Here are just a few things MediGap Plan G covers after youve met your Part B deductible. Coverage for your Original Medicare Part A deductible.

Medicare Supplement Plan G 2020 Updates Senior Healthcare Direct

Medicare Supplement Plan G 2020 Updates Senior Healthcare Direct

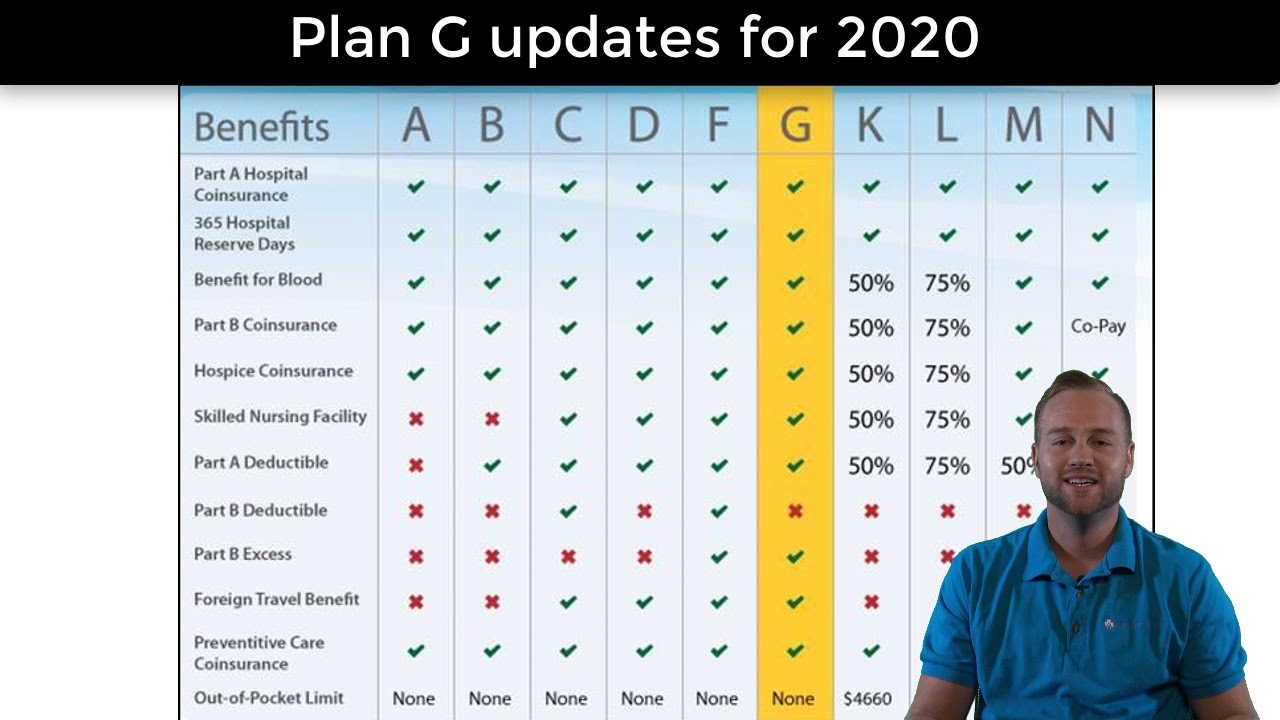

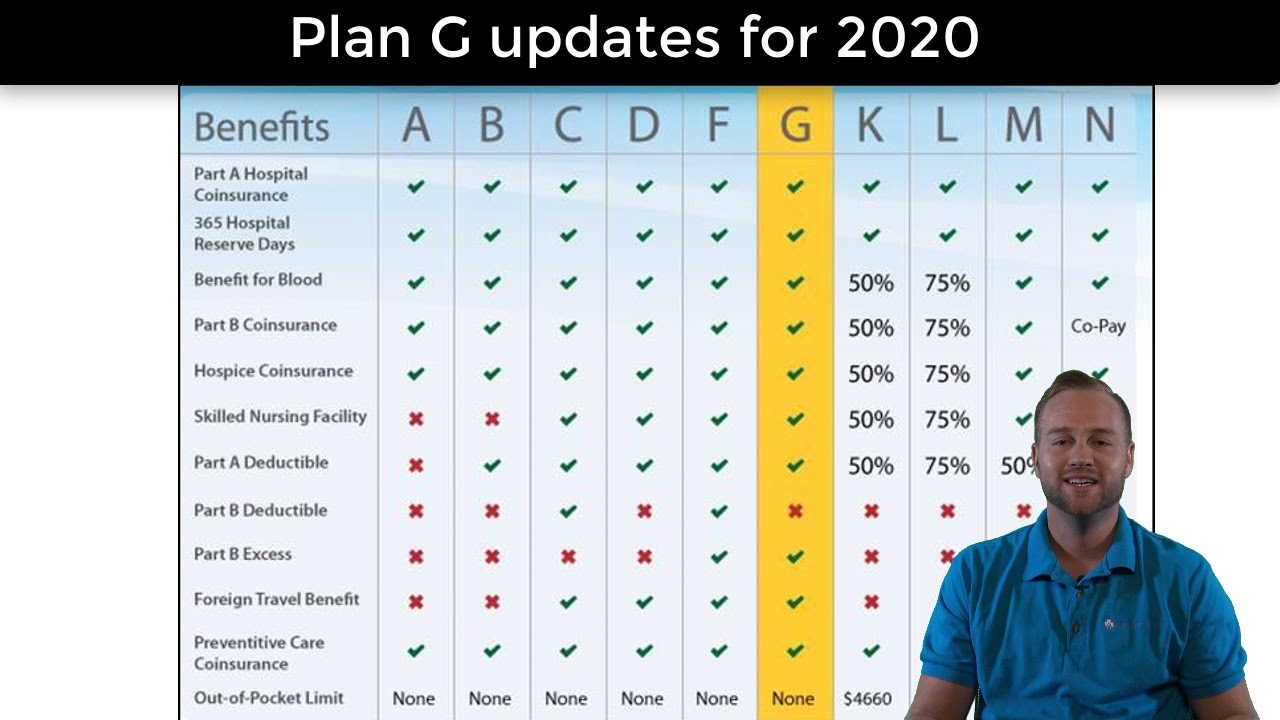

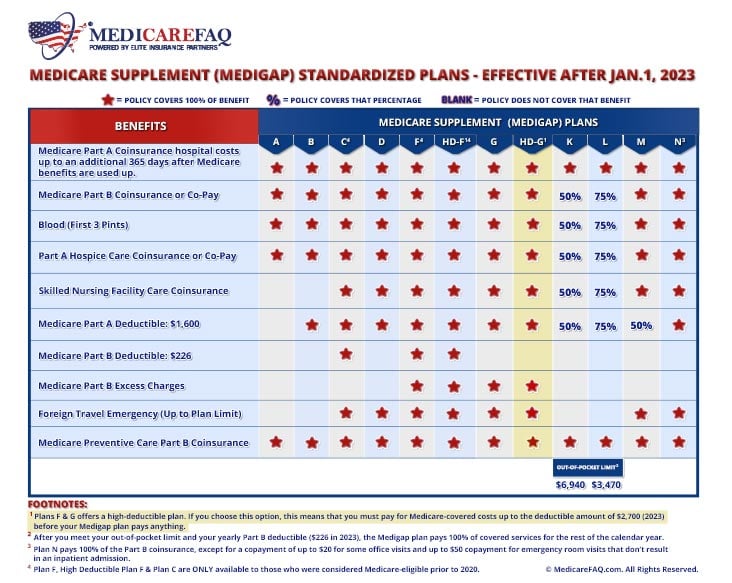

Lets take a look at what Medigap Plan G covers.

Does plan g cover medicare part a deductible. The only difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket. Medicare Supplement Plan G coverage includes Medicare Part A coinsurance and hospital costs hospice care coinsurance and copayment and the deductible. Aside from the Medicare Part B deductible which is 203 in 2021 Medicare Supplement Plan G covers a significant portion of your Medicare cost-share at an affordable premium.

