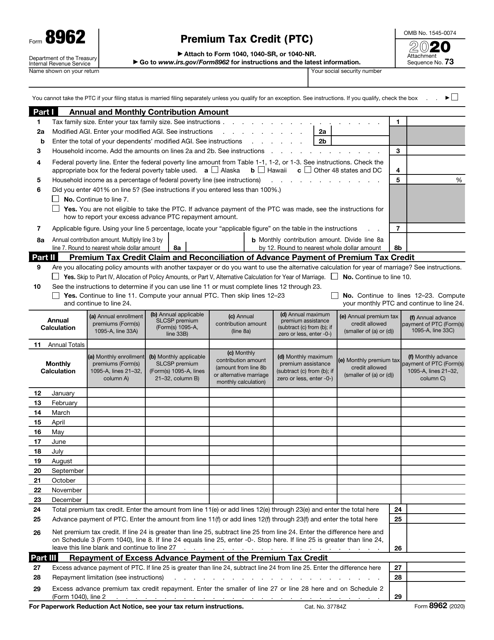

Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC.

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Document Cloud

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Document Cloud

Download the form and open it using.

Irs tax form 8962 instructions. If this isnt you you can ignore this section. Please open up Form 8962 Premium Tax Credit PTC and IRS Instructions for form 8962 and your 1040 form since your Tax Credit is based on the results of your 1040. If you or a member of your family enrolled in.

The IRS is requesting Form 8962 for 2020. The following step by step instruction given below will guide on how to complete the IRS Form 8962. Slightly its the person who claims you as a dependent who would file Form 8962 for the purpose of calculating any premium tax credit score and if crucial repaying any excess advance premium.

Its specifically designed to cover health insurance and reconcile the credit given to such people through Health Insurance Marketplace. Its also advisable to have an IRS form 8962 instructions file. Enter a term in the Find Box.

You may be able to enter information on forms before saving or printing. Your social security number. Start completing the fillable fields and carefully type in required information.

The 8962 form also known as Premium Tax Credit is a document used by individuals or families whose income is below average. IRS Form 8962 If you are claimed as somebodys dependent then you arent eligible for the premium tax credit and you do not file according to instructions for 8962 tax form. Name shown on your return.

Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium. Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. Instructions for How to Complete IRS Form 8962.

Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. You and the other tax family will have to decide how you will split the burden of reconciling any APTC repayments if applicable. If no APTC was paid for a policy shared between two tax families consult the Form 8962 instructions.

Quick steps to complete and e-sign Form 8962 Instructions online. If this is you consult the directions. Click on the product number in each row to viewdownload.

Click on the product number in each row to viewdownload. If you filled out the form during one of the previous years itll make an example of form 8962 filled out. Instructions for Form 8962 Premium Tax Credit PTC 2018 Form.

Click on column heading to sort the list. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Go to wwwirsgovForm8962 for instructions and the latest information.

Use Get Form or simply click on the template preview to open it in the editor. Well help you create or correct the form in TurboTax. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax.

You may be able to enter information on forms before saving or printing. You can get the IRS Form 8962 from the website of Department of the Treasury Internal Revenue Service or you can simply download IRS Form 8962 here. General Instructions for Forms W-2 and W-3 PDF.

You may take PTC and APTC may be paid only for health. Select a category column heading in the drop down. This will make following along easier and more helpful.

Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Part V is only for couples who got married in the tax year for which theyre filling out Form 8962. Enter a term in the Find Box.

Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file. Employers must file a Form W-2 for each employee from whom Income social security or Medicare tax was withheld. Click on column heading to sort the list.

You will also need forms 1095-A 1095-B or 1095-C which show minimum essential coverage. 15 Zeilen Inst 8962. Select a category column heading in the drop down.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)