Plan F is the most comprehensive one it covers the most but it is no longer going to be available after January 1 2020. Devis gratuit en ligne.

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

It may provide additional insurance coverage or pay for costs not covered by a traditional health insurance plan including coinsurance copays and deductibles.

What does plan f supplemental insurance cover. Annonce A partir de 1999mois. Learn more and get a quote today. Part B Excess Charges.

If you sign up before then or you already have it you will be able to keep it however. Medicare Supplement Plan F offers the most comprehensive basic benefits out of all the standard Medicare Supplement Medigap insurance policies available in most states. If you have Plan F you will need to enroll in separate dental coverage.

Instead these plans cover the costs youre responsible for with Original Medicare. Below is a list of costs and benefits covered by Medicare Supplement Plan F. Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted Medicare Part A hospice care copayment or.

As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N. 1 2020 you will not be able to sign up for this plan. Trouvez une mutuelle rentable et adaptée à vos besoins.

Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans. Also plan F is being discontinued and after Jan. Plans E H I and J are no longer sold.

Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers Part A hospice care copayment or coinsurance costs. It is important to understand that these plans do not cover. Hospital costs after you run out of Medicare-covered days.

These costs can include. Annonce A partir de 1999mois. Medicare Supplement Plan F helps cover about 20 of medical costs that Medicare Part B does not cover such as deductibles and copayments.

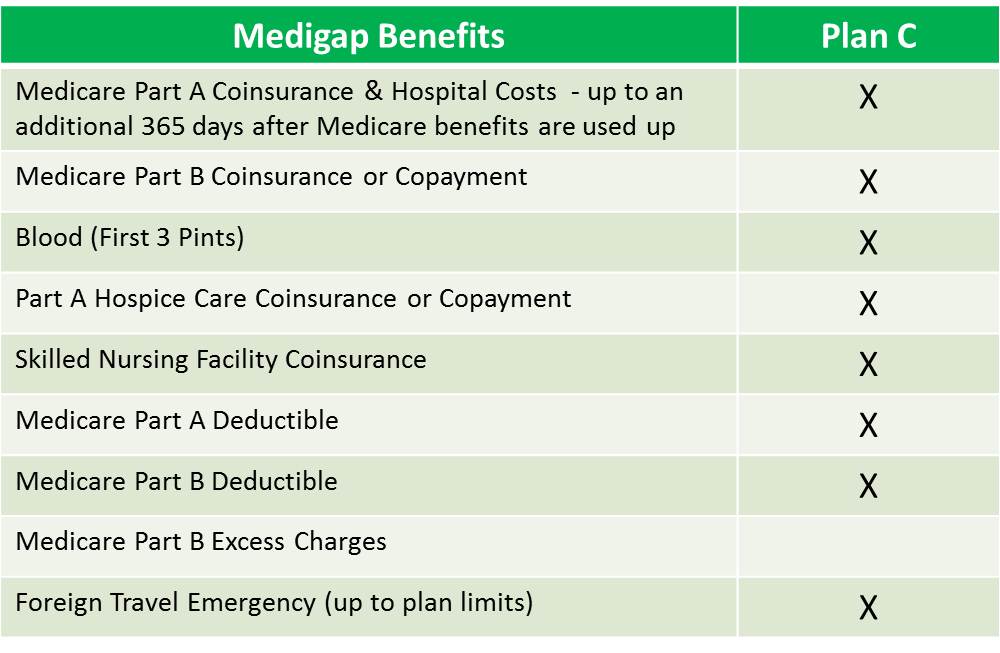

However it also tends to have the highest premiums too so depending on what health insurers are charging in your area and how. Plan F is the most popular Medicare Supplement insurance plan. Same coverages as plan C along with Part B excess charge coverage.

Supplemental health insurance is an insurance plan that covers costs above and beyond standard health insurance policies. Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance the Part B deductible and excess charges. An alternative that providers are suggesting is Plan G since it also offers a good amount.

Plan F covers the gap in coverage associated with Parts A and B. Plan F covers all of the costs of 3 pints of blood per calendar year. As a result of providing a complete benefits list Medigap Plan F is often the most expensive plan option out of all other Medigap plans yet it remains a popular choice among Medicare beneficiaries.

Plan F is a high-deductible option and enrollees are required to pay Medicare-covered costs up to 2240 before their Medicare supplement insurance pays anything. Plan F provides the most robust coverage of any supplemental insurance plan and for this reason is very popular with people who know they may incur significant out-of-pocket medical costs. Trouvez une mutuelle rentable et adaptée à vos besoins.

3 Pints of Blood The first 3 pints of blood or equal amounts of packed red blood cells per calendar year unless this blood is replaced. Medigap Plan F leaves enrollees with minimal out-of-pocket expenses by covering. This plan enables someone to be able to visit a doctors office or hospital to receive approved treatment and walk out without paying anything virtually eliminating all out of pocket costs.

Plan F covers all of the costs for an additional 365 additional hospital days. Devis gratuit en ligne. Plan F covers all cost-sharing services for Plan A and Plan B.

Medigap Plan F may cover. They are designed to cover out-of-pocket expenses for Original Medicare. Medicare supplement plans dont work like most health insurance plans.

Additionally it covers foreign travel agency care and skilled nursing facility coinsurance explains BlueCross BlueShield of. Your Medicare deductibles. For example compare Plan L from one Medigap insurance company with Plan L from another.

It all depends on the type of supplemental health insurance plan. Medigap Plan F is generally considered the most robust Medicare supplement insurance since it covers the most out-of-pocket costs. Medicare Supplement insurance plans such as Plan F do not include coverage for routine dental care.

They dont actually cover any health benefits.

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medigap Plan F The Most Common And Comprehensive Plan

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

What Is Medicare Supplement Plan F Gomedigap

What Is Medicare Supplement Plan F Gomedigap

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Other Medigap Plans Medigap Plans C D And More 65medicare Org

Other Medigap Plans Medigap Plans C D And More 65medicare Org

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.