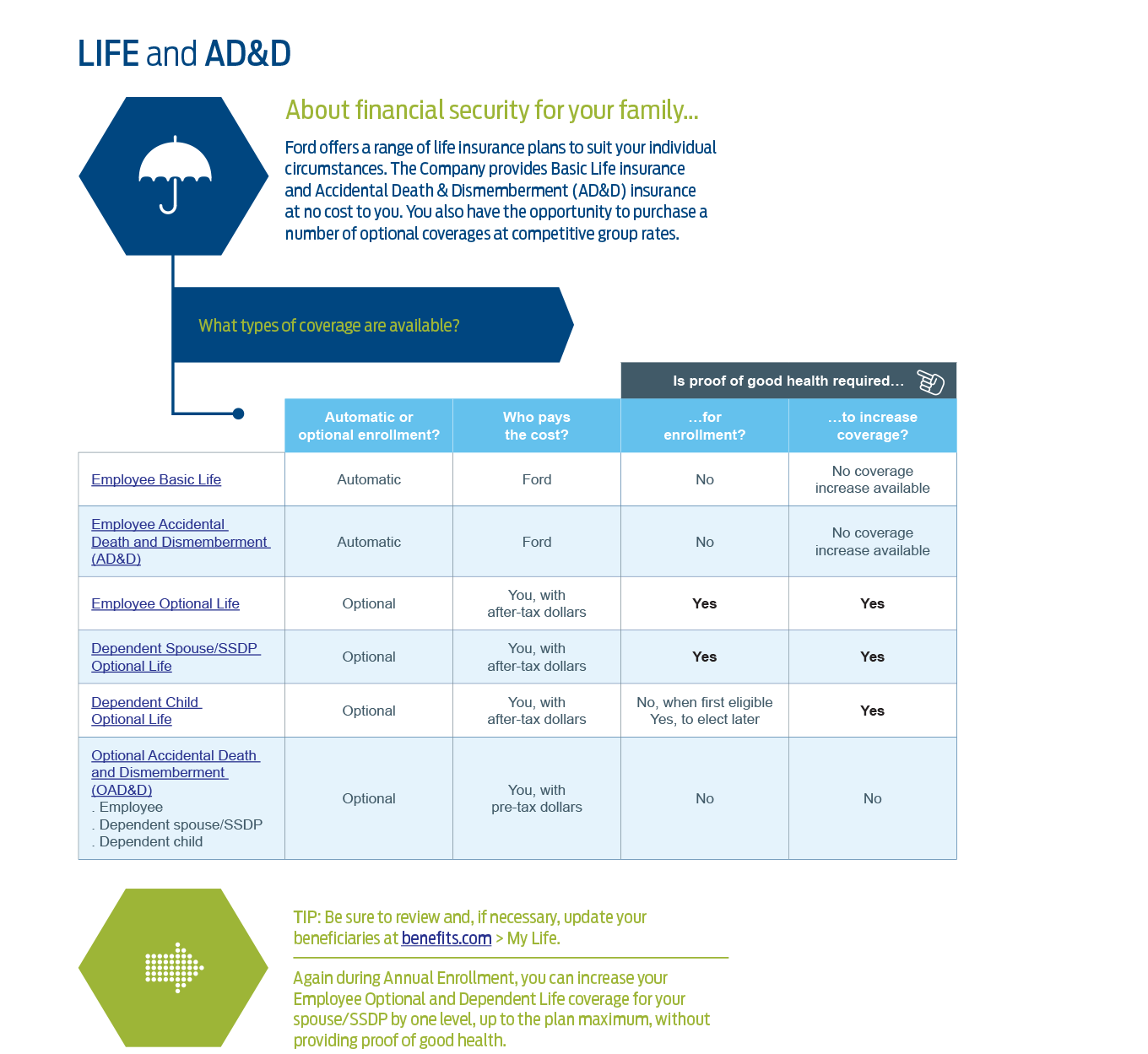

You must provide your beneficiary information on the enrollment form. If you are a full-time employee you automatically receive Basic Life Insurance and ADD coverage of 2x Benefit Compensation up to 2 million.

