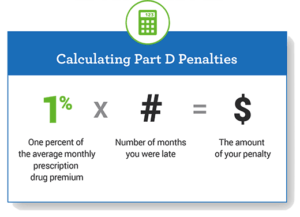

Your Part D penalty would be 33 percent of the national beneficiary premium one percent for each of the 33 months you waited. The late enrollment penalty is an amount thats permanently added to your Medicare drug coverage Part D premium.

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

If you allow more than 63 days.

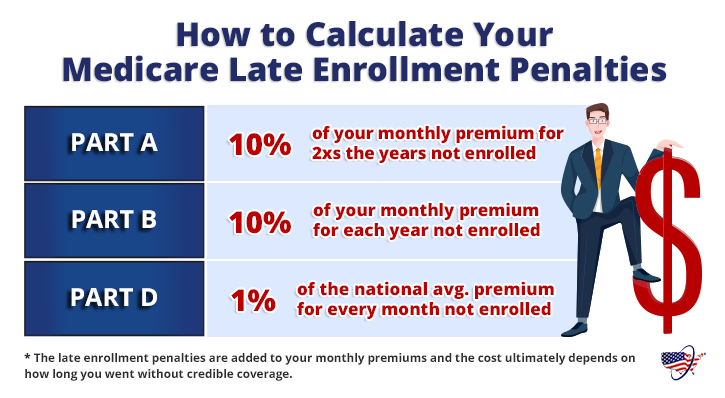

How long does medicare part d penalty last. The penalty for delaying enrollment in Medicare Part B is an increased premium. This would be calculated as 3306 x33 1090. To file an appeal youll need to provide details about the bad advice including when you received it.

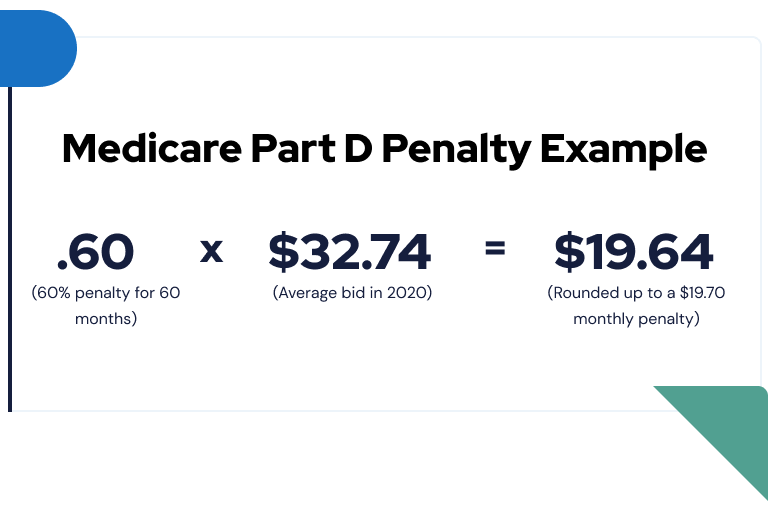

If you are enrolled in Medicare because of a disability and currently pay a premium penalty once you turn 65 you will no longer have to pay the penalty. Part D premium for as long as he or she. If you were previously without creditable prescription drug coverage for five years 60 months you would pay in addition to your monthly Medicare plan premium a monthly penalty of 1991 60 months without drug coverage 1 of 3319 or around an additional 239 per year for your drug coverage.

Medicare rounds this amount up to the nearest 010 then adds it to your monthly Part D. Your first deduction will usually take 3 months to start and 3 months of premiums will likely be deducted at once. The easiest way to avoid this penalty.

In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage. As long as you have creditable drug coverage you qualify for an SEP once that coverage ends. Furthermore you will owe the late penalty every month you are in a Medicare Part D Plan.

How do you calculate your premium penalty. The Special Enrollment Period lasts a full eight months for Medicare Parts A and B but only 63 days for Part D. After that only one premium will be deducted each month.

For our example lets say you had Part D coverage starting when you were initially eligible through 2010 and then decided that you did not need coverage starting January 1 2012 so you dropped your Medicare Part D. For plan year 2021 the Late Enrollment Premium Penalty is 033 for each month that you were not enrolled in a Medicare Part D plan but were eligible for Medicare Part D. You may also see a delay in premiums being withheld if you switch plans.

The national base premium 3306 in 2021 may change each year so your Medicare Part D late-enrollment penalty may vary from year to year. The late enrollment penalty is added to your monthly Part D premium for as long as you have Medicare. How long does medicare part d penalty last Medicare has many different parts and can be difficult to navigate.

The penalty is rounded to 970 which youll pay along with your premium each month. Its not a one-time penalty. Thats because each year your late penalty will be recalculated.

Someone gave me bad advice and I. Generally the late enrollment penalty is added to the persons monthly. If you want to stop premium deductions and get billed directly contact your drug plan.

Beneficiaries can get a Part B penalty waived if their enrollment delay was the result of bad advice from the government. If you enroll in a Medicare Prescription Drug Plan when youre first eligible for Medicare you wont be subject to a late-enrollment penalty. What if my Part D late enrollment penalty is a mistake.

As soon as you enroll in a Part D plan Medicare audits your insurance history and checks for gaps over 63 days in your prescription drug coverage. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over theres a period of 63 or more days in a row when you dont have Medicare drug coverage or other. This penalty is added to your monthly Part D premium and youll have to pay it for as long as you have a Medicare drug plan.

