All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. Learn the difference between an HMO and a PPO plan why your choice of doctors is important and see if your doctor is in our network.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

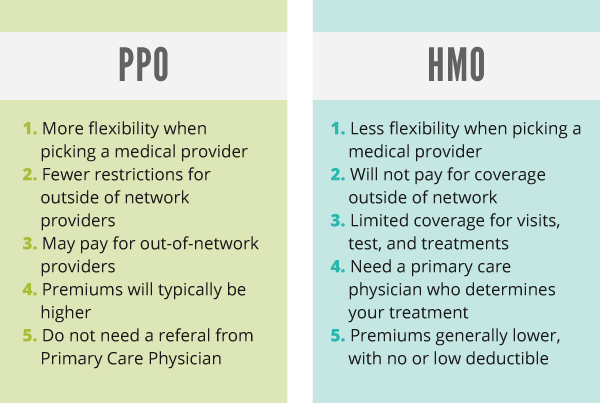

The monthly payment for an HMO plan is lower than for a PPO plan with a comparable deductible and out of pocket maximum.

Diff between hmo and ppo. Most differences between the two types of plans are. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. Are you unsure of the right one to settle for.

Think lower cost with less flexibility to choose health care providers. And unlike an HMO you dont need a referral to contact any of these providers. Lets update your browser so you can enjoy a faster more secure site experience.

The difference between HMO and PPO is that HMO restricts the use of services of the medical services within the network only while PPO puts in no such control. HMO stands for health maintenance organization. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network.

The differences besides acronyms are distinct. A decision between an HMO and a PPO should be based on whats most important to you. There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan fees.

It looks like your browser is out of date. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care. An HMO plan might be right for you if lower costs are important and you dont mind choosing your doctors from within the HMOs network.

A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network. Out-of-pocket medical costs can run higher with a PPO health plan as well so they are a more expensive option than an HMO. Medicare HMO PPO Medicare also has both PPO and HMO options.

But the major differences between the two plans. Compared to PPOs HMOs cost less. Well you need to define the type of medical or healthcare plan you need before selecting any of them.

An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. The difference between them. Individuals who are healthy with not many healthcare needs should opt for an HMO plan.

The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment. With all intent and purposes the difference between HMO and PPO is seen often in the costs choice of medical professionals and the prescriptions. The major differences between an HMO and PPO plan are in terms of cost plan-network size access to specialists and coverage for out-of-network services.

2 But they tend to have lower monthly premiums than plans that offer similar benefits but come with fewer network restrictions. HMOs require primary care provider PCP referrals and wont pay for care received out-of-network except in emergencies. PPO stands for preferred provider organization.

HMO acts as an acronym for Health Maintenance Organization while PPO serves as an acronym for Preferred Provider Organization The layout of. The premium charge of an HMO plan is towards the lower end in comparison to PPO where the cost of the premium is comparatively high.