Like many other Medigap policies Plan F also covers Part B copayments and the deductible. However there is coverage for emergency oral surgery that takes place in the hospital.

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

While Medigap plans can cover your Original Medicare deductibles copays and coinsurance for dentistry-related hospitalization generally Medigap does NOT cover dental.

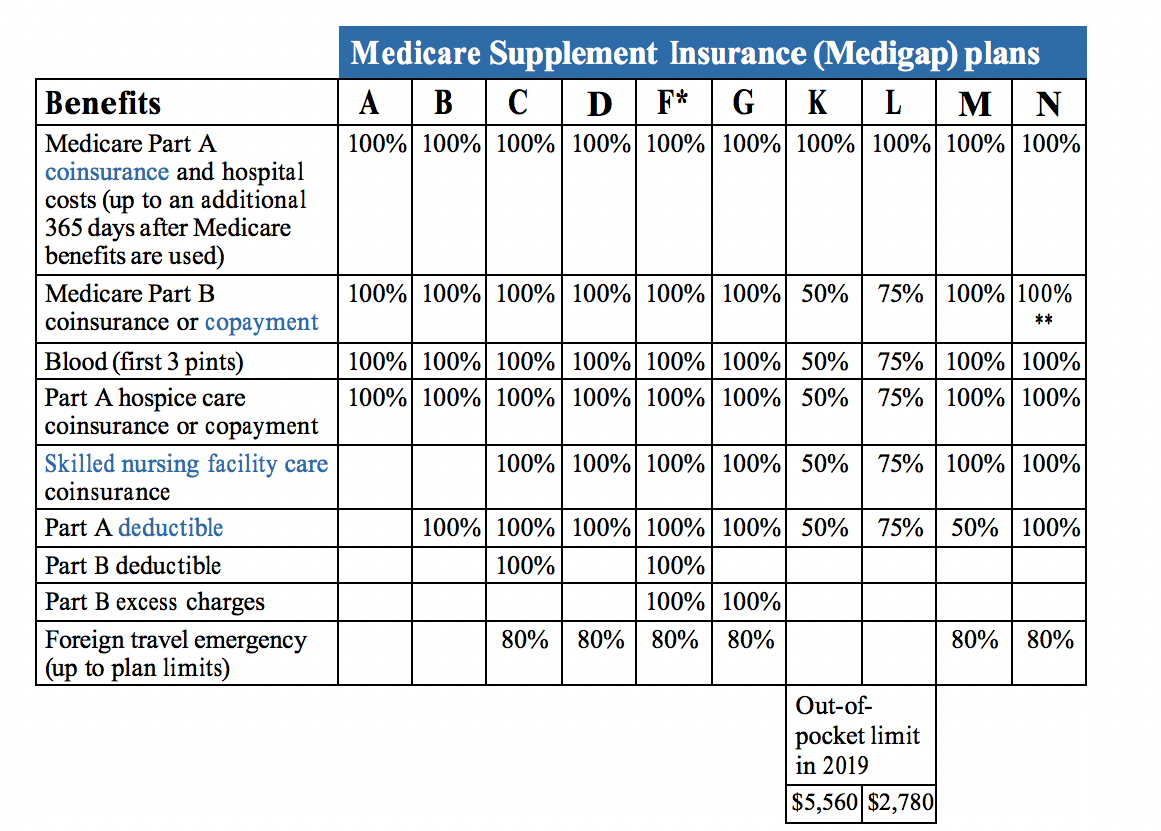

Medigap plan f dental coverage. Review the chart below for all the details of Plan F coverage or explore other Medicare Supplement plans. High-deductible Plan F. Medigap Life 1900 Corporate Blvd NW Suite W 300 Boca Raton FL 33431 1025 Old Country Rd Westbury NY 11590 8008 Corporate Center Dr Suite 120 Charlotte NC 28226 855 997-7001.

It comes with a monthly premium like other private insurance policies. You pay for Medicare-covered costs up to the 2340 2370 in 2021 before the plan begins to pay for anything. What Is Medigap Coverage.

