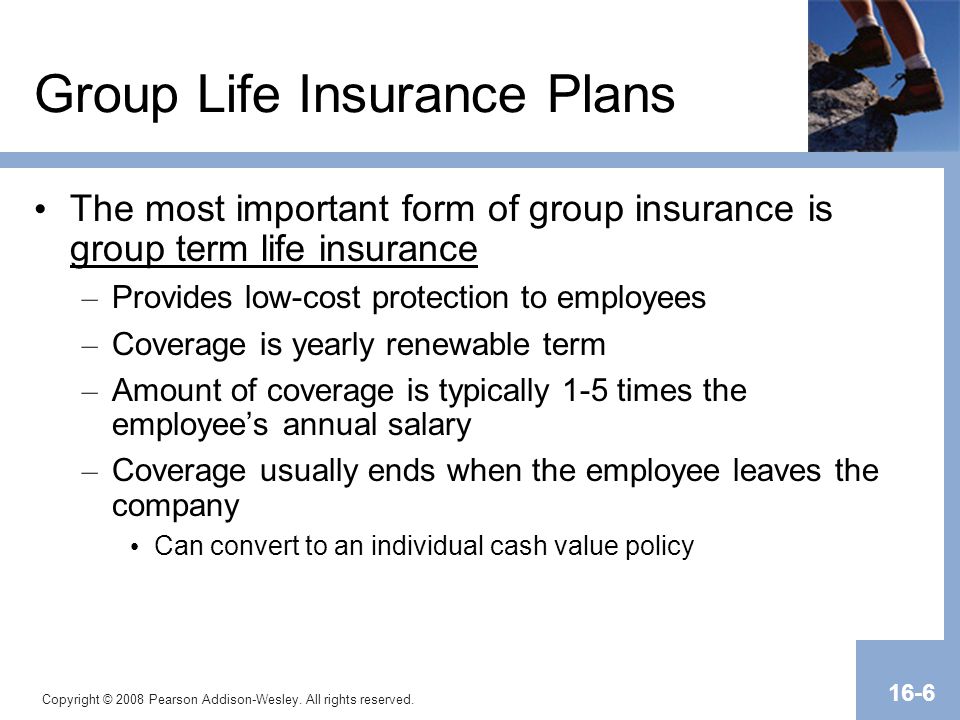

Employers generally provide term life insurance coverage for their employees and the amount of coverage is typically some multiple of the employees annual salary. Life and Health Insurers Life and Health Insurers Life and health LH insurers are companies that provide coverage on the risk of loss of life and medical expenses incurred from illness or injuries.

Federal Employee Life Insurance Needs Options For Coverage Part Ii

Federal Employee Life Insurance Needs Options For Coverage Part Ii

Group life insurance is an easy way for employees to get some life insurance coverage for free or at a very low cost.

Employee life insurance coverage. All premiums for Optional Life. Term life insurance coverage is provided automatically at no cost to eligible employees through the. Travel Accident is a State paid group term accidental death insurance that provides coverage for employees who are on state business in travel status on authorized State business.

Here are three main advantages of getting group life insurance through your employer. However sometimes the amount of. Group life insurance covers employees typically as part of an overall benefits package.

The Basic insurance coverage amount is equal to your annual basic salary rounded up to the next even 1000 plus an additional 2000. It pays 75000 100000 or 200000 depending on bargaining unit to your beneficiary if you die accidentally. Experts suggest having life insurance benefits up to 10 times your income.

The Federal Employees Group Life Insurance FEGLI Program offers Basic insurance coverage and three types of Optional coverage. That allows a company to offer workers this coverage for free or far less than theyd pay individually. Employees may purchase Optional Life insurance coverage.

No benefit is payable if the assaulter is an immediate family member. Group life insurance often is term life insurance. Employee Life Insurance Coverage Basic Life Coverage.

Additionally there is an extra benefit for employees under age 45. Owning an individual life insurance policy on top of a group plan ensures that you have enough coverage. If the amount of the death benefit is.

The customer - the purchaser of the insurance policy - pays an insurance premium for the coverage. The insurance company charges the employer a discounted group rate for this insurance. Group Term Life Insurance scheme refers to insurance coverage that is given to a group of individuals.

This insurance covers only a narrow occurrence the. The incident must have occurred at the members normal place of business or while the member was on work-related travel. This is often an amount that is one times their salary.

Members basic group life insurance coverage provides additional benefits if they die or are dismembered as a result of a felonious assault while performing their job duties. Employer-sponsored policies do not provide enough coverage or flexibility for most people especially those with dependents. The paperwork is often part of your hiring documents.

