In fact if you wait too long to sign up you could be facing some serious penalties to the tune of a 10 increase in monthly premiums or more. Your Part D penalty would be 33 percent of the national beneficiary premium one percent for each of the 33 months you waited.

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

There may however be.

Penalty for not signing up for part d. Your penalty will not decrease if you enroll in a Part D plan with a lower premium. The penalty is again added to your Part D monthly premium and is lifelong. Ron doesnt enroll in Part D because he isnt currently prescribed any medications.

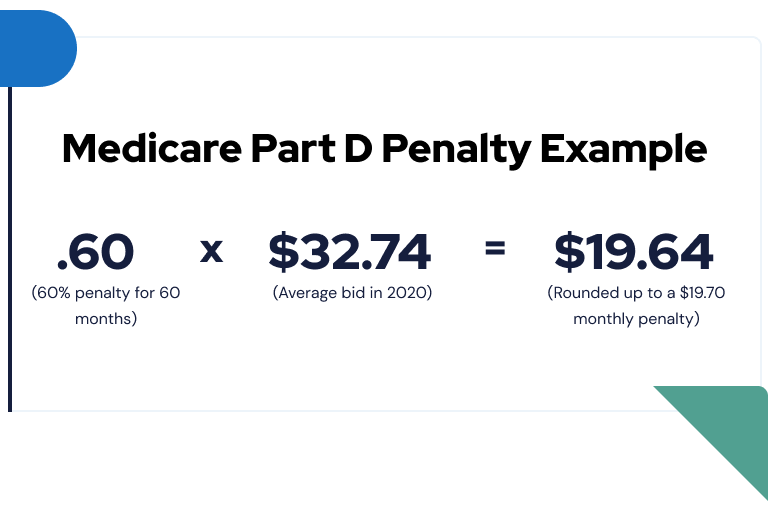

3502 x 04 140. You forgot to sign up for a Part D plan in May so its been 4 months since youve had creditable drug coverage. Heres your Part D penalty calculation.

The penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. A person enrolled in a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage. The good news is that its not too hard to avoid the penalties for not signing up for Medicare.

Youll pay this penalty in addition to your Part D Premium. Heres your Part D penalty calculation. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage.

The Part D penalty is rounded to the nearest 10 cents. He goes 48 months without Part D. You can enroll in Medicare Part D without incurring a late enrollment penalty during the 3-month period that begins when your Medicare parts A and B.

Now if you fail to enroll in Part D you will get a LEP just like with Part B. The Part D penalty is the number of full months you were eligible for Part D prescription drug coverage but didnt enroll in a Medicare plan providing this coverage and didnt have other creditable coverage multiplied by 1 of the national base beneficiary premium which is 3306 in 2021. The best way to avoid paying the Part D late enrollment penalty.

Medicare Part D late enrollment penalty. For most people the Medicare Part D Initial Enrollment Period is the same period of time as their Medicare Initial Enrollment Period. In all other situations you are liable for Part D late penalties.

The monthly premium is rounded to the nearest. If someone signs up for Parts B and D just 12 months late and lives on Medicare for 20 years they could be spending almost 4200 in unnecessary fees over the course of their lifetime. Heres how theyre calculated.

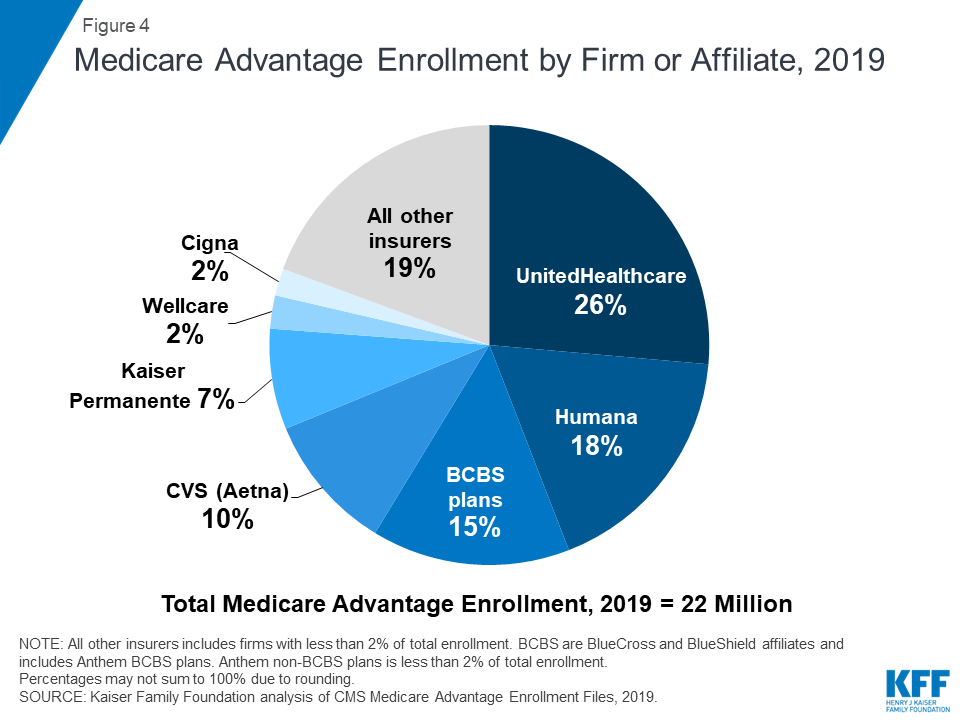

Currently the late enrollment penalty is calculated by multiplying 1 of the national base beneficiary premium 3274 in 2020 by the number of full uncovered months that you were eligible but didnt enroll in Medicare drug coverage and went without other creditable prescription drug coverage. How much is the Part D penalty. Enroll in Medicare as Soon as You Can.

How to Avoid the Medicare Part D Penalty If you dont sign up for a Part D prescription-drug plan when you become eligible for Medicare you could face a penalty --. This would be calculated as 3306 x 33 1090. Heres what you need to do.

That may be added to a persons monthly Part D premium. In all of these examples your final calculation should be rounded to the nearest 10 cents. You pay 1 percent of the national average Part D premium known formally as the base beneficiary premium in any given year multiplied by the number of months youve been without creditable drug coverage since enrolling in Part A andor Part B.

3274 x 114 3732 Now we round to the nearest 010 so your Part D penalty would be 3730 per month. I know this probably very difficult to hear. Youll probably owe a late-enrollment penalty for Part B due to the years you were eligible for Medicare but not enrolled in it.

The Part D penalty is always calculated using the national base beneficiary premium. These penalties could put a stra in on a Medicare enrollees budget which might alerady be tight. Suppose your Initial Enrollment Period ended and you waited 33 months to sign up for Part D.

If you go 63 consecutive days without creditable drug coverage after your Initial Enrollment Period is over you could face a Part D late enrollment penalty if you eventually choose to sign up for a plan. Your monthly premium penalty would therefore be 231 3306 x 1 03306 x 7 231 per month which you would pay in addition to your plans premium. When you return to the country you will receive a special enrollment period to choose a Part D plan and wont have to pay a penalty for not being enrolled in that coverage.

Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. It is calculated by multiplying 1 of the national base premium which is 41 by the number of uncovered months without creditable coverage.