To encourage consumers to make better informed choices about their health care. An HDHP can set a lower deductible for preventive care than for other benefits or waive the deductible and charge only a preventive care copayment. Out-of-pocket expenses such as in-network co-pays deductibles and coinsurance but not premiums.

HDHP plan members have higher annual deductible costs for their health care coverage as the plan name suggests. This type of preventive coverage does not prevent an HSA owner from making or receiving tax-free HSA contributions. For 2020 an HDHPs deductible starts at 1400 for an individual plan and 2800 for a family plan.

A high deductible health plan HDHP has lower monthly premiums and a higher deductible than other health insurance plans. High-deductible health plans or HDHPs are health insurance plans with lower premiums and higher deductibles than traditional health plans. When combined with a Health Reimbursement Arrangement HRA an HSA with an HDHP can be a powerful health benefit that sets you apart.

HDHPs are the only plans that allow an enrollee to contribute to a health savings account HSA. A high deductible plan HDHP can be combined with a health savings account HSA allowing you to pay for. High-Deductible Health Plans Defined According to IRS rules an HDHP is a health insurance plan with a deductible of at least 1400 if you have an.

For 2020 the Internal Revenue Service IRS defines an HDHP as one with a deductible of 1400 or. The monthly premium is usually lower but you pay more health care costs yourself before the insurance company starts to pay its share your deductible. At least part of this deductible amount is covered by the HSA or HRA.

High-deductible health plans cost less than traditional insurance coverage on a monthly basis but HDHP coverage can have high out-of-pocket costs if you have a minor injury and dont meet your deductible. However the catch is that if you used the last-month rule the IRS requires that you stay under HDHP coverage for all of the following year 2020. A high-deductible health plan HDHP is a health insurance plan with a high minimum deductible for medical expenses.

Your Comprehensive Guide to HDHPs According to the IRS an HDHP is defined as a health insurance plan with an annual deductible of at least 1400 for individual plans and 2800 for family coverage. The two purposes of HDHPs are. The last-month rule lets you use the full annual HSA contribution limit if you had HDHP coverage on December 1 even if you were not covered by an HDHP for all of the year.

A high deductible health plan HDHP paired with a Health Savings Account HSA is growing in popularity because it allows employees to pay for medical expenses tax-free. The idea is to give patients control over how to spend and invest their money. Use this tool to calculate an estimate of the maximum HSA contribution you may make based upon your HDHP coverage type.

What Is An Hdhp Your Guide To High Deductible Health Plans

What Is An Hdhp Your Guide To High Deductible Health Plans

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

What You Need To Know About High Deductible Health Plans

What You Need To Know About High Deductible Health Plans

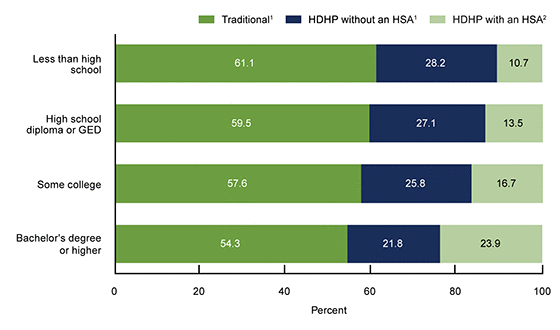

Products Data Briefs Number 317 August 2018

Products Data Briefs Number 317 August 2018

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Https Ascensioncaremanagement Com Media Hdhp Ppo Example 2020 Pdf La En Hash 5c6bb78c3ff7628e49609ab26211cf7e24dee834

Getting To Know The Hdhp Hsa Human Resources

Getting To Know The Hdhp Hsa Human Resources

Making Sense Of Your Insurance Deductible One Medical

Making Sense Of Your Insurance Deductible One Medical

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

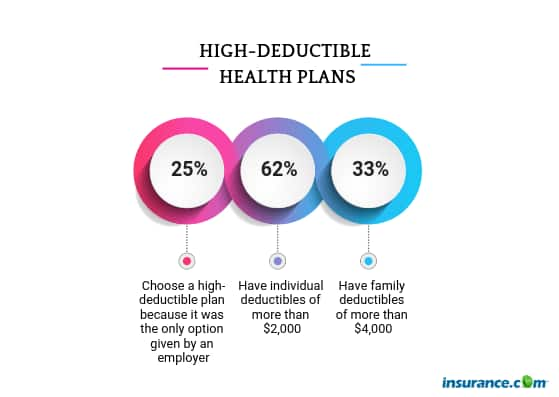

Health Plan Survey Insurance Com

Health Plan Survey Insurance Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.