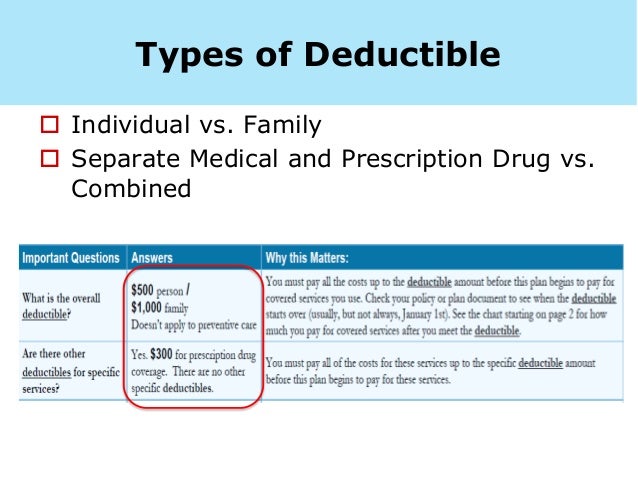

The only deductible that is involved when you have Plan G is the Part B annual deductible which is 203 in 2021. The Part B deductible for 2021 is 203.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

This plan will be like the High Deductible Plan F.

Plan g deductible. Once you reach that level of spending in a calendar year the plan kicks in and pays all remaining costs for the rest of. After your out-of-pocket expenses reach the Part B deductible amount you must pay 20 of the cost of Medicare-approved Part B services. Are comfortable paying a higher deductible in exchange for lower monthly premiums Semi-frequently see the doctor or need to visit.

Medicare Supplement plans are used to help cover medical costs that Original Medicare doesnt cover like deductibles and coinsurance. Is there a Lower Premium Option for Plan. What is the deductible for Plan G in 2021.

