California health insurance - Covered Ca Questions - Covered Ca Income What Sources Of Income Do They Look At. The minimum deductible allowed for HSA-qualified accounts this year is 1300 for individual coverage 2600 for family coverage.

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

HSA stands for health savings account.

Covered california health savings account. Must not be enrolled in Medicare. They have different costs for premiums and services but the same great benefits. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement.

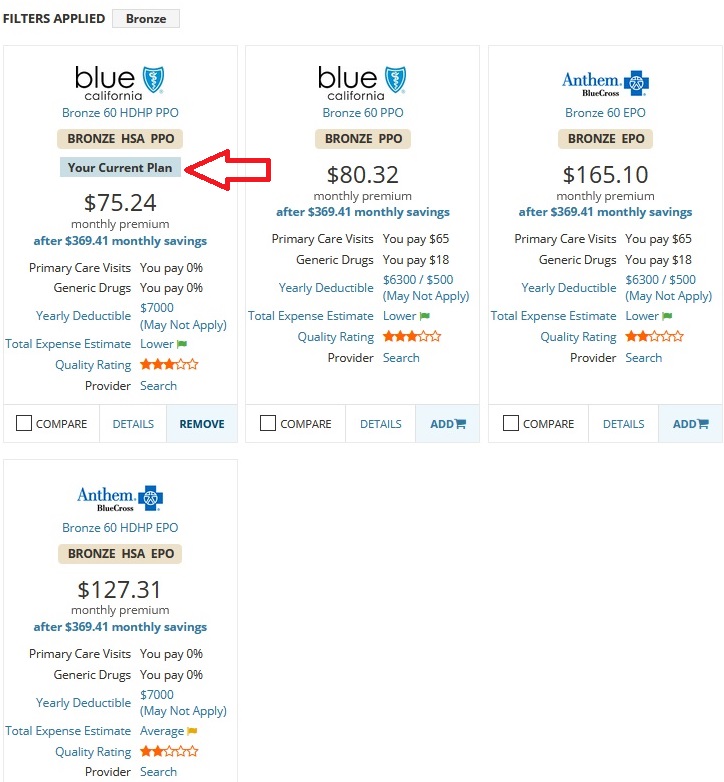

With this health plan you have the option of setting up a separate Health Savings Account with a bank of your choice and saving money designated for medical expenses. In general family deductibles are twice the amount of an individual deductible. The Bronze 60 HSA can oftentimes be a few dollars cheaper than the standard Bronze 60.

These funds roll over to the next year if they arent spent. A Covered California analysis finds that an estimated 25 million Americans could potentially benefit from. California residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a.

That would be a Covered California plan labeled Bronze 60 HSA. Its offered to people who have high-deductible health plans HDHP. Covered California Health Plans Our health plans come in four metal tiers.

If you do not already have such a plan you will not be able to change for one until 1116. HSA plans make sense if you plan on funding the account detail below HSA plans will continue to be offered after Health Reform detail below Preventative is now covered prior to the deductible Interest and investment is generally tax deferred and you can pay eligible expenses pre-tax. Find out your options if you have Missed the Open Enrollment here A lot of the enrollment process centers around income now since thats the key driver for health.

To qualify for a Health Savings Account the savings account that goes with HSA compatible health insurance plans you must meet the following criteria. In California Bronze level HSAs have an individual deductible of 4500 and a family deductible of 9000. Speak with a Covered California certified agent.

Better than an IRA however money can be withdrawn from an HSA for qualified medical expenses at any time without penalty. Like an Individual Retirement Account IRA money deposited into a Health Savings Accounts qualifies for a Federal income tax deduction. Call 888 413-3164 or Shop Online Now.

If you choose a health plan other than a HSA-qualified plan you can no longer make pre-tax contributions to your existing HSA account. Health Savings Accounts HSAs allow enrollees to save money on a tax favored basis to pay for medical expenses. Must not be claimed as a dependent on another persons tax return.

Your plan wont fly. The American Rescue Plan lowers health care premium costs for people who get coverage through Covered California or through other Affordable Care Act marketplaces across the nation by providing new and expanded subsidies to make health insurance more affordable than ever before. Must be age 64 or less.

We highly recommend using a Health Savings Account HSA if your plan has an annual deductible of more than 1300 for self-only coverage or 2600 for family coverage. You can only open a health savings account HSA if you have a HSA qualified high-deductible health plan. Finding the Best HSA Values On The California Health Insurance Market.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. Health Savings Account Overview All funds you put in your HSA are 100 tax deductible from gross income and can be used tax free to pay for. Its the only place where you can get financial help when you buy health insurance from well-known companies.

HSA is an abbreviation for a specific bank account called a Health Savings Account. SUMMARY This bill would in modified conformity to federal law allow a deduction in computing adjusted gross income AGI relating to Health Savings Accounts HSA as well as provide conformity to allowance of rollovers from specified accounts as is allowed on a federal individual income tax return. Non HSA Bronze plans have a 5000 individual deductible and 10000 per family.

Health Savings Accounts. Weve been fans of the HSA or Health Savings Account health plans in California. Must have a HSA compatible health insurance plan.

People who choose to enroll in one can add funds to their HSA that arent subject to federal income tax when theyre deposited. All ACA exchange health plans designated as a HSA are a Bronze metal level. Medicare is not considered a high-deductible plan although the.

A business can allow employees to open a California HSA account only after the employee has enrolled in a qualified high deductible medical insurance plan. Covered California offers these plans at the Bronze level.