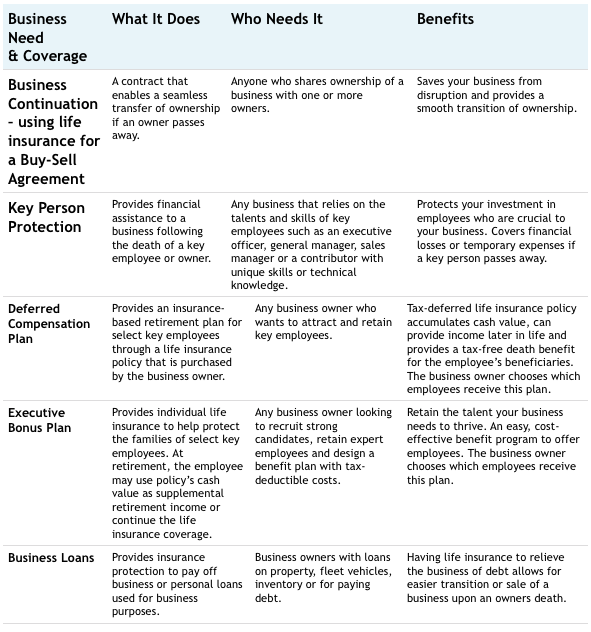

Many employers offer basic life insurance to their employees as part of their benefits package. There are other types of insurance that you can offer besides group-term life including. Business travel accident insurance.

Group life insurance plans provide financial independence to the families of the employee involved in the case of demise. Essential Life Insurance coverage for your employees The majority of group benefits packages include some form of group life insurance coverage. Basic life insurance coverage for new employees is effective on the first day you are in a pay and duty status in an eligible position unless you waive.

Group accidental death and dismemberment. Getting coverage through work can be relatively easy. Note that many employers offer a basic level of life insurance coverage for employees free of charge.

It is meant to offer a financial guarantee to the survivor affected by the community life insurance scheme in the insureds death. This benefit is usually provided at little or no additional cost to employees and often allows them. This type of life insurance policy is usually for a pre-determined set amountsuch as 10000 or a years salaryand is offered at a very low cost or even free.

Many companies also offer the option to purchase a. Basic coverage through work is usually free for the employee making it an easy way. Commonly known in the industry as ADD this coverage pays benefits to the.

Insurance Education Part 4 Basic Life Insurance Basic

Insurance Education Part 4 Basic Life Insurance Basic

Business Life Insurance Find Group Coverage Today Trusted Choice

Business Life Insurance Find Group Coverage Today Trusted Choice

Business Owners Life Insurance The Client S Insurance Agency

Business Owners Life Insurance The Client S Insurance Agency

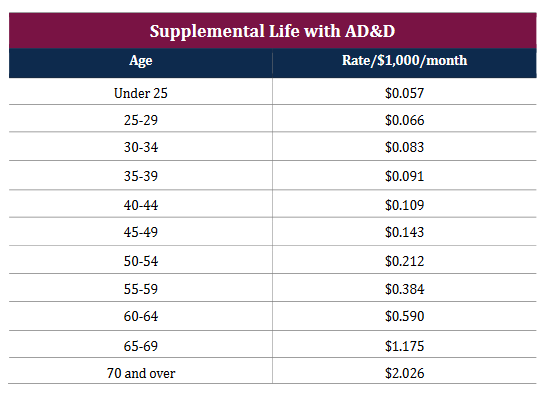

Https Www Flumc Org Files Fileslibrary Human Resources Unum Life Rate Sheet Pdf

Report The Future Of Life Insurance Business Insider Intelligence

Http Pubdocs Worldbank Org En 464681553541621694 Guide Cigna Group Life Insurance Portability Brochure Pdf

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Http Pubdocs Worldbank Org En 515511423565778977 Guide Cigna Group Life Insurance Plan Retiree Brochure Pdf

Benefits Employee Life Insurance

Benefits Employee Life Insurance

Do You Offer Life Insurance To Employees Hr Daily Advisor

Do You Offer Life Insurance To Employees Hr Daily Advisor

Real Time Quotes On Term Life Insurance Best Term Life Insurance Policies In Malaysia Compare And Apply Dogtrainingobedienceschool Com

Real Time Quotes On Term Life Insurance Best Term Life Insurance Policies In Malaysia Compare And Apply Dogtrainingobedienceschool Com

Http Nebraska Edu Docs Benefits Benefits Life Pdf

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.