A new employer is offering a plan with a 3000 individual deductible and a 9000 family deductible. If youre in good health and rarely use your plan a higher deductible may be best for you and your budget.

Medical Insurance 90 70 Ppo Kent State University

Medical Insurance 90 70 Ppo Kent State University

Protect yourself and your family with the compassion of the.

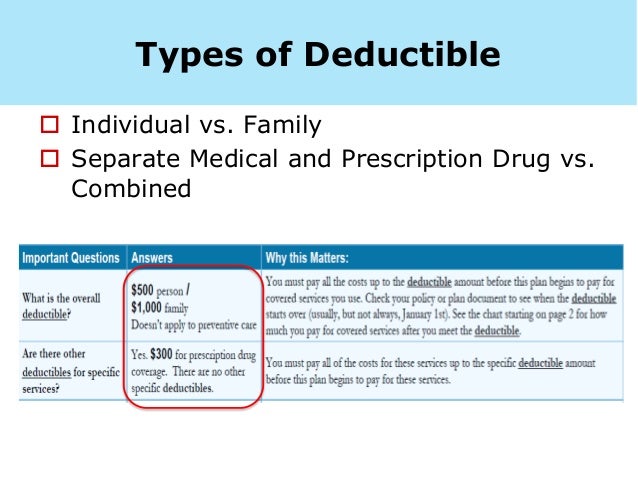

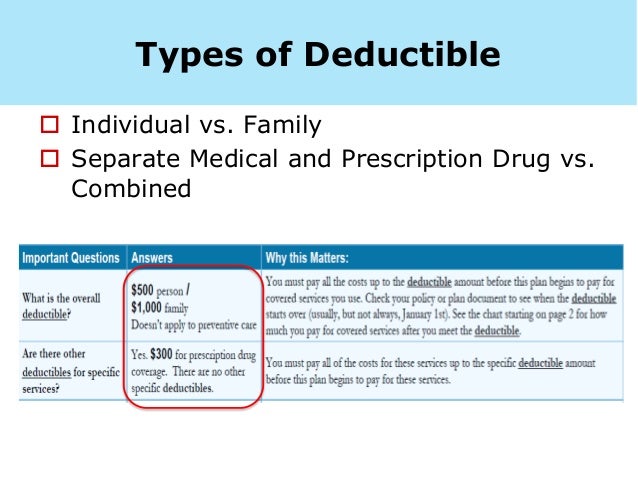

Family deductible vs individual deductible bcbs. Family plans have both individual and family deductibles. The deductible and out-of-pocket maximum for a family plan is usually double of an individual plan. Some family insurance has separate deductibles for each individual and then a family deductible limit.

The family deductible can be reached without any members on a family plan meeting their individual deductible. Lets say the aggregate deductible for your 2020 family plan is 12000. Choose the card that opens doors in all 50 states.

The main difference between individual and family coverage is how the annual deductible is computed. Your health insurance plan has a. INDIVIDUAL FAMILY PLANS.

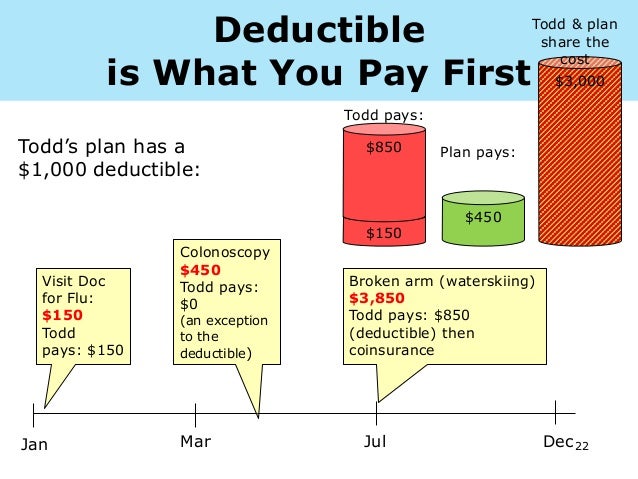

1998-2021 BlueCross BlueShield of Tennessee Inc an Independent Licensee of the Blue Cross Blue Shield Association. So while deductibles vary its rare for a family to pay more than two individual deductibles in one year. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs.

