The Anthem Preferred Provider Organization High Deductible Health Plan Anthem PPO HDHP includes comprehensive coverage for medical prescription vision behavioral health and organ transplant services with no pre-existing condition limits or waiting periods. Did you know preventive health measures and screenings can prevent 85 of illness and disease and are covered at no cost for many plans.

Https Www Nh Gov Insurance Lah Documents Mthp Nh Bmp Pdf

Preventive Care Plans Guidelines.

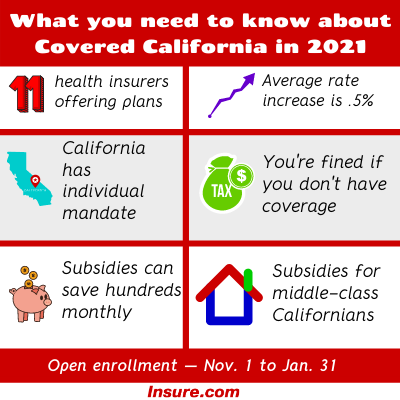

Does anthem insurance cover iud. Make sure to get all the screenings and vaccines recommended for your age and gender. As part of Obamacare covered participants are supposed to provide contraceptives at no out of pocket costs to the individual. Compare Business Insurance From 15 Providers Now Find A Policy To Suit Your Needs.

Does my insurance cover the Paragard IUD. Check with your insurance provider to confirm coverage related to your individual plan. She got an IUD at Palo Alto Medical Foundation in Palo Alto.

The Affordable Care Act ACA generally requires health plans to cover FDA-approved contraceptives including intrauterine devices IUDs at low or no cost to the patient eg co. If you do not have health insurance or if Kyleena is not covered by your insurance the cost of Kyleena is 99928. Ad Protect Your Business With Compare The Market Get A Quote In Minutes.

If not ask about your out-of-pocket costs. This comes to 1665 per month over a 5-year period. There is no copay deductible or coinsurance even if your deductible or out-of-pocket maximum has not been met.

Please follow this link to see the complete current contraceptives list that BCBS has released. Many health insurance plans cover IUDs -- especially those with a birth control coverage rider. She was billed 1354.

If NEXPLANON is covered. Coverage includes generic over-the-counter 81mg and 325m g aspirin pr odu cts to pr event pr eec lampsia in pr egnant w omen and to prevent cardiovascular disease and co lorectal can cer in adults 60-69 years old. Administrative services provided by United HealthCare Services Inc.

1 2021 Your health plan may provide certain contraceptive coverage as a benefit of membership at no cost to you when you use a pharmacy or doctor in your health plans network. You should also ask your health plan representative about coverage and out-of-pocket costs for removal keeping in mind your insurance may change. For patients covered by insurance out-of-pocket costs likely include a copay of 10 to 30 for the initial doctors visit and a similar copay for the insertion or a percentage of the total cost usually about 20 percent.

Insurance coverage provided by or through UnitedHealthcare Insurance Company or its affiliates. The Affordable Care Act ACA or health care reform law requires Anthem Blue Cross and Blue Shield Anthem to cover certain preventive care services with no member cost-sharing copayments deductibles or coinsurance1 Cost-sharing requirements may still apply to preventive care services received from out-of-network providers. Anthem Blue Cross paid 114856 and she was charged 224 but will pay the 197 for follow-up.

Most Women With Insurance Can Get Paragard at No Cost. Covered contraceptives generally include birth control pills the birth control patch such as Ortho Evra a diaphragm contraceptive gel and an IUD. MT-1146192 717 2017 United HealthCare Services Inc.

Paragard is fully covered under most insurance plansthis may mean no co-pay deductible or out-of-pocket costs. If the plan has limitations on. Mifepristone is covered only in plans that cover elective abortion.

When you elect the Anthem PPO HDHP you are also eligible to elect a Health Savings Account HSA a special tax-advantaged bank account to help cover. Ask the representative whether NEXPLANON and the insertion procedure are 100 covered. If you have health insurance.

Preventive Care Coverage at No Cost to You Effective Jan. Aetna considers mifepristone medically necessary for the medical termination of early pregnancy and second trimester abortion. Paragard is fully covered under most insurance plansthis may mean no co-pay deductible or out-of-pocket costs Check with your insurance provider to confirm coverage related to your individual plan.

Fees for the Paragard placement procedure may apply. Aspirin 81mg 325mg tab ec tab chew BOWEL PREP Coverage includes generic prescription and over-the-counter products and are. With Insurance If you have insurance then the IUD should be free or low-cost thanks to the Affordable Care Act Obamacare which mandates that insurance plans cover one type of contraception within each of the 18 FDA-approved birth control methods in other words dont try to buy the pill patch vaginal ring and IUD all at once and expect everything to be free.

Process is 100 covered under womens heath provisions under Affordable Healthcare Act She got an IUD at East Bay Family Practice in Oakland. There are also additional guidelines if youre pregnant. Most health insurance plans will cover the cost of an IUD.