What To Know About Ad D Insurance Forbes Advisor

What To Know About Ad D Insurance Forbes Advisor

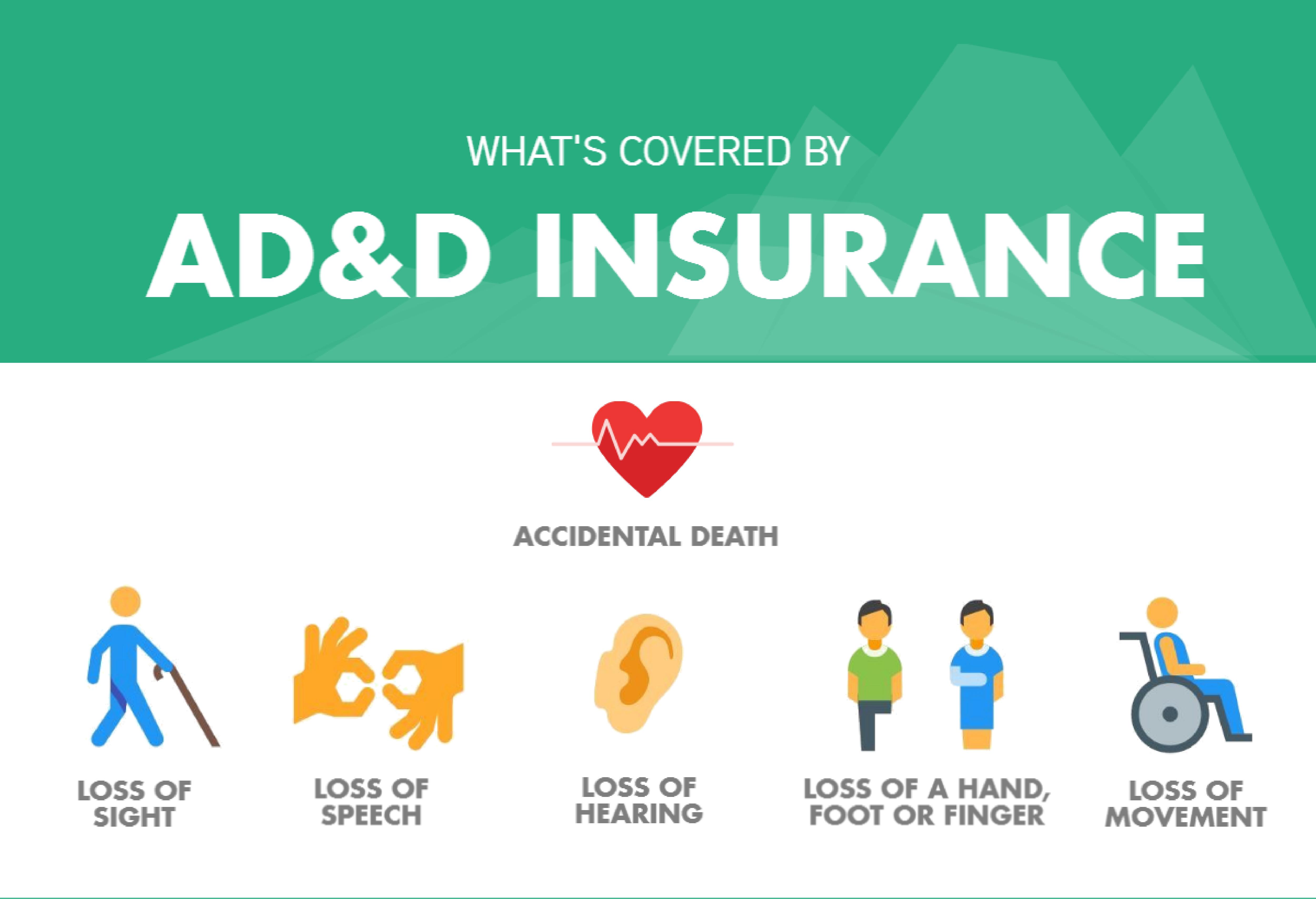

ADD insurance pays you or your beneficiaries a set amount of money if your death or dismemberment is the direct result of an accident.

Basic ad and d insurance. Most ADD policies pay a percentage for the loss of a limb partial or permanent paralysis or. FY 2019-2020 Employee Optional Life and ADD Insurance Monthly premium rates are for 1000 of coverage 100 Employee paid. FY 2019-2020 Basic Life and ADD Insurance Monthly premium rates are per employee per month 100 State-paid.

Because young people are more likely to die from an accident than from illness or natural causes the thought is that ADD insurance is the smarter buy. Some insurance brokers position accidental death and dismemberment insurance as a substitute for life insurance especially to young shoppers. ADD insurance pays out if you die or are injured in an accident but it shouldnt replace life insurance.

ADD coverage is paid to you or your beneficiary if you suffer a serious injury or die because of an accident. This type of insurance coverage generally applies to deaths and injuries from automobile accidents falls exposure to the elements. When adding an ADD rider also known as a double indemnity rider to a life insurance policy the.

