Life Insurance 300000 in death benefits 100000 in cash surrender or withdrawal values Health Insurance 500000 in hospital medical and surgical insurance benefits. Sum assured is paid out as death benefit.

Group Term Life Insurance An Overview

Group Term Life Insurance An Overview

Group Term Life insurance protects the life you love by securing it for the people most important to you.

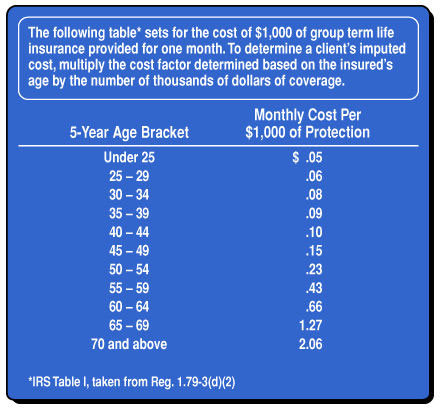

Group term life insurance benefits. As the name itself suggests a group term life insurance is designed to offer life insurance to a group of people under a single policy. When employer-provided group term life insurance GTLI exceeds 50000 for an employee the value of the excess coverage as determined by the IRS must be reported as income minus any after-tax premiums paid by the employee. 300000 in disability insurance benefits.

The Basic Group Term Life Insurance Program is a state-paid benefit provided for managerial. A group insurance is not limited to employer-employee group only because it extends to other groups like banks NGOs etc. Group Term Life With Living Benefits Insurance Plan Plan structured to allow benefit payments for qualifying critical health conditions in addition to the standard accelerated death benefit in the event of a terminal illness diagnosis and a death benefit.

The FLTCIP helps pay for long term care services in a variety of settings and for your choice of caregiver. Group Term Life GTL insurance is a great way to provide your loved ones with financial protection when you cant be there and when they need it most. The imputed cost value of the excess benefit coverage is subject to So.

Surrender benefits are applicable. Option to convert to individual endowment or whole life premium for members. Savings plan Group Savings Plans can be used to accumulate wealth over a period of time.

It is totally upon the organization whether to introduce the life insurance or not. The Federal Long Term Care Insurance Program FLTCIP is the group long term care insurance program that is designed specifically for Federal employees. Term insurance is life insurance that is in effect for a certain period of time only.

Its main purpose it to offer benefit to employees so that families have some financial protection when an employee die. Most employers offer group-term life insurance as an employee benefit although other types can be offered. Group term life insurance is an employee benefit thats often provided for free by employers.

Here are some of the benefits of group term life insurance policies. Metlife group insurance employer life insurance vs private group life insurance through employer what is group life insurance group term life insurance taxable guarantee trust life provider portal metlife group universal life group term life insurance definition Protected Access different modes of contingencies you win a burden and Liverpool. Generally in the case of employer-provided term life insurance the term is for as long as the employee is employed.

Group Term Life Insurance Meaning. There is option for employees to purchase the insurance. A group term life insurance policy is one for which the only amounts payable by the insurer are policy dividends experience rating refunds and amounts payable on the death or disability of an employee former employee retired employee or their covered dependants.

Including the FLTCIP in your financial plan can help protect your savings and assets should you ever need long term. Employers are allowed to provide employees with 50000 of tax-free group term life insurance coverage as a benefit. Term policy If a member of the group life insurance plan dies the sum assured will be paid to the nominee of the member.

It is the one of the most important benefit that is provided by the employer to their employees. As per the tax laws in force death benefits are excluded from tax under Section 1010D of the Income Tax Act 1961. Group Term Life insurance protects the life you love by securing it for the people most important to you.

Employees may also have the option to buy additional coverage through payroll deductions. 300000 in long-term care insurance benefits. No minimum or maximum sum assured limits.

Minimum group size of 10 members. They also deliver life insurance benefits seamlessly. In comparison group insurance policies are doubly successful both in terms of staff wellbeing and longevity.

100000 in other types of health insurance benefits Annuities. Tax Benefits Group Term Life Insurance plans provide all employers and workers with tax incentives. Group Term Life GTL insurance is a great way to provide your loved ones with financial protection when you cant be there and when they need it most.

