Do you have more questions about Blue Choice. Information about the cost of this.

Http Saleskits Bluecrossma Com Media Document 1 700262sg1120 Preferred Blue Basic Saver Pdf

Blue Cross and Blue Shield Service Benefit Plan.

Blue cross basic coverage. 247 access to your benefits with our member site or app. Network Coverage In-network care only except in certain situations like emergency care Out-of-Pocket Maximum PPO Self Only. Members are encouraged to show this list to their physicians and pharmacists.

Basic Option Coverage for. PPO 1 of 6 The Summary of Benefits and Coverage SBC document will help you choose a health plan. For more than 70 years the Blue Cross name in Canada has stood for affordable quality supplementary individual health and travel insurance coverage as well as group benefits and group life insurance delivered with trustworthy and personalized service.

Blue Cross Blue Shield of Massachusetts provides a Summary of Benefits and Coverage SBC with online access to the corresponding coverage policy to all of our fully insured members and accounts. 27 Zeilen A comprehensive plan including coverage for ambulance dental prescription. Physicians are encouraged to prescribe drugs on this list when right for the member.

With low monthly rates for comprehensive coverage Basic Plus is the simplest cost-effective answer. However decisions regarding therapy and. Self Only Self Plus One or Self and Family Plan Type.

This is a list of preferred drugs which includes brand drugs and a partial listing of generic drugs. Anthem Blue Cross CalPERS Select Basic PPO Plan Coverage Period. Travel coverage up to 30 days until age 70.

Blue Cross Blue Shield members can search for doctors hospitals and dentists. This booklet gives you the details about your Medicare health care and prescription drug coverage from. Stay in-network for care.

Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Blue Cross Medicare Advantage Basic HMO SM. It explains how to get coverage for the health. IndividualFamily Plan Type.

Physicians are encouraged to prescribe drugs on this list when right for the member. Boost your personal health plan by adding Bronze Silver or Gold Dental coverage. Click here to contact a benefit specialist.

Higher coverage is available to cover endodontics root canals and major work bridges crowns etc. It offers coverage for ambulance services nursing care prescription drugs dental. In the United States Puerto Rico and US.

With low monthly rates for comprehensive coverage Basic Blue Choice is the simplest cost-effective answer. January 1 December 31 2021. Blue Cross and Blue Shield is pleased to present the 2019 Drug List.

Basic Option gives you access to our Preferred provider network that includes 96 of hospitals and 95 of doctors in the US. It offers coverage for ambulance services nursing care prescription drugs dental care and even out-of-province. Blue Cross and Blue Shield is pleased to present the 2020 Drug List.

Members are encouraged to show this list to their physicians and pharmacists. Outside the United States. You also have 0 online doctor visits using LiveHealth Online.

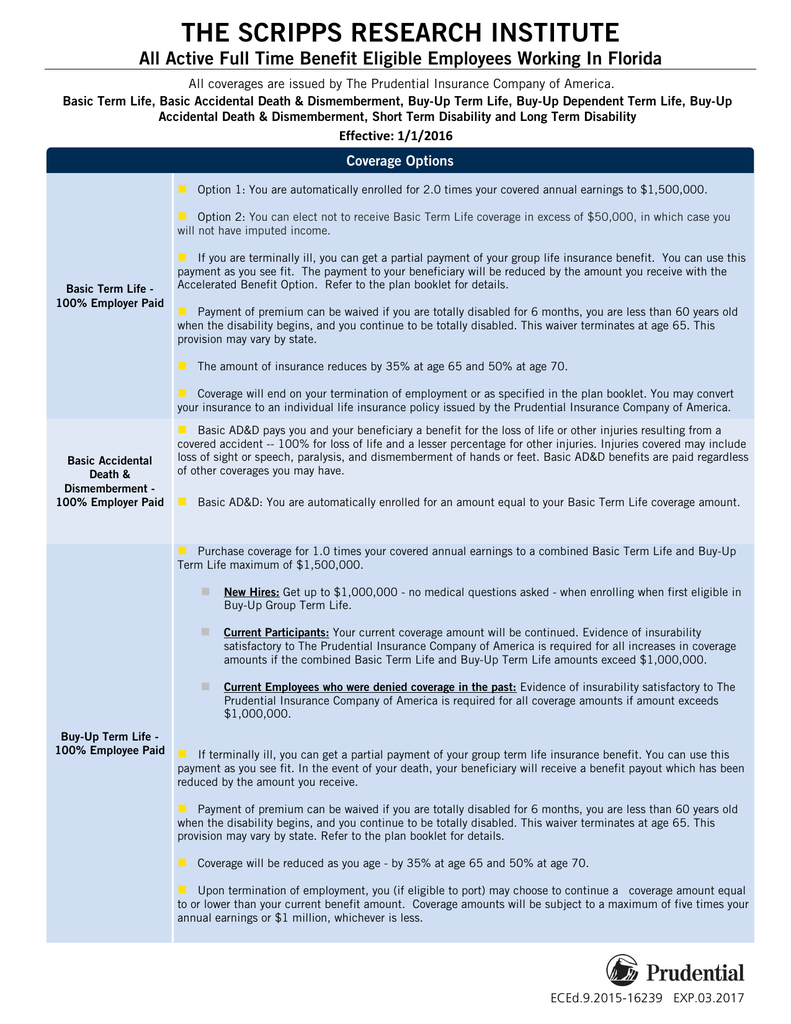

Extended Health Benefits up to 5000. Term Life and Accidental Death and Dismemberment. Our basic plan provides you with the health benefits that make sure you get the care you need when you need it.

Basic Health Benefits The Basic Blue Choice plan is available to those 74 years of age or under. 01012015 12312015 Summary of Benefits and Coverage. Over 60000 retail pharmacies.

About Coronavirus and COVID-19. Each option covers 80 of basic services which include regular cleanings and check-ups. The SBC shows you how you and the plan would share the cost for covered health care services.

Simply present your Blue Cross member card to the participating provider and mention Blue Advantage. Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage. If you are not covered by a company health plan Basic Blue Choice can be invaluable.

Blue Advantage saves you money on a variety of health-related products and services from participating providers across Canada regardless of whether the item is covered under your benefit plan. What this Plan Covers What it Costs Coverage for. This is a list of preferred drugs which includes brand drugs and a partial listing of generic drugs.

Plan at a Glance. Dental coverage maximum up to 1500. Basic health insurance package The Basic Plus plan is available to those 16 years If you are not covered by a company health plan Basic Plus can be invaluable.

All cost-sharing coinsurancecopay for screening and testing including hospitalemergency room urgent care and provider office visits for the purpose of screening andor testing for COVID-19 is being waived. You can also add to your core benefits by choosing from our list of Custom Options including dental prescription drugs travel and life insurance to create your personal customized plan. Self One and Self Family.

To view your coverage policy document select the size of your employer group then the plan name listed at the top of your SBC.