Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted Medicare Part A hospice care copayment or coinsurance Medicare Part B coinsurance Medicare Part B excess charges. United American Plan F.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

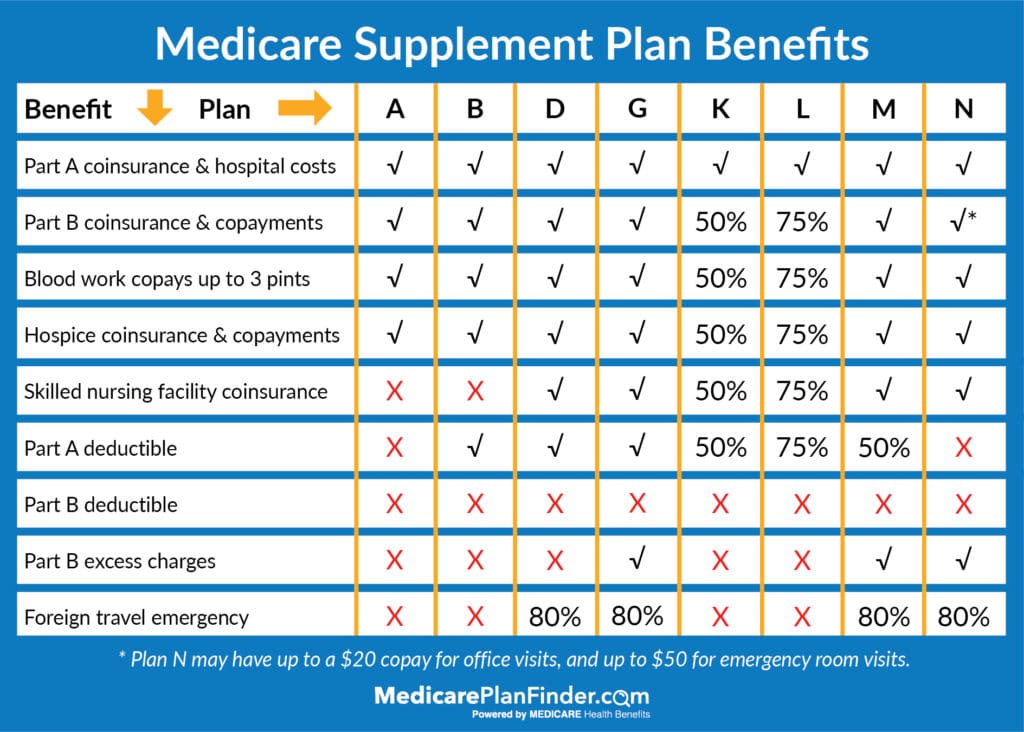

As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N.

Supplement plan f benefits. It covers many of your deductibles such as hospitalization hospital outpatient and. Unlike most other plans it covers the Part B calendar year deductible. Additional Part A Hospital Benefits.

These plans are regulated which means every insurance company that offers Plan F must offer the exact same benefits. However it has a lot more to offer as well. Medicare Supplement Plan Fs main advantage is that it covers all the Medigap.

