Out of the 10 available Medigap plans one of them stands out at the most economical choice. Medigap Plan N Coverage Medicare supplement N coverage includ.

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

During this period Medigap providers must sell you any Medigap plan you like.

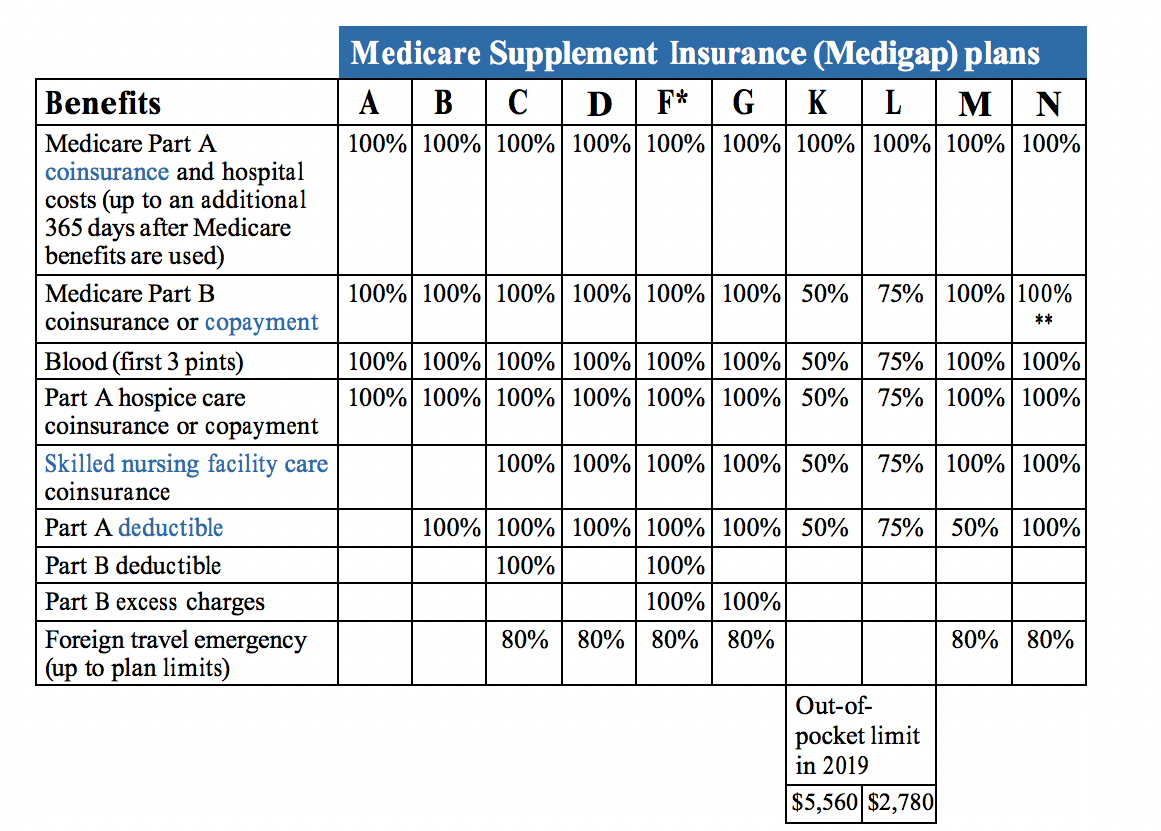

Medigap plan n. Medigap Plan N and G are very easy to compare as they share most of the same benefits. Medicare Supplement Plan N is one type of insurance policy that you can. In other words Medigap plan N has the same coverage regardless of which insurance company you choose.

Medigap Plan N Coverage As we mentioned there are ten different policies and all of them are different. Now available on all Priority Health Medigap plans. However outside of your one-time Medigap.

It covers the majority of supplementary medical expenses and it is usually priced very affordably and competitively. Medigap Plan N is a relatively newer Medigap plan. Inpatient Hospital Coverage Part A Outpatient Medical Coverage Part B.

What is Medicare Supplement Plan N. It originated when the plans were re-standardized in 2010. In this review well explain several similarities and differences between these 2 popular policies.

Medigap Plan N includes the following benefits. Medigap Plan N The Best Plan for 2021 and Beyond Since its introduction in 2010 the Medigap Plan N has steadily grown in popularity. Original Medicare leaves Medicare enrollees with many out-of-pocket costs including deductibles and coinsurances.

The best time to buy Plan N is during something called the Medigap Open Enrollment Period This is a one-time period that begins as soon as you are enrolled in Part B or turn 65 and lasts for six months. The Plans provisions were designed to prevent individuals from abusing the Medicare Part B system. This plan provides coverage for out-of-pocket costs that are not covered by Medicare Part A and Medicare Part B.

Medigap Plan N is a plan and not a part of Medicare such as Part A and Part B which cover your basic medical needs. The good news is that Medicare Supplement Plan N and Medicare Supplement Plan G are two of the most popular plans also known as Medigap plans. That said it has definitely picked up traction as one of the increasingly popular options among the Medigap plans.

Additional Medigap Plan N coverage includes. Also as mentioned you may have to pay 20 copay for doctor visits and 50 for emergency room visits if you arent admitted as an inpatient. Out of pocket costs for the insured.

Medicare Supplement Plan N offers identical basic benefits like the more popular Plan F but. Since the introduction of Medigap Plan N enrollment increases each year. Medicare Part A Deductible.

Introduced almost eight years ago Plan N offers a unique option to Medicare recipients who are looking to save on premiums in exchange for a small deductible and copay at the doctors office. Your Medigap Plan N Costs. When Should I Purchase Medigap Plan N.

The lower premium and option to still go to the doctor of your choice without network limitations makes it a great alternative to restrictive Medicare Advantage plans. The 2017 report from Americas Health Insurance Plans AHIP found that Medigap Plan N saw a 27 increase in enrollments between 2014 and 2015. Medicare Supplement Plan N also known as MediGap Plan N is a plan designed to help fill in the gaps left by your Medicare Part A and Medicare Part B Original Medicare.

It helps pay some of the health care costs not covered by your basic Original Medicare benefits. Medicare Supplement Plan N was developed for people who are willing to pay for some copays and a small annual deductible to have lower premium costs the amount you pay for the plan. Plan N is a plan that offers a lower premium in exchange for some cost-sharing ie.

Medigap Plan N Similar to the other nine supplement plans Plan N offers standardized benefits for all its beneficiaries. It also covers your Medicare Part A deductible and emergencies worldwide when you travel. That is Medicare Supplement Plan N which provides some powerful health insurance.

What Does Medicare Plan N Cover. Plan N does not cover Medicare part Bs deductible or any Part B excess charges. Medigap Plan N provides the same standard coverage benefits no matter where you purchase the plan.

Medicare Part A Coinsurance. Medigap Plan N is Medicare supplement insurance. Medicare Plan N Part N Plan N Coverage.

This popularity is not surprising because the policy offers a decent amount of coverage at a. This standardized Medicare Supplement covers the 20 that Medicare. If you are considering enrolling in some additional health insurance beyond the Original Medicare plan.

In this article Im going to detail the pros and cons of a Plan N which is one of the popular options for supplemental coverage. There is no one plan fits all that will work well for every applicant. A standard doctors visit has a 20 copay and an emergency room visit that doesnt result in admission calls for a 50 one.

All Medigap Plan N policies include the following benefits. Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits run out Part A hospice care copayment or coinsurance Part A deductible Part B coinsurance costs except for office visits and emergency room visits Part B. Medicare Plan N Eligibility.