8 Problems With Group Term Life Insurance Glg America

Guide To Employee Benefits Open Enrollment 2020 Group Term Life Insurance Certifiably Financial

Guide To Employee Benefits Open Enrollment 2020 Group Term Life Insurance Certifiably Financial

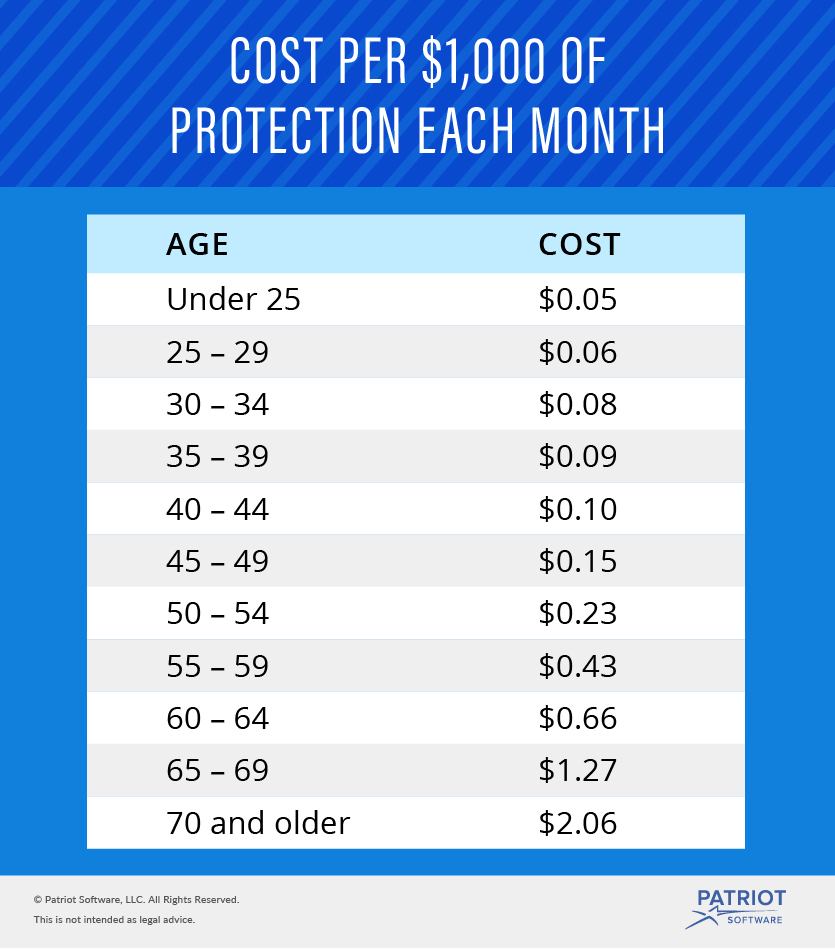

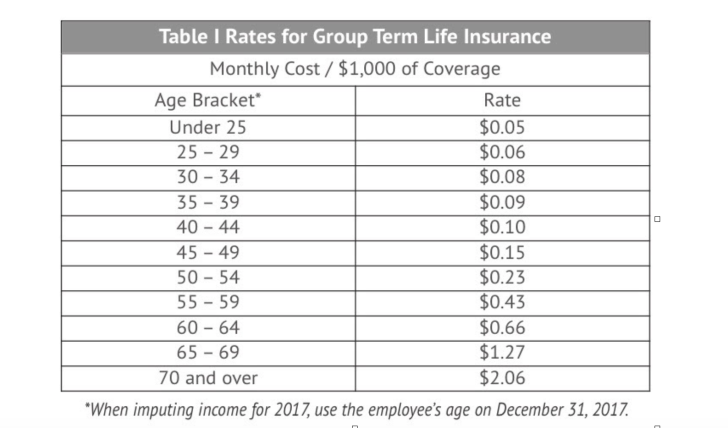

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Group Term Life Insurance Questions To Ask Yourself Today Ieee Spectrum

Group Term Life Insurance Questions To Ask Yourself Today Ieee Spectrum

Life Insurance Through Employer Cigna

Life Insurance Through Employer Cigna

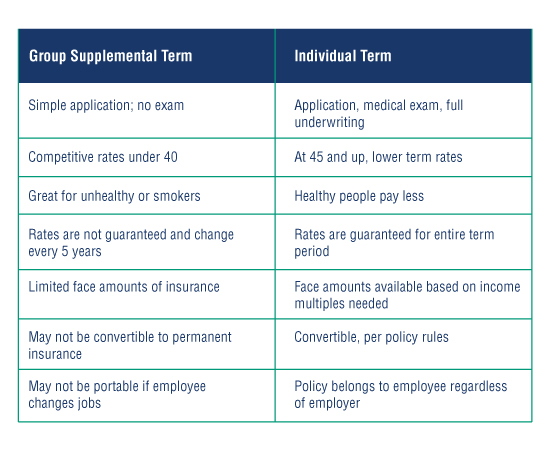

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Jyoti Samuhik Myadi Jeevan Beema Group Term Life Plan Jyoti Life Insurance Company Ltd

