Summary of Benefits and Coverage SBC Templates Instructions and Related Materials for plan years beginning on or after 4117. Payment for services will be linked to better quality outcomes.

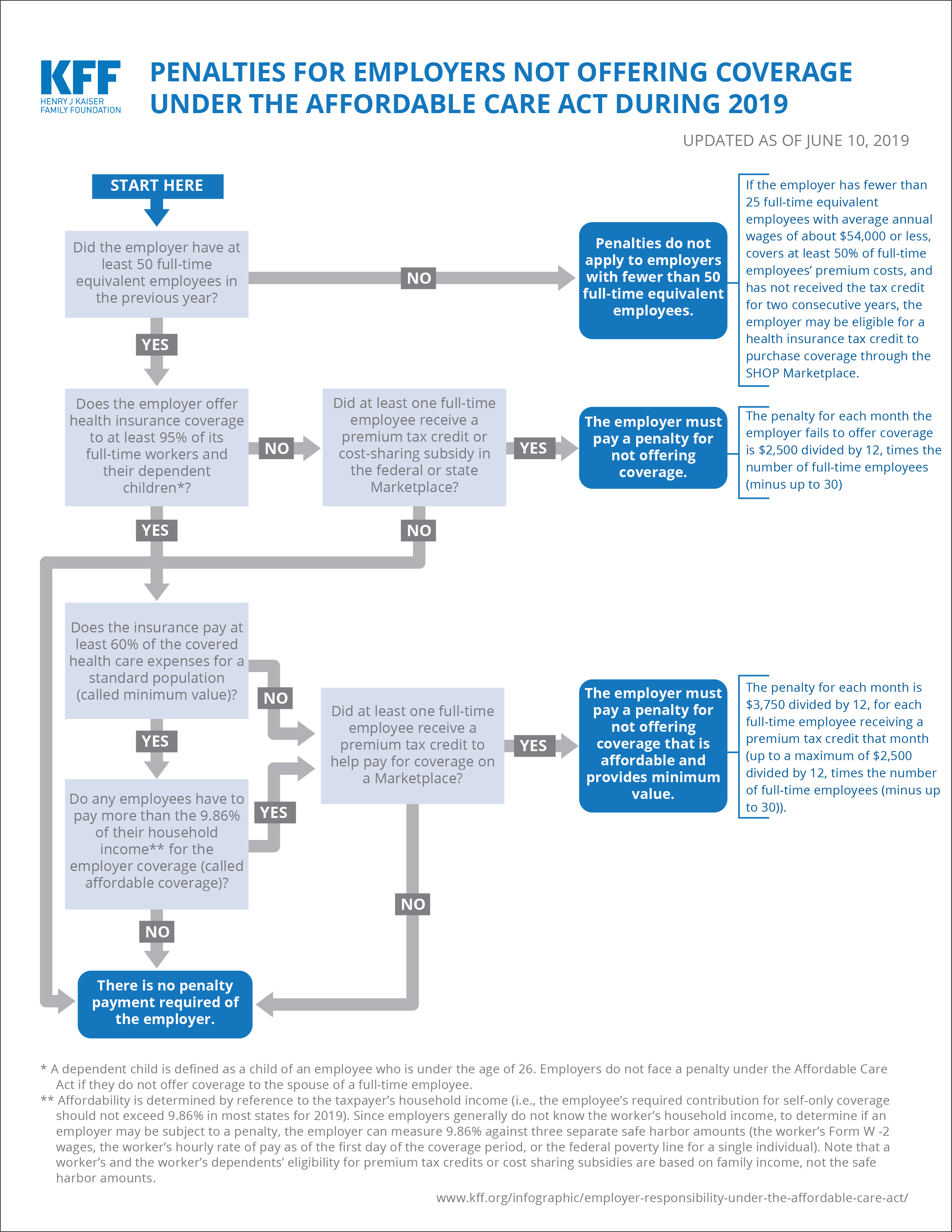

Employer Responsibility Under The Affordable Care Act Kff

Employer Responsibility Under The Affordable Care Act Kff

Washington Council Ernst Young.

