Most providers offer coverage for bodily injury and property damage that occurs on your property or happen as a result of the operations services or products you offer. The Nonprofit Insurance Industry will neither help the Healthcare Industry nor will it be Practical.

Health Benefits For Non Profit Organizations

Health Benefits For Non Profit Organizations

Insurance for non-profits - The Co-operators Insurance for non-profit organizations Affordable coverage and risk management advice To protect the thousands of voluntary non-profit organizations supporting communities across Canada we designed Community Guard with affordable coverage for liability property damage and more.

Health insurance for non profits. Demonstrating that youre invested in your employees. A for-profit health fund pays the shareholders with their surplus while a not-for-profit health fund uses that money to better serve their policyholders. A team of US.

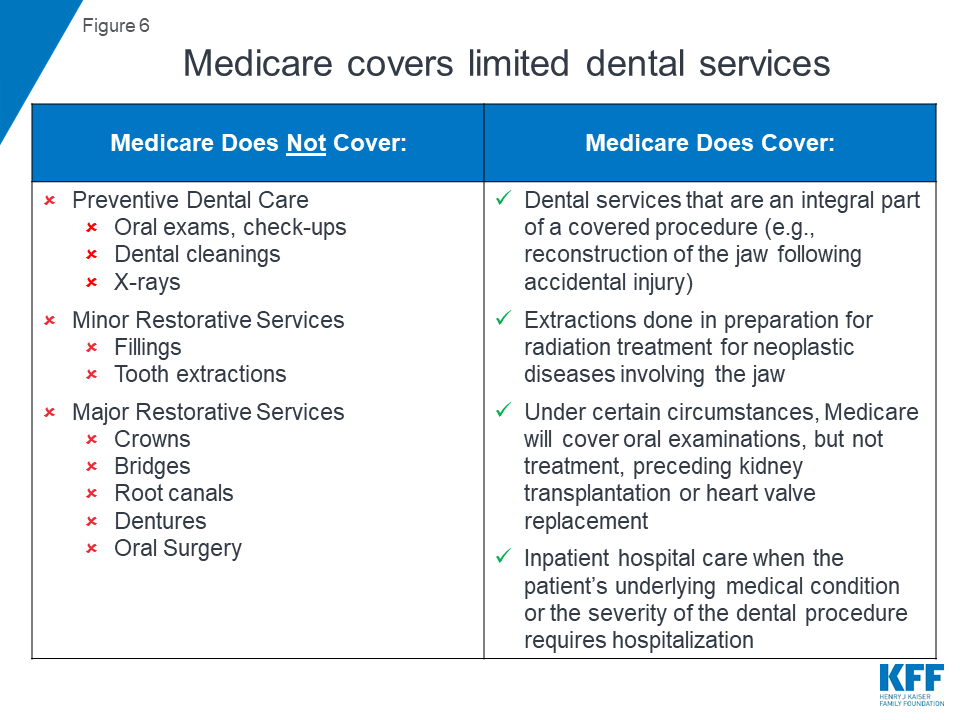

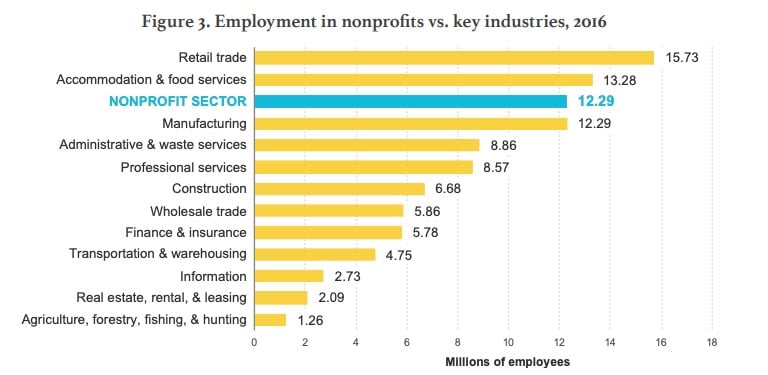

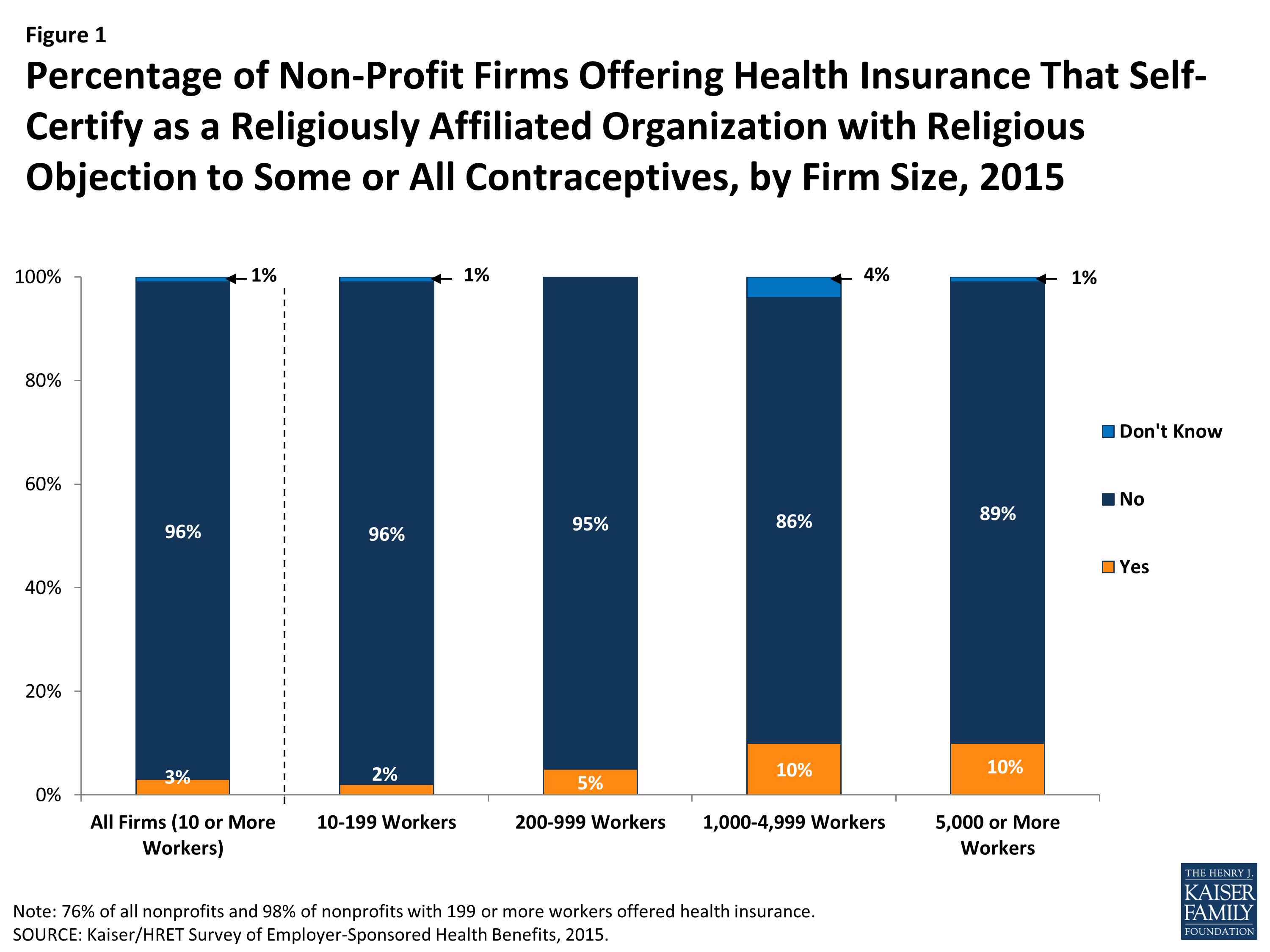

Health insurance dental and vision insurance life and disability policies flexible spending and health reimbursement accounts and more. Health savings accounts short-term insurance and childrens plans are also common. Group Health Insurance for Non-Profits An estimated 10 of all workers in the United States work for tax-exempt non-profit organizations.

Property Liability Insurance. You can visit the websites of non-profit health insurance providers to get quotes apply online and compare plans. Health insurance is always the first on peoples minds when discussing insurance.

Among nonprofits with fewer than 50 employees two-thirds of all nonprofits 47 offer health insurance for their employees. Non-Profit Insurance Non-profit insurance is business insurance designed to accommodate the needs of a not-for-profit organization. Insurance brokerage professionals known as Lockton Alliance for Ministry Protection LAMP understands the unique needs of non-profit and faith-based organizations.

