All schemes do however offer benefits for tests and procedures conducted to identify the cause of infertility. Typically fertility testingdiagnosis does get covered by many health insurance plans.

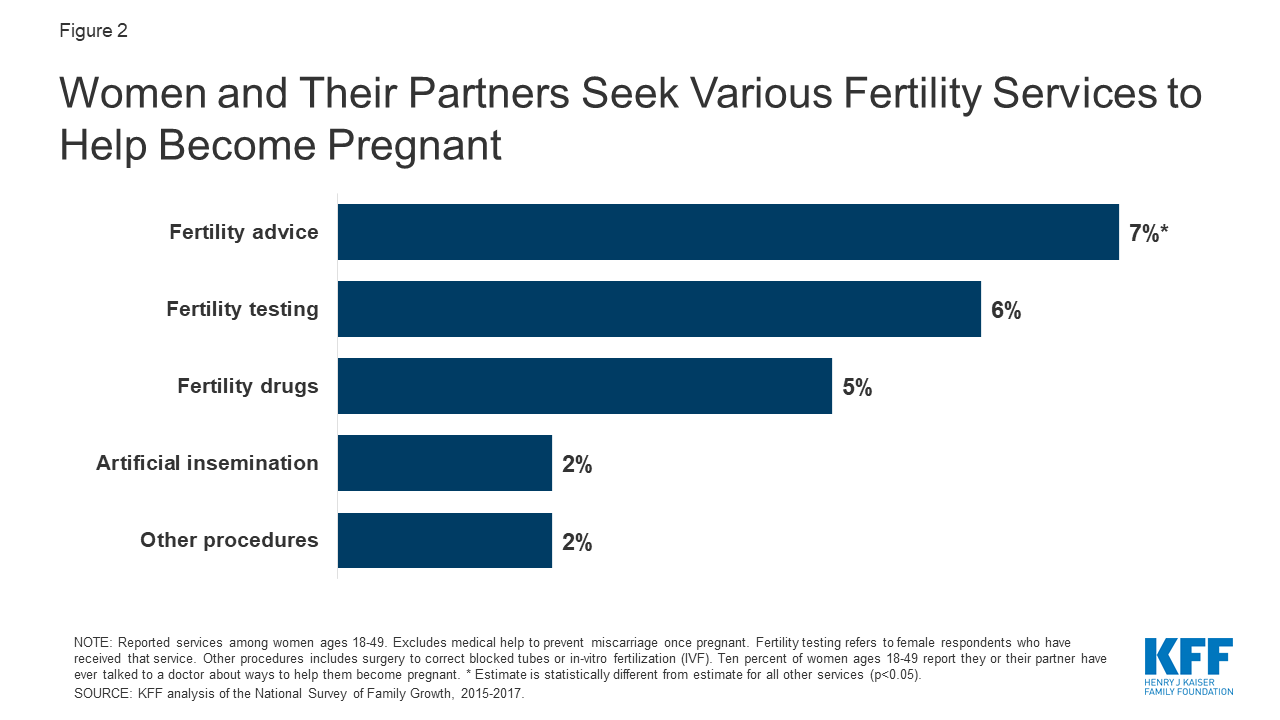

Coverage And Use Of Fertility Services In The U S Kff

Coverage And Use Of Fertility Services In The U S Kff

Its important to choose a clinic thats right for you so take your time over your decision.

Does medical cover fertility testing. Fortunately more states are recognizing infertility as a medical issue one that warrants insurance coverage. If your health insurance did not cover fertility treatments before it does not have to now. The bad news first.

1-866-414-1959 TTY 711 for general information 1-877-844-4999 TTY 711 for technical issues. Like other insurance providers for IVF and IUI United Healthcare also provides specific infertility coverage based on. Infertility as a PMB condition.

For those with this plan it is important to complete all testing before moving forward with treatment such as ovulation induction. Infertility is considered a pre-existing condition. This coverage designation only covers testing and does not cover treatment.

Many infertility tests including the physical exam medical history and blood tests can be done in your doctors office or clinic by an obstetrician or reproductive endocrinologist. As these services would be considered a non-covered benefit. If they do they can offer coverage of diagnosis diagnostic testing medication surgery and Gamete Intrafallopian Transfer GIFT.

There are certain terms and conditions that you should also be aware of to avail Infertility Treatment Insurance. Medicare Advantage Part C plans also help cover fertility treatments if the treatments would be covered by Medicare Part B. 2 Waiting period - The waiting period to avail.

Group insurers must offer coverage of infertility treatment except for IVF but employers can decide if they want to make IVF part of their employee benefit package. There are 15 states that require health insurance providers to cover fertility treatments. Now for the good news.

For members who meet the eligibility criteria IVF with MET is medically necessary when the medical criteria above is met. Your internist or family medicine physician may do some of the first tests. In May 2019 the Access to Infertility Treatment and Care Act HR.

Testing for Infertility Testing to determine the diagnosis of infertility is a covered service and not subject to the infertility benefit in this policy. The bill would not only require healthcare plans and individual markets to cover fertility treatments but also fertility preservation services. This coverage plan applies to as many of 20 of patients.

Medical necessity review of infertility drugs by Aetna Specialty Pharmacy Guideline Management may be bypassed for infertility drugs that are for use with infertility medical procedures if the infertility procedure has been approved for coverage under the members Aetna medical benefit plan. 2920 was introduced by Representative Rosa DeLauro CT and Senator Cory Booker NJ into the US House and Senate. Infertility is one of 270 prescribed medical benefits diagnostic treatment pairs recognised by the Medical.

All individual group and blanket health insurance policies that provide for medical or hospital expenses shall include coverage for fertility care services including IVF and standard fertility preservation services for individuals who must undergo medically necessary treatment that may cause iatrogenic infertility. Its no secret that IVF can come with a steep price tag. From the cost of medication and monitoring to the procedure itself not to mention any additional preimplantation genetic testing PGT fees can easily total thousands of dollars for just one cycle.

Infertility treatment is not one of the essential health benefits mandated by the ACA. United Healthcare IVF coverage. West Virginia But these states are just mandated to offer some coverage meaning that how much help youll actually receive varies.

They are also legally obliged to cover the costs of certain surgeries and techniques aimed at creating the optimal conditions for a natural pregnancy. However this only implies that the plan will pay for services related to testing and not necessarily cover those relating to treatment. 1 Eligibility - Depending on your age medical history and other health complications.

In order for Medicare to cover any infertility treatments they would need to be deemed reasonable and necessary tests or treatments for infertility in a person when fertility would be expected. At a specialist fertility clinic youll be offered an assessment followed by tests and treatments if these are appropriate for you. Covered health services include procedures to diagnose infertility and therapeutic medical or surgical procedures to correct a physical condition which is the underlying cause of the Infertility eg for the treatment of a pelvic mass or pelvic pain thyroid disease pituitary lesions etc.