The penalty is added to your premiums for as long as you stay in the Part D programand its possible that you may pay higher penalties in future years. Lets say you delayed enrollment in Part D for seven months and you do not meet any of the exceptions listed above. If it sounds like a foreign language to you then you probably arent alone.

You pay the late penalty every month you have a Part D Plan. Youll pay this penalty in addition to your Part D Premium. For example 12 months equals a 12 late penalty.

The penalty lasts as long as youre enrolled in a Part D plan or a Medicare Advantage plan that includes Part D coverage. The number of months youve been without coverage 115 in your case remains constant. If you go without creditable prescription drug coverage for 63 days in a row or more after you sign up for Medicare you may have to pay a late enrollment penalty.

The Part D penalty is rounded to the nearest 10 cents. Your penalty for 2021 would be 33 cents x 12 for the 12 months of 2020 you werent covered or 396.

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

Do I Have To Sign Up For A Medicare Part D Plan 65medicare Org

Do I Have To Sign Up For A Medicare Part D Plan 65medicare Org

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Unintended Part D Late Penalty Could Get You If Enrolling After Age 65 Aarp Medicare Plans

Unintended Part D Late Penalty Could Get You If Enrolling After Age 65 Aarp Medicare Plans

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

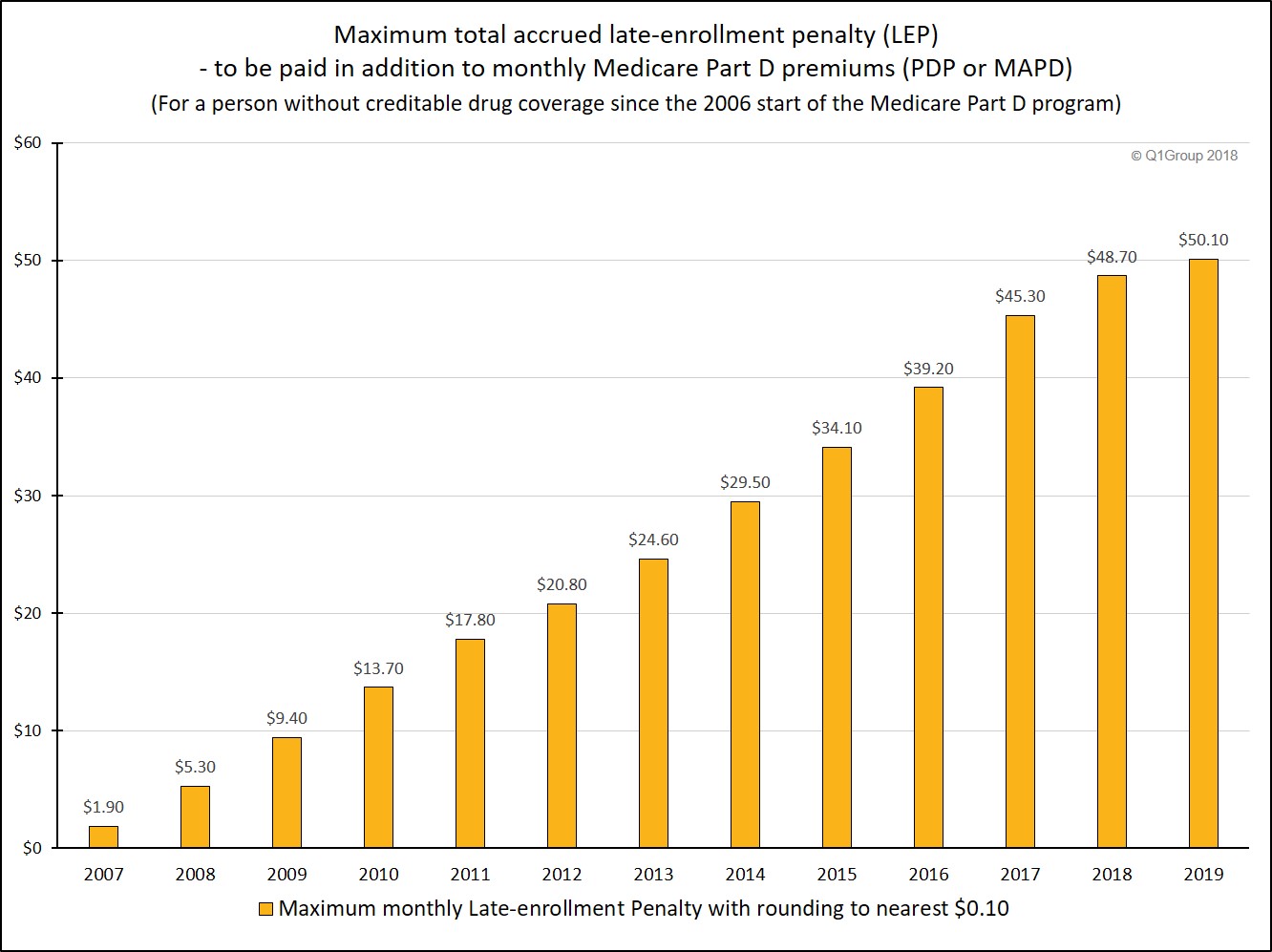

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

:max_bytes(150000):strip_icc()/medicare-part-d-costs-4589863_FINAL-a334073127ad461fbd5457a7d74d1e6c.png) How Much Does Medicare Part D Cost

How Much Does Medicare Part D Cost

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.