Coinsurance is a common term that refers to a percentage of your medical expenses that you split payment with your insurance company once the deductible is met. For example if you have an 8020 plan it means your.

Coinsurance And Medical Claims

Coinsurance And Medical Claims

In property insurance it means buying a policy that covers a specified percentage of the replacement value.

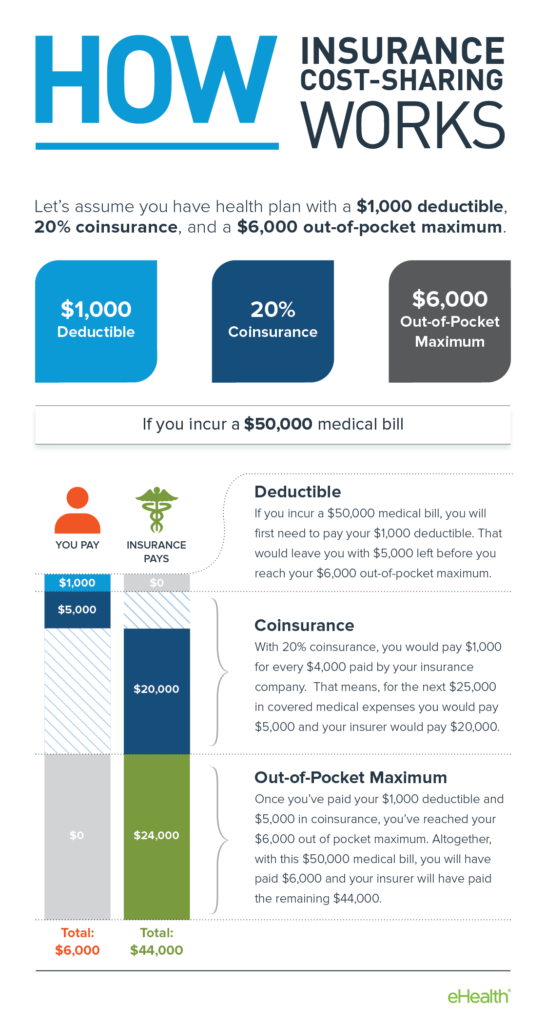

What is coinsurance mean. Thats how long your health insurance company will cover your medical expenses if you keep up with. Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met. Coinsurance The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible.

Insurers commonly require 80 of the propertys value to be covered but the exact percentage can vary depending on the insurer and property in question. Coinsurance can be a tricky thing and its hard for many people to understand exactly what it means. Coinsurance is the amount generally expressed as a fixed percentage an insured must pay against a claim after the deductible is satisfied.

Thats the monthly fee you pay to keep your insurance going. In this case your coinsurance payment is calculated as a function of how much income will be reimbursed and for how long. Coinsurance is a form of cost-sharing or splitting the cost of a service or medication between the insurance company and consumer.

Coinsurance percentage refers to the amount that either the insured or the insurer pays for a service. What Does Coinsurance Percentage Mean. In health and dental insurance coinsurance is the percentage of costs you cover out-of-pocket.

Your coinsurance will usually be split into 2 different percentage totals. Coinsurance is the requirement that policyholders insure a minimum percentage of a propertys value in order to receive full coverage for claims. You typically pay coinsurance after meeting your annual deductible.

Hero Images Getty Images When you are selecting your health insurance policy you might have several choices including a few plans with the option of coinsurance. Your health insurance plan pays the rest. Coinsurance is the percentage of covered medical expenses you pay after youve met your deductible.

Coinsurance is a type of insurance in which the insurer and the insured split risks with each other. Coinsurance is cost-sharing between an insurance company and the policy owner. 2 Heres how it works.

So what does coinsurance mean for you and your business at the end of the day. The first number is usually what your health insurance company will pay towards the claim and second is what you will pay towards the claim. Your insurance plan will pay for some portion of your medical costs generally after you meet the deductible the amount that you have to pay before the insurance coverage kicks in.

But with coinsurance you pay a percentage of the bill rather than a set amount. Coinsurance is what youthe patientpay as your share toward a claim. Coinsurance is another type of cost-sharing where you pay for part of the cost of your care and your health insurance pays for part of the cost of your care.

In health insurance a coinsurance. Lets use 20 coinsurance as an example. And coinsurance may also come up in business income interruption insurance.

In addition to lowering the cost of insurance for the insured coinsurance also benefits other people who are insured with the same company by ensuring that the insurance company will be able to pay all claims. Coinsurance means that you will share some percentage of the payment for your healthcare bills with your health insurer. So What Is Coinsurance And All That Other Stuff.

Coinsurance a term found in every health insurance policy is your out of pocket expense for a covered medical or health care cost after the deductible which generally renews annually has been paid on your health care plan. Kind of like the monthly bill you pay to keep. The system of coinsurance is represented by a percentage where paying is concerned with the insurer taking on the bigger percentage and the insured taking on the lower one.

Your deductible if you werent aware is the amount you have to pay. What does coinsurance really mean and how does it apply to your needs right now. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20.

Coinsurance is the amount of a medical cost such as the cost of a therapy session that you must cover. A Few Final Words on Coinsurance and Your Business. But since a coinsurance clause can be found on just about any type of commercial property insurance policy its definitely important to know how it.

In the above scenario you have a plan that splits coinsurance costs 8020 meaning your insurer pays 80 while you pay 20.