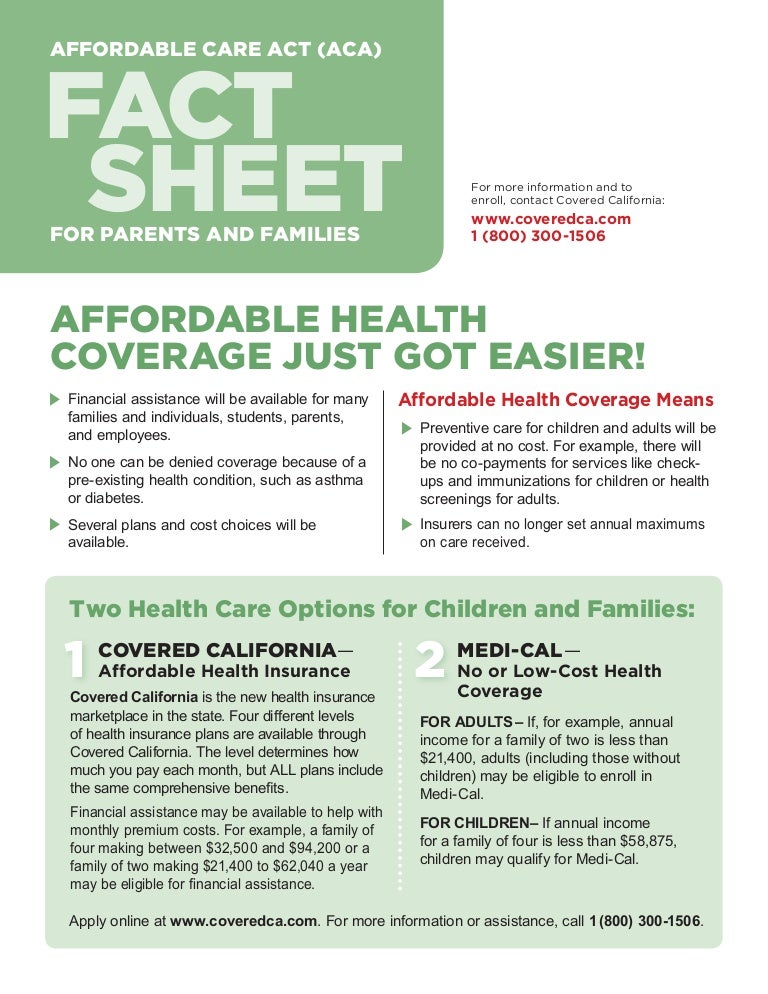

An EPO can have lower monthly premiums but require you to pay a higher deductible when you need health care. The Premiums for Gold plans are high and the deductibles in the lower end of the range.

Get Quality Affordable Health Coverage In Los Angeles And Orange County For Real

Get Quality Affordable Health Coverage In Los Angeles And Orange County For Real

When you choose an EPO plan you will instantly notice that the fees you are charged with by the medical service providers that have accepted to join your insurance companys network are significantly lower than those normally charged.

Epo insurance coverage. Plantin and Moretuslei 295. However an HMO or PPO could potentially be cheaper depending on your individual situation and coverage needs. What is an EPO plan.

Coverage codes and statistics The EPO provides users with high-quality online patent data from more than 80 different countries. An EPO is a type of managed care plan which means that your health insurance plan will cover some of your medical expenses as long as you visit a health care provider doctor hospital or other place offering health care services within a particular network. Why will you look for an EPO health insurance plan.