This Dental plan also includes Vision and Hearing benefits. If you have a Blue Cross Medicare Supplement or Legacy Medigap plan this tells you how to get dental vision and hearing coverage to go with your plan. The complete coverage of Medicare Plan F makes it attractive however it is also the most expensive.

This plan covers Part B excess charges and your Part B Deductible. Understanding Medigap Coverage. Since medical bills can stack up quickly having this supplemental insurance can be vital.

Medigap Plan F may cover. Plan F also pays the 20 for a long list of other Part B services. Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service.

Some doctors charge a 15 excess charge beyond what Medicare pays. Plan F covers that for you. You had to go to the emergency room and it was medically necessary to repair something in your mouth immediately - you can check with Medicare if youre not sure if a given procedure would be covered.

Learn More about Medigap. Some procedures may be covered under certain conditions eg. Just like dental insurance you may choose your own eye doctor.

An allowance for prescription glasses and contact lenses. Does Medigap Cover Dental. Plans E H I and J are no longer sold.

This includes durable medical. Neither Medicare nor Medigap cover routine dental care such as teeth cleaning fillings and tooth extractions. When you receive health care services that are covered by Medicare you typically face costs such as a Medicare deductibles and coinsurance.

Routine vision exams may help in maintaining good overall health and recognize any problems that can lead vision complications. Medigap Lifes website is operated by Medigap Life LLC a licensed health insurance agency doing business as Medigap Life. The function of a Medigap policy is covering costs that Medicare.

The purpose of this site is the solicitation of insurance. Or you qualified for Medicare due to a disability before January 1 2020. Your Medicare supplement plan provides even more value when you add the Dental Vision Hearing Package to your plan.

Medicare Advantage plans that cover dental and vision care may cover services such as. Medigap and Dental Care. Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs.

As of January 2020 Plan F is not available to new Medicare beneficiaries. This plan is typically the most expensive Option. If you are eligible for Medicare you have options when it comes to dental care coverage.

Plan C is the other. You can add this supplemental insurance to your Original Medicare insurance. Medigap insurance can help cover costs that Original Medicare does not.

The high-deductible version of Medicare Plan F has a lower monthly premium and higher out-of-pocket expenses. That means you could see a doctor with little to no money out of your own pocket. Medigap coverage is a private insurance policy that you buy in addition to your Medicare coverage.

Plan F coverage also includes your other doctor visits for illnesses and injuries. Medigap does offer stand-alone dental plans within the application as an additional product for purchase. Then your Plan F supplement pays your deductible and the other 20.

Plan F leaves you with no out-of-pocket costs because it pays all remaining inpatient and doctor costs after Medicare pays its share. An allowance for dentures. Medigap Plan F is the most comprehensive Medigap Plan Option.

For 1525 a month you can add dental vision and hearing coverage to enhance. A Medigap Plan F only covers a dental service if Medicare covers it. Medigap can cover your Part A deductible and coinsurance.

Get coverage on eye exams eyeglasses and contact lenses with this combined plan. Plan F is only available if you first became eligible for Medicare before January 1 2020 which means your 65th birthday occurred before January 1 2020. As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N.

Currently not available to those that turned 65 after 112020. Other common problems include gum disease receding gums and even oral cancer. Medigap Plan F.

Find a Medigap Plan to Help Cover Your Medicare Costs. This includes your deductibles coinsurance. Routine dental care is not covered by Medicare.

Medigap Plan F is the most comprehensive Medigap plan covering 100 of your cost-sharing. Medigap Life and Medicare supplement insurance plans. Plan G covers many costs and this is why its the second most popular.

These costs can add up quickly over time for covered. Contact may be made by an insurance agentproducer or insurance company. Plan F is a very comprehensive plan helping cover expenses that original Medicare doesnt.

Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers Part A hospice care copayment or coinsurance costs. That premium is in addition to your standard Medicare premiums. Medicare Part B first pays 80.