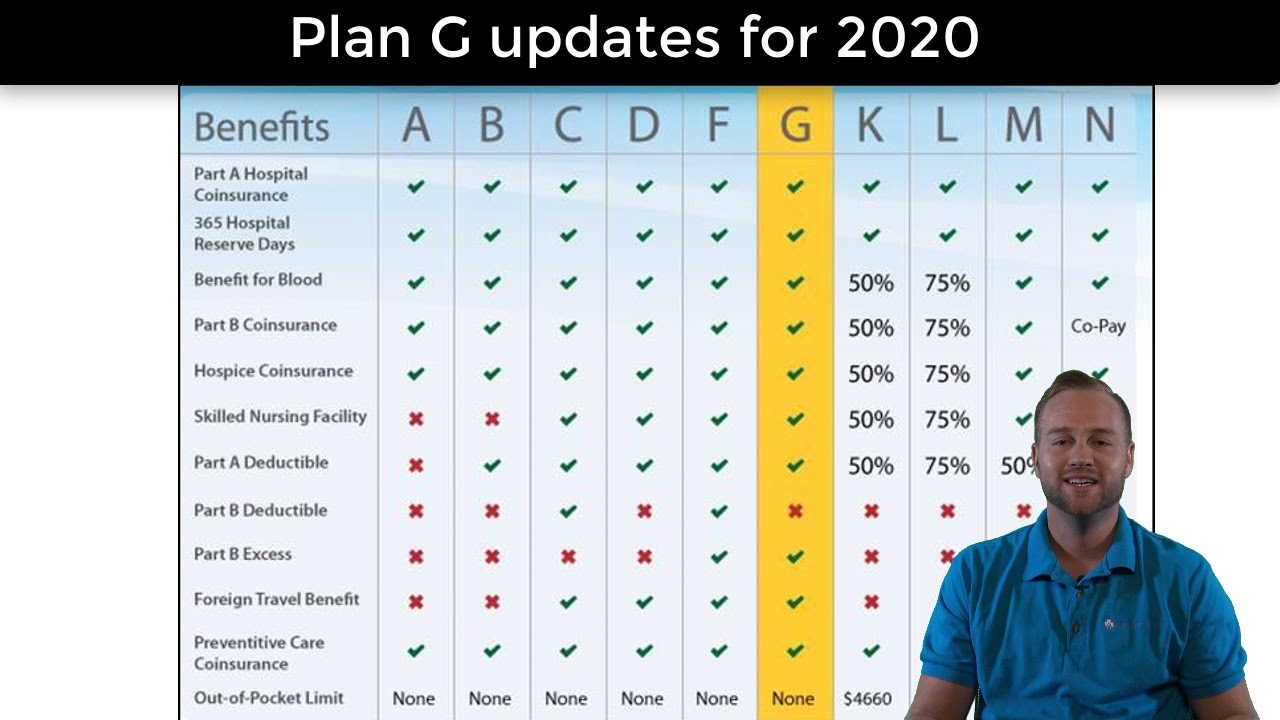

Plan G also covers 80 of emergency health care costs while in another country. How the Medicare Supplement Plan G works is that it pays all the holes or gaps in Medicare Parts A and B except for one which is the Medicare Part B annual deductible. High Deductible Plan G became available January 1 2020.

The deductible amount for the high deductible version of plans G F and J represents the annual out-of-pocket expenses excluding premiums that a beneficiary must pay before these policies begin paying benefits. Medicare Supplement Plan G does not have a deductible. Hospital stays can be expensive but with BCBS Plan G your hospital expenses are covered.

Learn more about this new policy how it affects you in 2021. After you satisfy the high deductible your High Deductible Plan G will cover everything listed. What this means is that when you use medical services Medicare will pay their 80 and you will be responsible for the other 20 until you meet the 2370 deductible.

This deductible is 203 in 2021. That in and of itself constitutes considerable savings but thats. Out-of-pocket expenses for this deductible are expenses that.

First Plan G covers each of the gaps in Medicare except for the annual Part B deductible. While the high-deductible plans exist so do their regular supplement plan counterparts. Also the plan sets a lifetime limit of 50000 on this type of coverage.

High-Deductible Plan G is available in 13 states including Alabama Arizona Delaware Georgia Illinois Iowa Kansas Louisiana Maryland North Carolina Ohio Pennsylvania and South Carolina. That includes the 1340 deductible thats normally owed with any hospital stay for Medicare patients. When using a plan with a high deductible youll usually.

This high-deductible plan pays the same benefits as Plan G after you have paid a calendar year 2340 deductible. However you must pay a 250 deductible first and the care has to occur during the first 60 days of a trip. However the premiums for Plan G tend to be considerably less than that of Plan F.

Medigap High Deductible Plan G is Ideal for Those Who. The high-deductible plan can be found for as low as 60 per month but comes with the stipulation of first paying the deductible 2340. For beneficiaries who became eligible for Medicare on or after January 1 2020 a High Deductible Plan G option will be available.

Aetnas Medicare Supplement Plan G has a premium discount of 7 if someone in your home is also on one of its plans. In addition tonormal Plan G with no deductible a high-deductible option is also available. Medicare Supplement Medigap insurance Plan G benefits are the same as Medigap Plan F except that the Medicare Part B deductible must be paid out-of-pocket.

Are there plans that cover the Part B deductible. When you have a Medicare Supplement Plan G you pay the monthly premium and the only out-of-pocket expense you have is Medicares Part B annual deductible 18300 for 2018. Medicare Supplement Plan F and Medicare Supplement Plan G.

Coverage with Medicare Supplement Plan G includes. The plan deductible will be 2370. Effective January 1 2021 the annual deductible amount for these three plans is 2370.

Benefits from the High Deductible Plan G will not begin until out-of-pocket expenses are 2340. However it will not cover your Part B deductible. Medicare Part A deductible coinsurance hospital costs Medicare Part B Coinsurance co-payment excess charges Preventative Care Part B Coinsurance Blood First 3 pints Basic doctor visits Foreign.

High deductible Plan G has a deductible of 2370 for 2021 this deductible changes each year. In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible. If you shop rates at Boomer Benefits we can often find a Supplement Plan G that saves quite a bit in premiums over Plan F substantially more than 203.

High-deductible Plan G often has lower monthly premiums. However youll have to. When you have a High Deductible Plan G policy Medicare pays its 80 share as usual but you pay the remaining 20 of all costs until your out-of-pocket costs reach 2340 2020 deductible.

The only plans that cover the Medicare Part B deductible are. With Plan G you will need to pay your Medicare Part B deductible.