You may have coverage for complicated inpatient dental procedures in the hospital. Medicare is comprised of 2 parts.

Drilling Down On Dental Coverage And Costs For Medicare Beneficiaries Kff

Drilling Down On Dental Coverage And Costs For Medicare Beneficiaries Kff

This allows you to maintain good oral health without paying a ton.

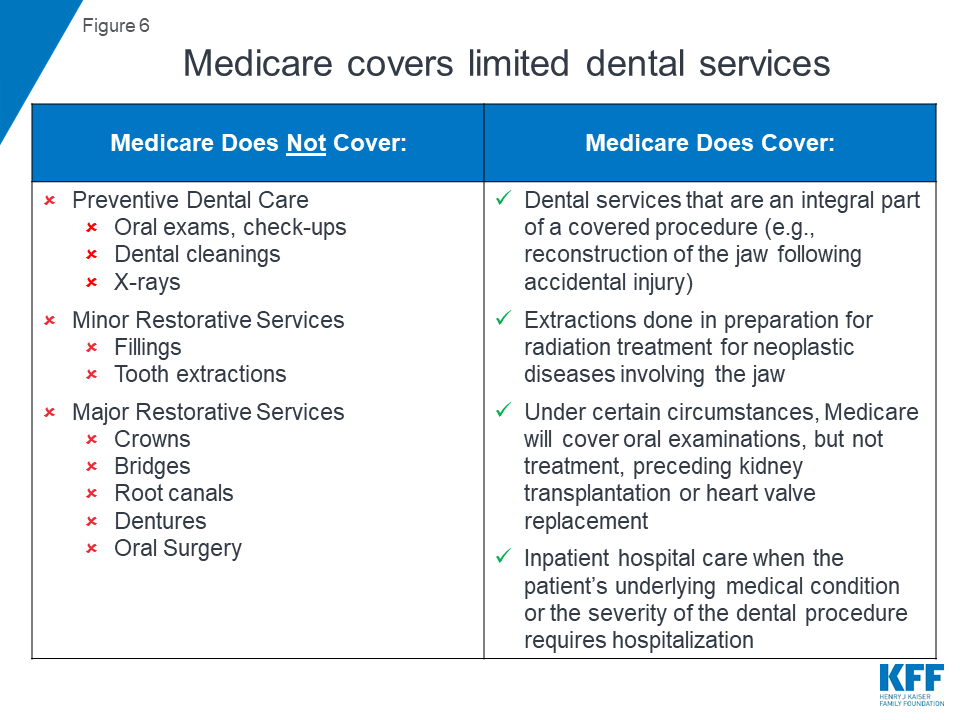

Dental plans for seniors on medicare. For this reason we offer complete information about all four types of dental. Medicare doesnt cover most dental work. As you are likely aware Medicare does not include senior dental care in NC.

If you have Medicare without dental insurance you can reduce costs and meet this important need with individual dental coverage. 50 of major procedures such as crowns bridges and implants. But for everything elselike cleanings x-rays implants and denturesyou need another dental insurance policy Many seniors dont think they can afford dental insurance and decide to skip it altogether which often leads to putting off necessary dental.

Dental insurance is preventive care you typically pay a small amount to get routine care like x-rays and cleanings. Unfortunately buying a dental insurance plan as an individual is unlikely to offer much help. Its excellent for those who dont require major dental work but is also a wise choice for those needing dentures.

Medicare Supplement plans help cover costs that are not fully covered by Original Medicare. Medicare Dental Plans For Seniors images similar and related articles aggregated throughout the Internet. Careington dental plans are great for seniors looking for a low-cost option to traditional insurance.

Theres one major area however where many seniors actually arent covered their teeth. However you may be able to get dental coverage through a Medicare Advantage Part C plan². For the most part Medicare gives seniors the medical care they need.

Medicare does not pay for dental implants unless a treatment step is medically necessary or integral to a covered medical service. 80 of basic procedures such as fillings root canals and tooth extractions. Dental insurance for seniors is the same as dental insurance for other individuals but focuses on the coverages seniors will need.

Are Dental Plans Included with Medicare. For example you could enroll in a Medicare Advantage plan. These include crowns root.

There are no health checks age-requirements or pre-authorizations needed before seeking treatment under the Careington Dental program nor is. 100 of routine preventive and diagnostic care such as cleanings and exams. Optional dental plans for seniors Choose a Medicare Advantage plan Some Medicare Advantage plans Part C include benefits like routine dental vision and prescription drug coverage.

Yes Medicare has dental plan options for seniors. Only certain Medicare Advantage policies include dental coverage. 19 of Medicare beneficiaries spent more than 1000 on out-of-pocket expenses for a year.

In general dental plans are not included with Medicare. Many Medicare Advantage plans include vision dental and prescription drug coverage. Dental insurance for seniors covers dental expenses commonly needed by older individuals.

If you receive dental care as listed above and still have copayments or deductibles that need to be paid your Medicare Supplement plan may pay the majority if not all of those expenses. Medicare Part A is hospital insurance which covers inpatient. Does Medicare Have a Dental Plan for Seniors.

Medicare on the other hand is set up as a health insurance plan. Policies sold in North Carolina are not standardized. If youre not familiar with dental insurance plans and how they protect you from oral health liability read our dental insurance for seniors information page.

There are quite a few plans to choose from with a wide range of premiums and coverage options. Therefore most seniors will need to find an alternative way to make all of the procedures more affordable. Affordable dental plans for seniors on Medicare For seniors on Medicare most dental care is not covered through Medicare Part A or Part B.

Dental coverage is often designed to pay for. Just be aware that dental benefits are usually limited to cleanings exams and bitewing X-rays depending on the plan. 6 Zeilen Careington POS Dental Plan.

Dont worry because there are insurances and plans available for every budget. Medicare covers any dental care that results in a hospital stay but routine dental procedures arent covered. These benefits are coordinated together so any premium costs will be included in your Medicare Advantage premium.

Heres a brief. Aetna Vital Savings PlanDP SmartHealth Plan.