Georgia Rose Apr 7 2021 Many or all of the products featured here are from our partners. Basic Life refers to life insurance that would pay the death benefit to the beneficiary if death occurred by any reason except suicide in the first two years. Commission or attempt to commit a felony or an assault.

ADD Insurance is designed to pay benefits in addition to other types of insurance coverage. How it Works for your Employees. ADDD stands for Accidental Death and Dismemberment.

Employee Basic Life Insurance is paid to your beneficiary in the event of your death. Basic Life and ADD All eligible employees receive company-paid basic life and accidental death and dismemberment ADD insurance. Understanding Accidental Death and Dismemberment ADD Insurance Accidental Death.

ADD is a limited form of insurance that covers you only in accidents. However there are coverage restrictions that make accidental death and dismemberment insurance far less useful. The benefit is equal to your annual base salary up to a maximum of 50000.

Including Cigna Accidental Death and Dismemberment ADD insurance on an employer- or employee-paid basis in your comprehensive benefits strategy helps employees stay financially protected and better prepared. It pays the beneficiary if death occurs by accident or it pays the insured person if they lose a limb. For example monthly premiums might start at 450 for every 100000 in accidental death coverage from Farmers.

Basic ADD Insurance will not pay benefits for death or dismemberment resulting directly or indirectly from. Basic Life and ADD Insurance are the names often used when offering supplemental insurance to employees. Intentionally self-inflicted injury or any such attempt while sane or insane.

What does ADD Insurance Cover. Yes it pays a death benefit but as the name suggests only provides coverage in the event you die due to an accident. It can be significant help to a family reeling from the death or serious injury of a primary wage earner.

ADD stands for Accidental Death and Dismemberment insurance. An accidental death and dismemberment insurance policy ADD is not the same as a standard life insurance policy. Under Basic ADD Insurance and Voluntary ADD Insurance you are the beneficiary for a covered loss other than death.

The World Bank Group offers basic Accidental Death and Dismemberment Insurance ADD to staff on regular open term and executive director ED appointments at HQ and country offices COs. HQ and CO staff on regular open term and ED appointments may enroll in optional Accidental Death and Dismemberment Insurance Additional Coverage HQ. For example if you suffer dismemberment due to a covered accidental injury.

Basic Life with ADD is most likely a policy that combines both those types of insurance. What is ADD insurance. In general ADD insurance premiums are tied to the amount of coverage you purchase.

What S Covered By Ad D Insurance The Florida Bar Member Benefits Insurance Retirement Programs

What S Covered By Ad D Insurance The Florida Bar Member Benefits Insurance Retirement Programs

Https Www Blueshieldca Com Bsca Bsc Public Broker Portalcomponents Streamdocumentservlet Filename A17765 1 15 Pdf

2017 Benefit Guide Keller Isd By Fbs Issuu

2017 Benefit Guide Keller Isd By Fbs Issuu

Employee Life And Ad D Insurance

Employee Life And Ad D Insurance

Https Employees Usc Edu Files 2018 12 Usc Culinary Group Basic Life And Add Insurance Pdf