Jyoti Samuhik Myadi Jeevan Beema Group Term Life Plan Jyoti Life Insurance Company Ltd

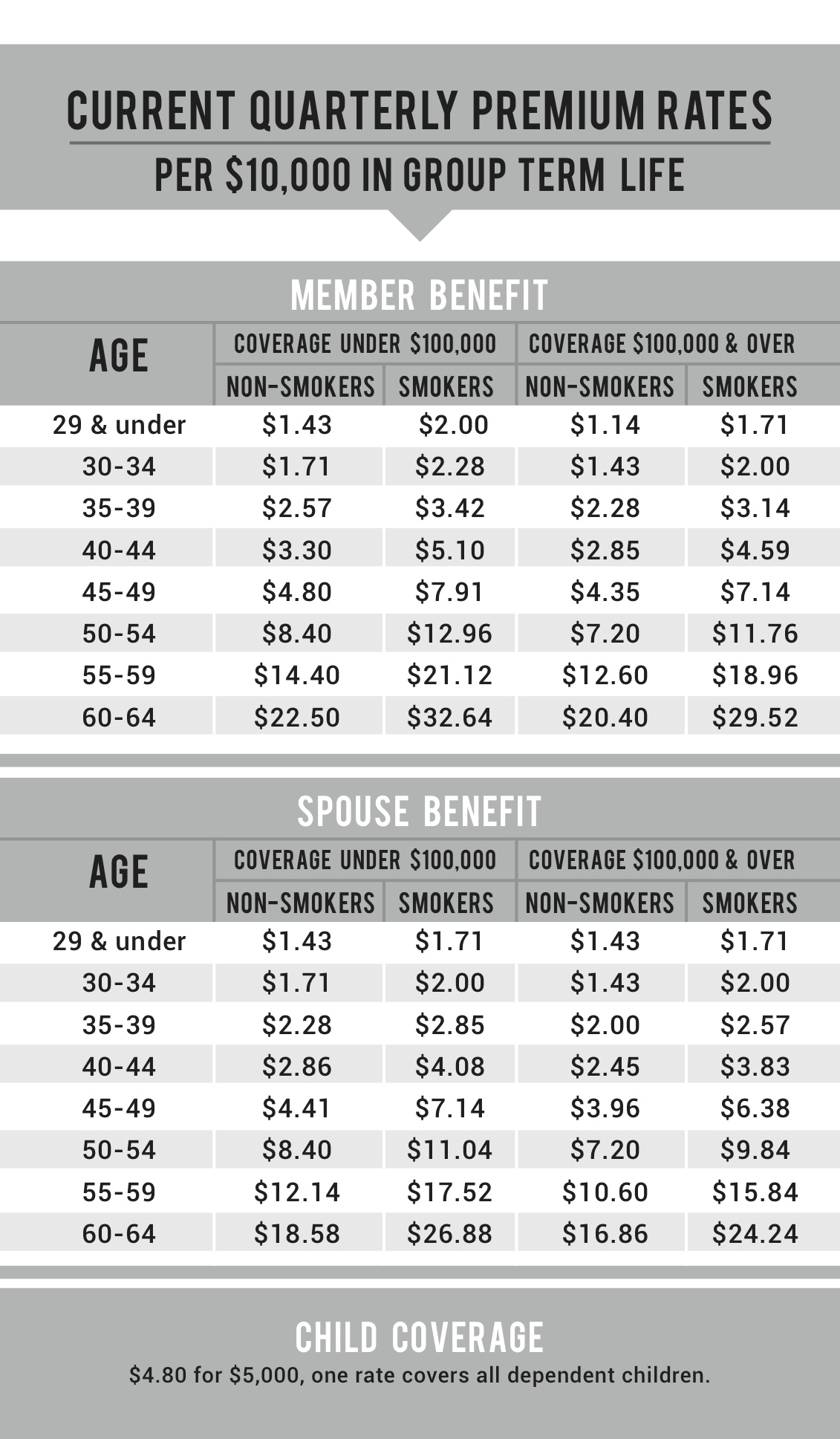

Group Term Life Insurance Compass Rose Benefits Group

Group Term Life Insurance Compass Rose Benefits Group

Https Www Standard Com Eforms 17090 Pdf

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Is Group Life Insurance A Good Deal Llis

Is Group Life Insurance A Good Deal Llis

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.