The nice part of a family deductible is that individual deductibles paid are applied to the family deductible as well. Any payments youve made this year toward your deductible or other costs wont carry over to your new plan. The single deductible is embedded in the family deductible so no one family member can contribute more than the single.

Individual deductibles focus on the amount towards a deductible that each individual in the plan has paid. This makes or breaks whether or not my spouse switches to BCBS. The family deductible can vary depending on your plan but is often about the sum of two individual deductibles.

An individual plan has one member or just one person covered by the plan. A plan might have a 5000 deductible for each family member and a 10000 deductible limit. Family plans cover two or more members.

However you might consider a low deductible plan if you or a family member has chronic health issues or you have young children. BlueCross BlueShield of Tennessee is a Qualified Health Plan issuer in the Health. Healthcare coverage is one of the most important decisions you make.

If you have a family plan two or more members there are two types of deductibles. The family has a deductible too. The Blue Cross Blue Shield System is made up of 35 independent and locally operated companies.

To shop for insurance you will need to visit your local BCBS company. The single most common plan design is a family deductible thats equal to twice the individual deductible. Co-pay coinsurance and cost of services may vary according to plan type.

The family deductible bucket is a fixed amount the entire family must pay before. After the family deductible is met youll only pay your copay andor coinsurance amount for services for each family member. All individual deductibles funnel into the family deductible.

If it is only my spouse and myself do we have a 3000 penalty for being a family and have to pay 9000 in deductibles. The individual deductible is a separate per-person deductible. A deductible is the amount you pay for health care services before your health insurance begins to pay.

Along with individual deductibles many family plans also include a family deductible. 5500 The maximum amount of money you pay. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.

The amount you owe for health services before your plan begins to help pay. It is a fixed amount of. Whats the Difference Between Individual and Family Deductibles.

When you have a family maximum deductible once the amount that all members of the plan have paid cumulatively towards a deductible meets the deductible then the plan considers the deductible as being met. With a family deductible once you met that one family deductible amount no other individual deductibles are needed. Youll likely reach your deductible limit quickly and your plan will help with health costs sooner.

This example uses a sample plan. Your plans deductible and out-of-pocket maximum are based on whether you have an individual or family plan. The Individual Deductible Bucket.

The first deductible is what is called an embedded deductible meaning that there are two deductible amounts within one plan. After that you share the cost with your plan by. Out-of-pocket expenses used to meet an individual deductible are counted toward meeting the family deductible which is normally twice as large as an individual deductible.

The Family Deductible Bucket. Individual Deductible Family Plans. Or is the total deductible 6000.

This obviously doesnt apply if family members have their own separate policies. Once any individual family member has paid 8150 toward the aggregate deductible amount coverage for that particular individual must kick in without requiring further cost. Each family member has an individual deductible.

Out-of-pocket maximum of 5000. If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. However after an individual meets his or her deductible coinsurance or copays typically will not count toward the family deductible.

25 Images What Is Individual Deductible In Health Insurance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Texas

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Texas

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Https Www Bluecrossmn Com Sites Default Files Dam 2020 06 P11ga 17045042 2019 T19030 Aware Hsa 2000 Nonembedded Deductible Plan Sbc Pdf

25 Awesome Individual Deductible Health Insurance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

25 Elegant Individual Deductible Vs Medical Deductible

25 Elegant Individual Deductible Vs Medical Deductible

25 Elegant Individual Deductible Vs Medical Deductible

25 Elegant Individual Deductible Vs Medical Deductible

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Bcbs Summary Of Benefits By Carrollton Public Schools Issuu

Bcbs Summary Of Benefits By Carrollton Public Schools Issuu

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Combined Aggregate Embedded What Does Bcbsil Mean Resource Brokerage Health Insurance Blog

Combined Aggregate Embedded What Does Bcbsil Mean Resource Brokerage Health Insurance Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.