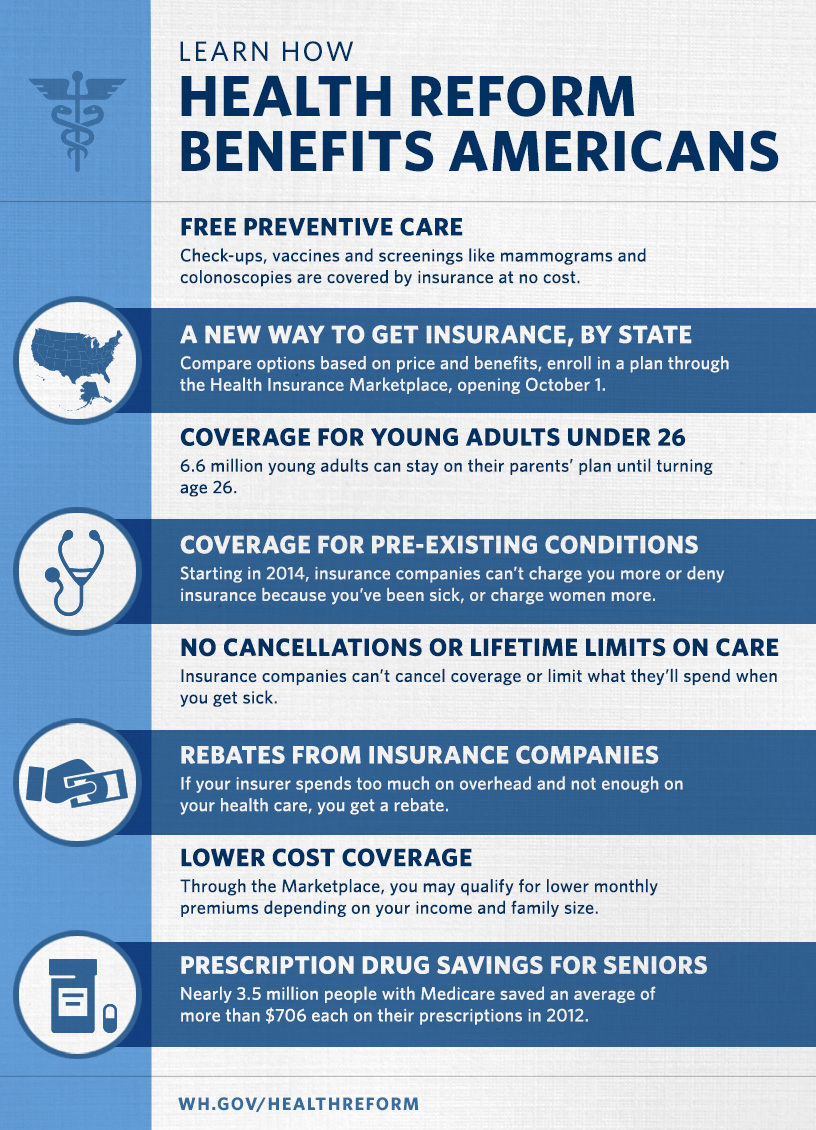

Affordable care act summary for employers. The law will also result in changes for some of the 156 million Americans who. Reporting for 2020 is just around the corner. Increases in health profession scholarship and loan programs.

Medical care services for everyone and especially for those enrolled in Medicare and Medicaid. Applicable employers are still required to file 1095 and 1094 BC forms to demonstrate that they have offered affordable health coverage that meets minimum value and minimum essential coverage to. Summary of Benefits and Coverage SBC Template MS Word Format.

Employers with fewer than 50 full-time equivalent employees will not face tax penalties if they do not offer coverage to full-time employees. In summary the Affordable Care Act has left an impact on health insurance coverage. The size and structure of your workforce determines what applies to you.

Technical Release 2013-02 Guidance on the notice to employees of coverage options under FLSA 18B and updated model election notice under COBRA. While the ACA does not require every business to offer health insurance coverage many will still opt in. Notice to Employees of Coverage Options.

Summary of the Affordable Care Act 4 where association coverage is offered to employer members to provide coverage to their employees the size of each employer. Increased funding for community. Mandates employers with 50 or more full-time equivalents to offer coverage to full-time employees and their dependents or pay taxes if an employee obtains Exchange coverage and a premium tax credit.

Businesses with fewer than 50 or fewer than 100 employees. For purposes of determining eligibility for subsidies through the Markplaces affordable employer-sponsored insurance is defined as requiring an employee contribution of less than 95 percent of household income for an employee-only plan that covers at least 60 percent of medical costs on average minimumvalue. This goes for individuals and companies alike.

Provisions of the ACA affecting small employers include. Sample Completed SBC MS Word Format. Instructions for Completing the SBC - Group Health Plan Coverage and Consumer Assistance Programs.

On March 23 2010 President Obama signed comprehensive health reform the Patient Protection and Affordable Care Act into law. Support for new primary care models such as medical homes and team management of chronic diseases. Model Notice for employers who offer a health plan to some or all employees MS Word Format Printer Friendly Version.

The following summary of the law as originally enacted focuses on. An employers size is determined by the number of its full-time employees including full-time equivalents. Support for training programs for nurses.

How it affects you depends on the number of full-time employees that work for you. These make up the bulk of employers responsibilities regarding the ACA. The Affordable Care Act or health care law contains benefits and responsibilities for employers.

The Patient Protection and Affordable Care Act will improve the quality and efficiency of US. The ACA addresses workforce issues through a number of provisions including reforms in graduate medical education training. The Patient Protection and Affordable Care Act ACA likely affects your small business in several ways.

SUMMARY The Affordable Care Acts ACAs Employer Shared Responsibility Provisions ESRP The employer shared responsibility provisions ESRP which often are referred to as the employer mandate generally incentivize large employers to offer adequate and affordable health. The Affordable Care Act has two major provisions that fall on many but not all employers. For help with determining the size of your workforce each year see our page on Determining if an Employer is an Applicable Large Employer.

This article focuses on the basics of Obamacare for a small business owner how to comply and your healthcare options as an employer. AFFORDABLE CARE ACT Summary of Provisions Affecting Employer-Sponsored Insurance Much of the public discussion about the Affordable Care Act ACA has focused on the expansion of coverage to the uninsured through subsidies to individuals and the expansion of Medicaid. The long list of provisions includes employer.

These include the shared responsibility provisions and the employer information reporting provisions for offers of minimum essential coverage. The Affordable Care Act refers to the comprehensive health care reform law meant to ensure health insurance is available and affordable to all.