The Part B deductible is not worth any consideration at this point because that benefit will. Its also referred to as Medigap Plan G. Skilled nursing facility care up to 100 days.

This can be different for Plan G. When you enroll in Medigap Plan G coverage you pay an annual deductible and your plan provides coverage for any gaps in Medicare coverage for expenses that would normally require additional payment on your part including deductible and copay amounts for hospital stays and skilled nursing facilities. Heres a quick look at what costs Plan G covers.

Medicare Part A hospital coinsurance and all costs up to 365 days after Original Medicare benefits are exhausted Part A hospice care coinsurance or co-payment. This means that you wont pay anything out-of-pocket for covered services and treatments after you pay the deductible. Foreign travel emergency medical care 80 of the costs up to a 50000 lifetime maximum.

Medicare Part B Excess Charges. This is the doctors office deductible. The only difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket.

Heres a quick look at what costs Plan G covers. Medicare Part A hospital coinsurance and all costs up to 365 days after Original Medicare benefits are exhausted Part A hospice care coinsurance or co-payment. Before June 1 2010 Medigap Plan J could also be sold with a high deductible.

Plan G covers everything that Medicare Part A and B cover at 100 except for the Part B deductible. However that deductible goes towards the larger HDG deductible so you would have already met it by the time you reach the 2370 HDG deductible. The plan deductible is 2370.

Medicare Part A comes with a deductible which is 1408 per benefit period in 2020. Medigap Plan G will cover your Part A deductible in full for each benefit period you require once you meet your Plan G deductible. So typically 1-2 doctor visits knock out the deductible.

Since cataract surgery is often. Plan G is a type of supplemental insurance for Medicare. The high deductible version of Plan F is only available to those who are not new to Medicare.

It is one of the more comprehensive Medigap plans and covers everything that Medicare does not cover with the exception of the Medicare Part B deductible which is currently 198year 2020. However it does not cover the out-of-pocket costs of the deductible. Medigap Plan G will cover your deductible in full for each benefit period you require.

Medicare Part A deductible for hospitalizations. Supplemental insurance plans help cover certain health care costs such as deductibles coinsurance and copayments. Without a supplement plan youd have to pay those expenses yourself.

While Plan G covers the Medicare Part A deductible it doesnt cover the Medicare Part B deductible. HDG like standard Plan G does not cover the Medicare Part B deductible 203year in 2021. Medicare supplemental Medigap Plans F and G can be sold with a high deductible option.

Unfortunately Medigap plans including. Medicare Supplement Plan G Plan G is known for its robust coverage compared to other supplement policies. Medigap Plan G covers your share for most medical benefits that original Medicare covers with the exception of the Part B annual deductible.

It covers all the components available in a Medigap program except the Medicare Part B deductible and there is no limit on out-of-pocket expenses. Medicare Supplement Plan G covers your share of any medical benefit that Original Medicare covers except for the outpatient deductible. So it helps to pay for inpatient hospital costs such as blood transfusions skilled nursing and hospice care.

The plan will pay what Medicare does not pay the 20. High Deductible Plan G is a good alternative to High Deductible Medicare Supplement Plan F which wont be available to new beneficiaries in 2021. Medigap policies typically donthave their own deductible.

For Part B costs Plan G includes coinsurance and copayment costs and excess charges. One of those is Medicare Supplement Plan G. Once the deductible is met you get the same coverage as a regular Plan G.

Like Medigap Plan F. Medicare Supplement Plan G covers semi-private room and board general nursing and miscellaneous services and supplies. Medicare Supplement Plan G covers your portion of medical benefits with the exception of the outpatient deductible covered by original Medicare.

Medicare Plan G What You Need To Know Ensurem

Medicare Plan G What You Need To Know Ensurem

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Supplement Plan G What Are The Facts Gomedigap

Medicare Supplement Plan G What Are The Facts Gomedigap

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.