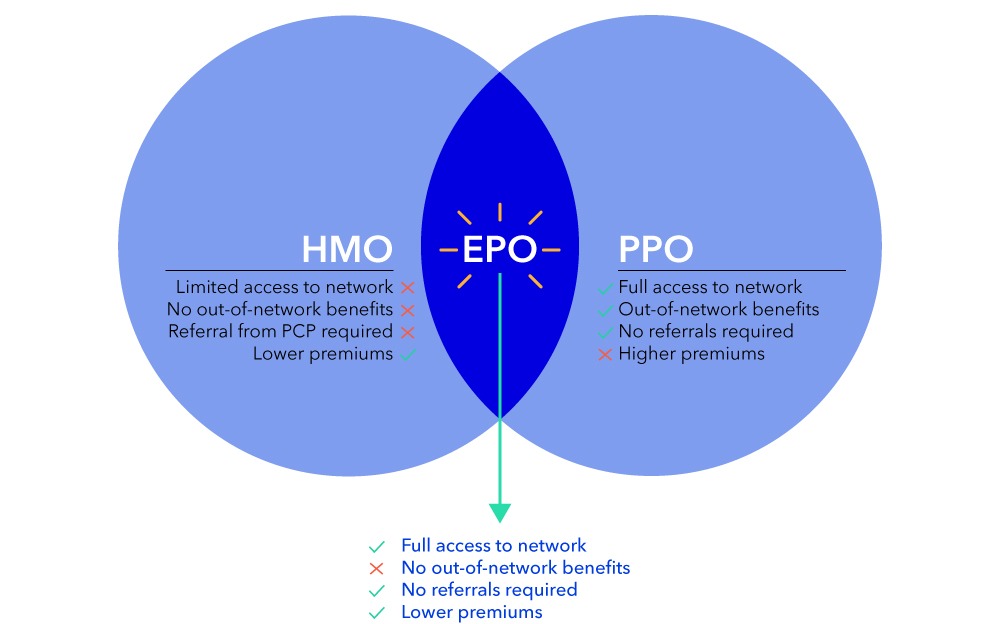

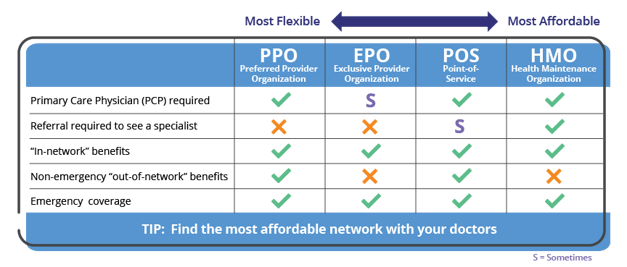

An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribers. Like PPO insurance you can go directly to a specialist and bypass the need for a referral from your primary care physician. Under EPO health insurance plans you will not receive any coverage out-of-network.

An Exclusive Provider Organization plan EPO is similar to an HMO plan in that it has a limited doctor network and no out-of-network coverage but it is similar to a PPO plan in that you dont have to designate a primary care physician upon applying and you dont need a. Its important to note that those with an EPO plan have health insurance coverage only for in-network doctors and hospitals and there are no out-of-network benefits except for emergencies. Platinum EPO plans cover about 90 percent of the benefits costs and leave ten percent for the consumer.

The Health Maintenance Organization is regulated under the HMO laws and regulations. However an EPO generally wont make you get a referral from a primary care physician in order to visit a specialist. An Exclusive Provider Organization or EPO is a type of health insurance plan in which members must utilize doctors and providers within the EPO network except in case of a medical emergency.

Exclusive Provider Organization EPO EPOs got that name because they have a network of providers they use exclusively. Gold EPO Plans cover 80 percent of benefits costs and leave 20 percent for the customer. An EPO Exclusive Provider Organization Insurance Plan can help prevent you from going bankrupt if youre hit with a surprise illness.

Basically an EPO is a much smaller PPO. More detailed information will be available to you once you start work. Coverage is provided worldwide and the employee has the free choice of doctors.

EPO health plans generally have lower monthly premiums co-pays and deductibles than non-EPO options. With most EPO plans you wont receive any insurance coverage when visiting a specialist outside the network. What is an EPO health plan.

When considering their coverage the EPO is better suited for the rural areas. It is important for people who are considering EPO insurance to carefully read the coverage terms and fine print. The premiums are high and the deductibles are low and reachable.

We monitor the three main patent data streams bibliographic facsimile images and full text at key stages in their life cycles to ensure that they are complete consistent accurate and up to date. EPO Health Insurance Plans. Continue reading What the heck is an EPO health insurance plan.

One of the most significant advantages to an EPO is participants dont need a referral from a primary care physician to see a specialist. The EPO healthcare insurance contract is managed by. EPO is the acronym for Exclusive Provider Organization an exclusive network of doctors hospitals and other medical facilities.

You must stick to providers on that list or the EPO wont pay. But like HMO insurance youre not covered if you see out-of-network providers however as mentioned in the case of a medical emergency EPO insurance will cover some of the costs of out-of-network expenses. An EPO is usually more budget-friendly than a PPO plan.

For that reason an EPO health insurance plan may be well-suited for those whose doctor is either part of their plans network or for those who. Married life can be great but unexpected things do happen -- often at the worst time. An EPO is a health insurance option similar to.

In technical speak. When you do not need a Primary Care Provider PCP. The HMO is determined on a capitated basis whereas the EPO is based on the services provided.

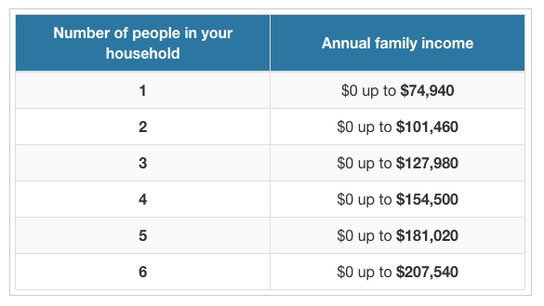

Most EPO health insurance plans cover basic medical treatments as well as preventative care long-term care emergencies and specialist treatment such as physical therapy and surgeries. An Exclusive Provider Organization EPO is a type of health plan that offers a local network of doctors and hospitals for you to choose from. When comparing the premiums the EPO has a lower premium than the HMO.

.jpg)