Council Services Plus can help your. By the numbers the median pay of health insurance executives in 2018 was 77 million. Sign Up Now Talk to an expert.

The benefits employees receive from their employer are directly linked to their. And we meet them with strategic risk management solutions. If theres only one type of insurance coverage a non-profit has it should be commercial general liability.

If you run a non-profit youll find that offering health insurance to your employees is a great way to show your appreciation. Having business insurance for non-profit organizations can be crucial as it can protect against a variety of risks from a car accident involving your business vehicle to a clients slip and fall in the office. Non-profit health insurers provide both individual and family coverage.

The most important thing about QSEHRA is that it allows nonprofits to reimburse employees tax-free for individual health insurance premiums and medical expenses. Any attractive benefits package for small business employees includes medical coverage. The cost of providing health insurance may seem high but it is essential for employee retention and job satisfaction.

Many non-profit health insurance providers are closely tied to state governments. Discover the new easier more affordable way for Non-Profits to offer health benefits using a Qualified Small Entity Health Reimbursement Arrangement QSEHRA. Healthcare is a way to increase productivity and minimize absenteeism.

A not-for-profit health insurance provider is one that invests its profits back into its members rather than shareholders. Our intuitive platform makes tax. This is a big deal because nonprofits can now get the same favorable tax treatment as big company group health plans but with a lot less hassle.

By offering health insurance you are also. Yes your nonprofit should offer healthcare. Affordable health insurance for non-profits.

Provides reimbursement for damage to property owned by your organization and coverage for lawsuits filed against your nonprofit and its representatives.