Generally speaking categories with higher premiums Gold Platinum pay more of your total costs of health care. 86 percent of workers participated in medical care plans with an employee contribution requirement where employees paid 13876 and employers paid 45970 per month.

Section 1 Cost Of Health Insurance 9335 Kff

Section 1 Cost Of Health Insurance 9335 Kff

Employers are incurring unplanned COVID-19 testing and treatment costs in 2020 and those costs likely will continue in 2021.

Healthcare premium costs. An increase in spending is expected in 2021 as the demand for care returns. The average health insurance premium for a policyholder at 45 is 289 up to 1444 times the base rate and by 50 its up to 357 which comes out to 1786 x 200. 54 Zeilen How Much Does Health Insurance Cost per Month in Each State.

Health care costs have risen faster than the median annual income. Categories with lower premiums Bronze Silver pay less of your total costs. Prices for outpatient office visits also grew much faster than general price inflation over the 2003 to 2016 period rising from an average price of 60 to 101 or 69 compared to a 28 increase in overall inflation.

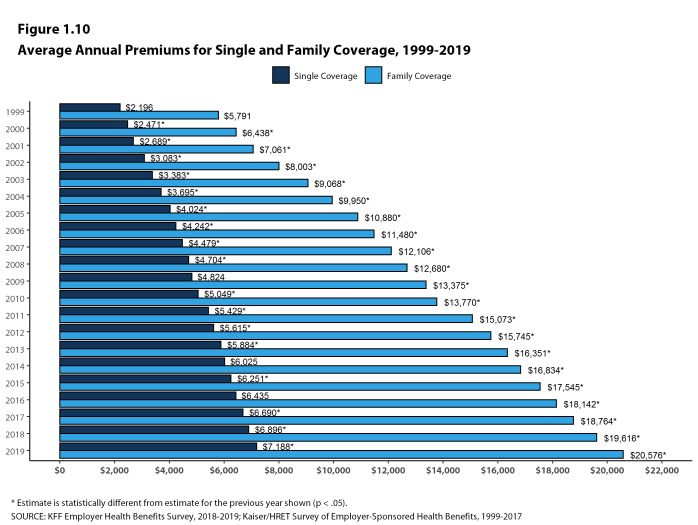

According to research published by the Kaiser Family Foundation in 2019 the average cost of employer-sponsored health insurance for annual premiums was 7188 for single coverage and 20576 for family coverage. The monthly maximum government contribution 72 of the weighted average is 52342 for Self Only 112116 for Self Plus One and 121821 for Self and Family. 1 In comparison health care cost 272 billion in 1960 just 5 of GDP.

It equals 177 of gross domestic product. In addition to your premium you usually have to pay other costs for your health care including a deductible copayments and coinsurance. Workers in some states paid potentially as little as 4700 for healthcare in 2017 while costs in several other states topped 8000 a report from The Commonwealth Fund found.

In 2020 these unplanned costs are expected to be more than offset by the savings from delayed care during the pandemic. In last weeks final debate Sens. For 2021 the biweekly program-wide weighted average premiums for Self Only Self Plus One and Self and Family enrollments with a government contribution are 33553 71870 and.

Costs of employer insurance are typically hidden from view. After much research you eventually end up selecting a particular plan that costs 400 per month. After age 50 premiums rise.

Health insurance premiums. 2017 260. The categories are based on how you and the health plan share the total costs of your care.

HealthCaregov directs. 14 percent of workers participated in medical care plans without an employee contribution requirement where the average employer premium was 60520 per month. Posted on October 20 2008.

Rising Health Insurance Premiums For those with employer-provided healthcare average annual premiums for family coverage rose 37 from 15545 in 2015 to 21342 in 2020. 4 Zeilen The average monthly cost of health insurance in the United States is 495. That 400 monthly fee is your health insurance premium.

But see the exception about Silver plans below. Health Care Premium Costs. 2 That translates to an annual health care cost of 11172 per person in 2018 versus just 147 per person in 1960.

Itll tell you the premium. 2018 412 369 increase 2019 406 15 decrease In contrast Mercers National Survey of Employer-Sponsored Health Plans found that premiums for group health insurance rose by an average of 2 to 6 percent per year from 2009 to 2019. If you have a Marketplace health plan you may be able to lower your costs with a premium tax credit.

Read on for the 10. What your annual premium might be and the size of the federal tax credit you may receive to offset your costs. John McCain and Barack Obama cited greatly different estimates for the average.

Dental care is one of. The report also found that the average annual deductible amount for single coverage was 1655 for covered workers. A healthy 65-year-old couple retiring in 2019 will need close to 390000 to cover health-care expenses including Medicare Parts B and D according to HealthView Services.

In order for all of your healthcare benefits to remain active the health insurance premium must. The amount you pay for your health insurance every month.