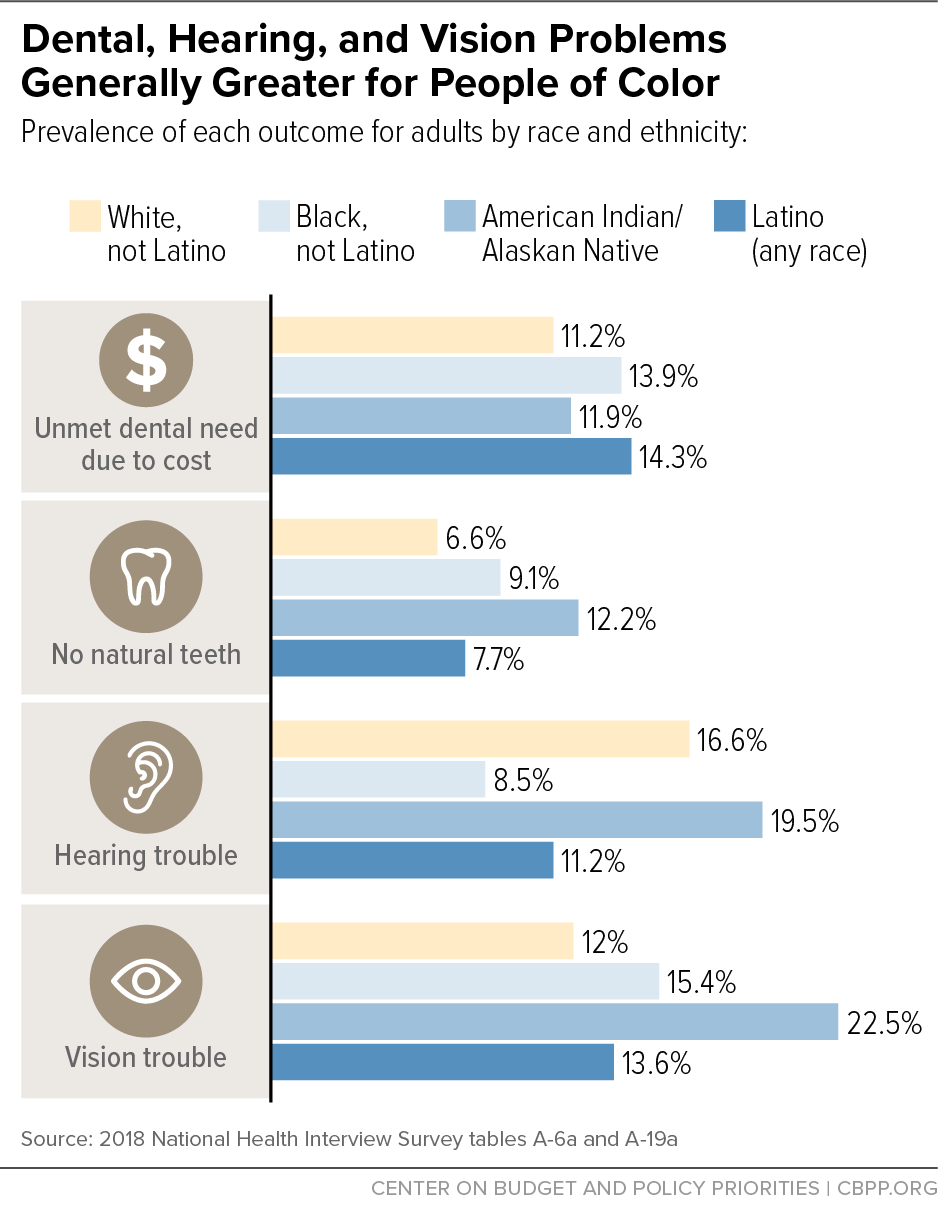

Medigap plan F covers the most benefits of all Medicare Supplement plans and is the most popular plan for Seniors 65 and over. Part A Hospital Coinsurance. Beneficiaries get lenses once each year for a 25 copayment.

AARP UnitedHealthcare Plan F Medicare supplemental insurance pays for the first three pints of blood needed for medical care covers the coinsurance costs of preventative care pays for the 5 percent fee for hospice and palliative medicine and covers the. Of course with benefits like that you should expect a larger price tag. For more detailed information read our page about Medicare Supplement Insurance benefits.

Plan F is the most popular policy mostly because it offers zero out of pocket expenses outside of your monthly premium. Although this plan is rather expensive it. Below is a list of costs and benefits covered by Medicare Supplement Plan F.

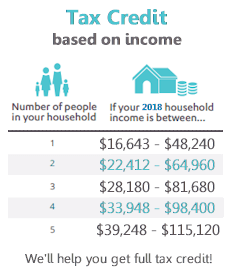

Medicare Supplement Plan F Rates For 2021. 1 Lets take a closer look at the benefits offered by Medigap Plan F how it compares to other Medicare Supplement Insurance plans. There is a California Bill called SB 407 which would restrict insurance companies from offering these plans in California.

Plan F also pays the 20 for a long list of other Part B services. Medigap Plan F Overview. Medigap Plan F is one of the Medicare Supplement Insurance plans.

You can get them covered by Medicare Supplements and only Plan F covers the entire list. Medigap Plan F may cover. Days 91-150 of a hospital stay.

Plans E H I and J are no longer sold. The benefits of AARP Medicare Supplement Plan F can provide you coverage for a great many medical expenses. Coverage is provided after a 250 deductible has been met for the year in 2020.

Plan F coverage also includes your other doctor visits for illnesses and injuries. Then your Plan F supplement pays your deductible and the other 20. Medicare Supplemental plan F naturally includes all of the regular things that Medicare Part A and Medicare Part B cover for Medicare beneficiaries.

Medicare will only pay for these 60 days once during your lifetime. California wants to restrict Innovative Plan F and Plan F Extra. Of the 10 Medicare Supplement Insurance plans Medigap that are available in most states Plan F is the most popular plan and offers the most benefitsIn fact 53 percent of all Medigap beneficiaries are enrolled in Medicare Supplement Insurance Plan F.

Some carriers offer access to a SilverSneakers gym membership. You have to decide for yourself if it covers enough or if it covers too much. This plan is only available to you if you qualified for Medicare before 1st January 2020.

If you take the time to compare this plan to your other choices you will see how it stacks up and how you may be able to save the most money possible on your healthcare. Medicare Part A copays- Youll be covered for per-visit expenses for your hospital stays. This Medicare Supplement plan policy helps you cover your Medicare coinsurance deductibles and copayments.

It would still allow insurance companies to offer these extra benefits but as a rider. Plan F covers that for you. Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers.

THIS LAW PASSED AND WENT EFFECT ON 07012020. Medigap Plan F pays for 80 of your foreign travel emergency care costs. With Plan F you get coverage for all of the following.

Innovative Plan F benefits may include nurse hotline access or a drug discount card. Days 61-90 of a hospital stay in each Medicare benefit period. Medicare Supplement Plan F benefits.

Some doctors charge a 15 excess charge beyond what Medicare pays. Plans offering routine eye exams range from 10 to 25. An extra 365 days of inpatient hospital care after you use your Original Medicare hospital benefits.

Medicare Part B first pays 80.

/Woman-having-smile-and-teeth-checked-at-orthodontist-with-dental-coverage-589149295f9b5874eedcb400.jpg)