It seems to be an error but I. How to fill out Obama Care forms 8962 Premium Tax Credit if you are Single You will need your 1095A health insurance marketplace statement 1040 1040 sched.

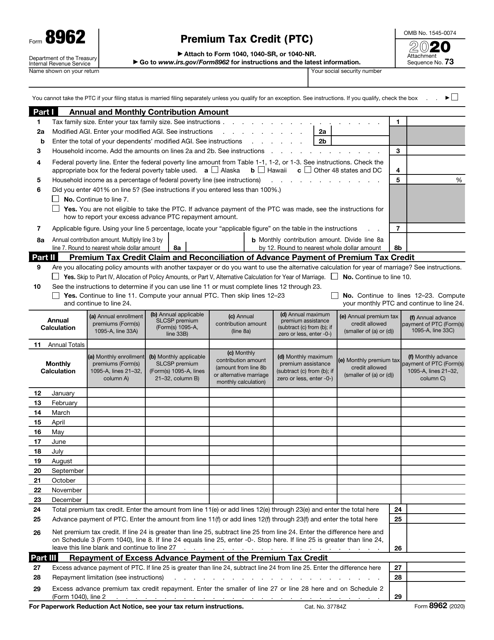

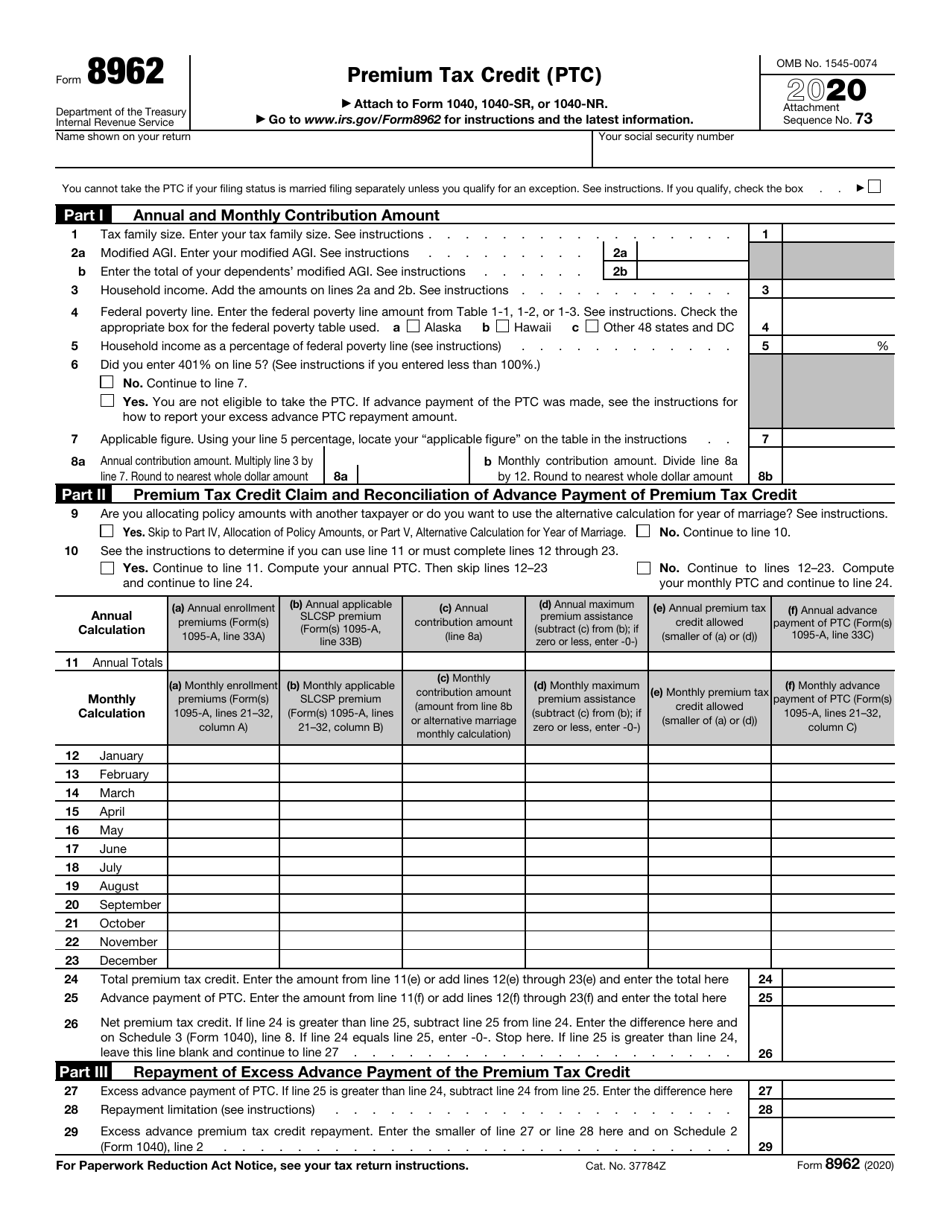

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

16 Mail a copy of your Form 1095-A along with Form 8962 to the IRS address indicated in your IRS letter.

Form 8962 online. You can sign save print and download at your convenience. No need to send form 1095-B through tax returns. Enter the combined total for each month on lines 1223 columns a b and f.