Additional Employee Life And Ad D Insurance

Additional Employee Life And Ad D Insurance

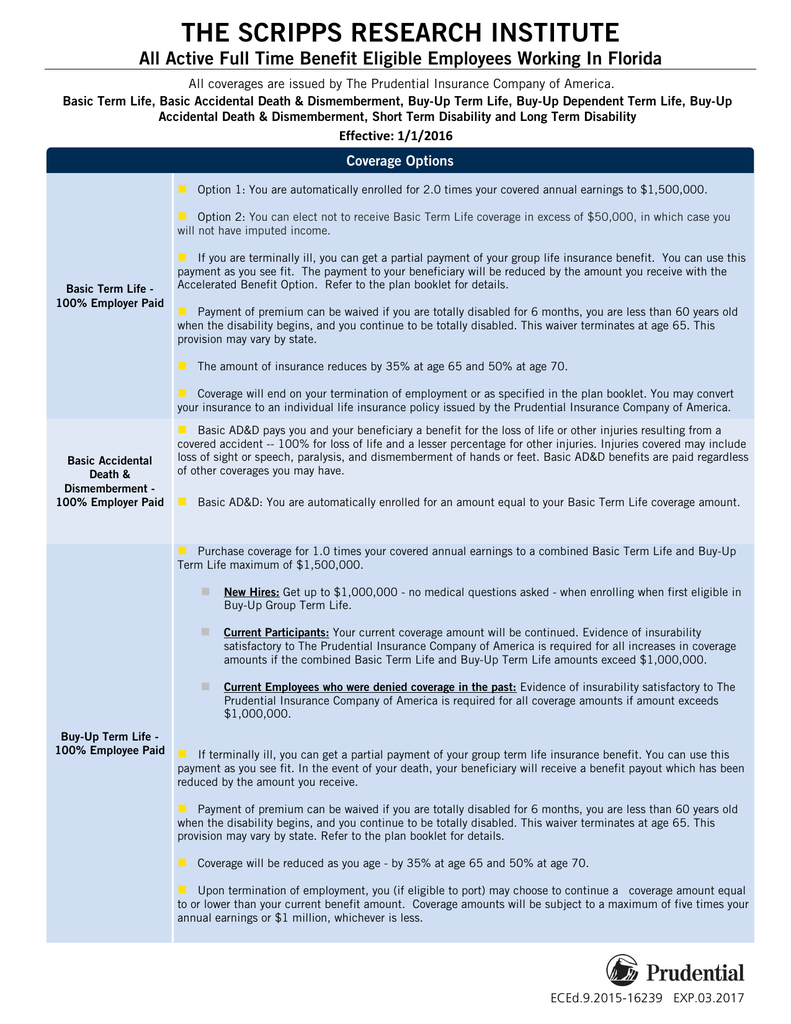

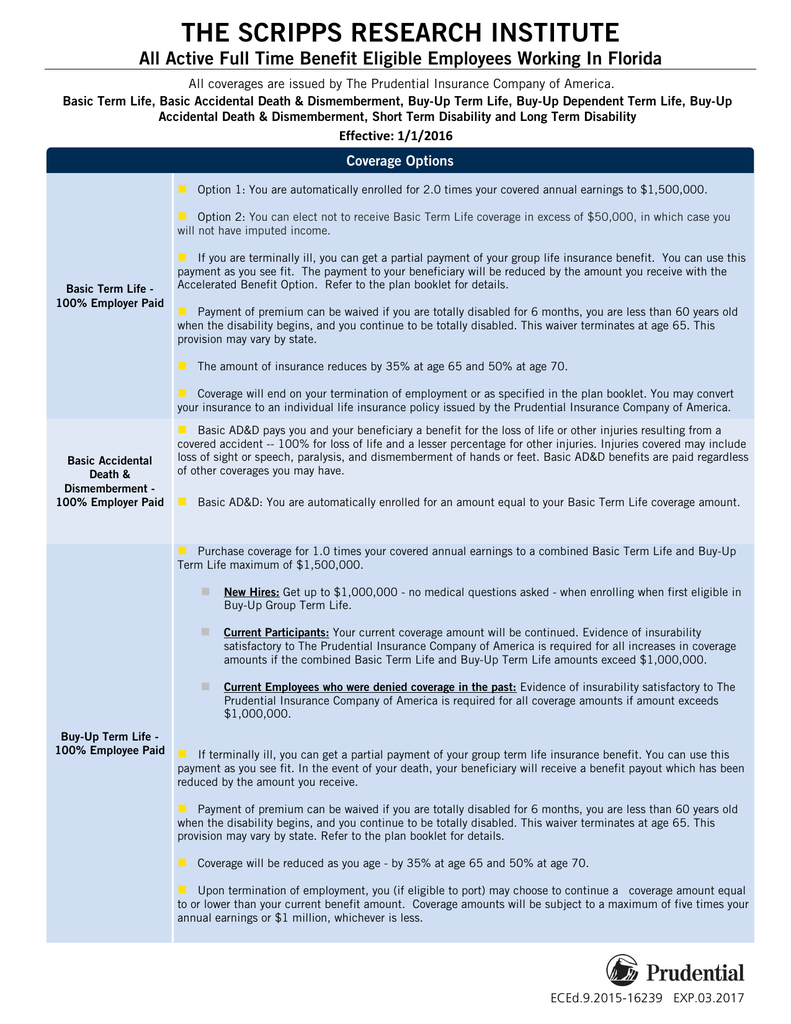

The Scripps Research Institute

The Scripps Research Institute

What Is A Family Coverage For Add Familyscopes

What Is A Family Coverage For Add Familyscopes

Life Insurance Hawaiian Financial Federal Credit Union

Life Insurance Hawaiian Financial Federal Credit Union

Is Group Accidental Death Dismemberment Ad D Worth It Glg America

Life Insurance Human Resource Management And Development The George Washington University

Life Insurance Human Resource Management And Development The George Washington University

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.