Add all allocated policy amounts and non-allocated policy amounts from Forms 1095-A if any to compute a combined total for each month. To start the form utilize the Fill Sign Online button or tick the preview image of the form. 8962 Form Fill Online By clicking the link above you can get to our page with fillable 8962 Form.

You fail to provide information of your form 1095A from the market place health insurance. The Form 8962 calculator will let you determine your PTC. Fill Online Printable Fillable Blank Form 8962 Premium Tax Credit Form Use Fill to complete blank online IRS pdf forms for free.

So you will be able to. Schedule 2 Line 2 is the Excess advance Premium Tax Credit Repayment that links to Form 1040 Line 17. Distribute the all set type through e mail or fax print it out or help save with your gadget.

Complete Form 8962 only for health insurance coverage in a qualified health plan described later purchased through a Health Insurance Marketplace also known as an Exchange. Quick steps to complete and e-sign Form 8962 online. Put an electronic signature in your Form Steps to Fill out Online 8962 IRS with the help of Indication Device.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. 15 On the Print dialog screen check the Current Page button and then click on the Print button to print Form 8962. Tax forms can be confusing and sometimes a little frustrating but its important to present the right form with the right information about the scope of medical care.

You will need to to. Allocation 1 30 a Policy Number Form 1095-A line 2 b SSN of other taxpayer c Allocation start month d Allocation stop month Allocation percentage applied to monthly amounts e Premium Percentage f SLCSP. Here we will explain how to fax IRS form 8962 by fax quickly and easily.

Start completing the fillable fields and carefully type in required information. Edit the following fillable form 8962 online at HandyPDF. In order to calculate these figures the taxpayer will need the information from their 1095-A which they received from their insurance company and their tax return.

See instructions for allocation details. The 8962 form will be e-filed. Multiply the amounts on Form 1095-A by the allocation percentages entered by policy.

After you complete your return we will generate Form 8962 for you based on the information you have entered from your Form 1095-A. Specifically their income should. In this video I show how to fill out the 8962.

Enter your official contact and identification details. Form 8962 is used to calculate the amount of credit you get. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit.

Once completed you can sign your fillable form or send for signing. With WiseFax online fax sending service you can send IRS form by fax in just a few seconds. The way to fill out the Form 8962 2018 on the web.

Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file. Find the paper copy of your Form 8962. Once you know your PTC you can settle it with Advance Premium Tax Credit.

Once the form is completed push Executed. However before we talk about the specifics of how to answer the IRS 8952 form we should talk about how one can qualify. Premium tax credit repayment of 1600 is calculated on form 8962 line 29 but is not posting to Schedule 2 line 2.

What is a 8962 Form Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. Form 8962 2020 Page 2 Part IV Allocation of Policy Amounts Complete the following information for up to four policy amount allocations. After your enter Form 1095-A Form 8962 should open up then Schedule 2 might be added automatically if repayment of PTC applies.

Compute the amounts for lines 1223. Additional Help can be. Use Get Form or simply click on the template preview to open it in the editor.

WiseFax also allows you to get a local fax number by subscribing to one of our short term plans. All forms are printable and downloadable. Form 8962 line 29 not posting to Sch 2.

The tax form 8962 is used to calculate the taxpayers premium tax credits or cost-sharing reductions as well as calculate a tax liability if they are eligible for this. It is worth noticing that Form 8962 only serves for health insurance coverage with a qualified health plan which purchased through a Marketplace. The advanced tools of the editor will guide you through the editable PDF template.

He or she must have their income levels within the range found at the US Health and Human Services. This includes a qualified health plan purchased on healthcaregov or through a State Marketplace.

Irs 8962 2014 Fill And Sign Printable Template Online Us Legal Forms

Irs 8962 2014 Fill And Sign Printable Template Online Us Legal Forms

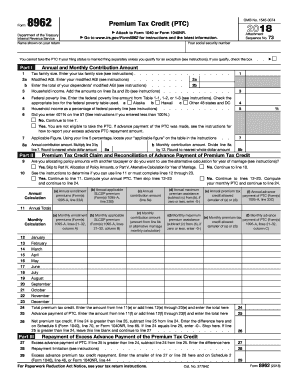

Irs Form 8962 2016 Irs Forms Irs Number Forms

Irs Form 8962 2016 Irs Forms Irs Number Forms

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Form 8962 Edit Fill Sign Online Handypdf

Form 8962 Edit Fill Sign Online Handypdf

Fill Free Fillable Premium Tax Credit Ptc Form 8962 Pdf Form

Fill Free Fillable Premium Tax Credit Ptc Form 8962 Pdf Form

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 2016 03 Premium Tax Credit Tips And Tricks Pdf

Applicable Figure Table 2019 Fill Online Printable Fillable Blank Pdffiller

Applicable Figure Table 2019 Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Form 8962 Free Online At Etax Com Resources Calculators Youtube

How To Fill Out Form 8962 Free Online At Etax Com Resources Calculators Youtube

Das Irs Formulars 8962 Richtig Ausfullen

Das Irs Formulars 8962 Richtig Ausfullen

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.