Any distribution from an IRA to an HSA must be added to. California residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a.

Personal Finance Ep 84 How To Pick A Good Health Insurance Plan Dollars Ense La

Personal Finance Ep 84 How To Pick A Good Health Insurance Plan Dollars Ense La

Those days are gone unfortunately.

Hsa plans in california. Look at the Bronze HSA plans and then choose according to network and pricing. Blue Advantage Silver HMO 103. We still have HSA compatible plans on the market.

Many taxpayers are unaware of the triple tax benefit of an HSA. OneShare Health It is not insurance but rather an affordable alternative. Learn more at our HSA Guide.

Health Savings Account HSA Plans California What Is A Health Savings Account HSA Plan. Covered California offers these plans at the Bronze level. People who choose to enroll in one can add funds to their HSA that arent subject to federal income tax when theyre deposited.

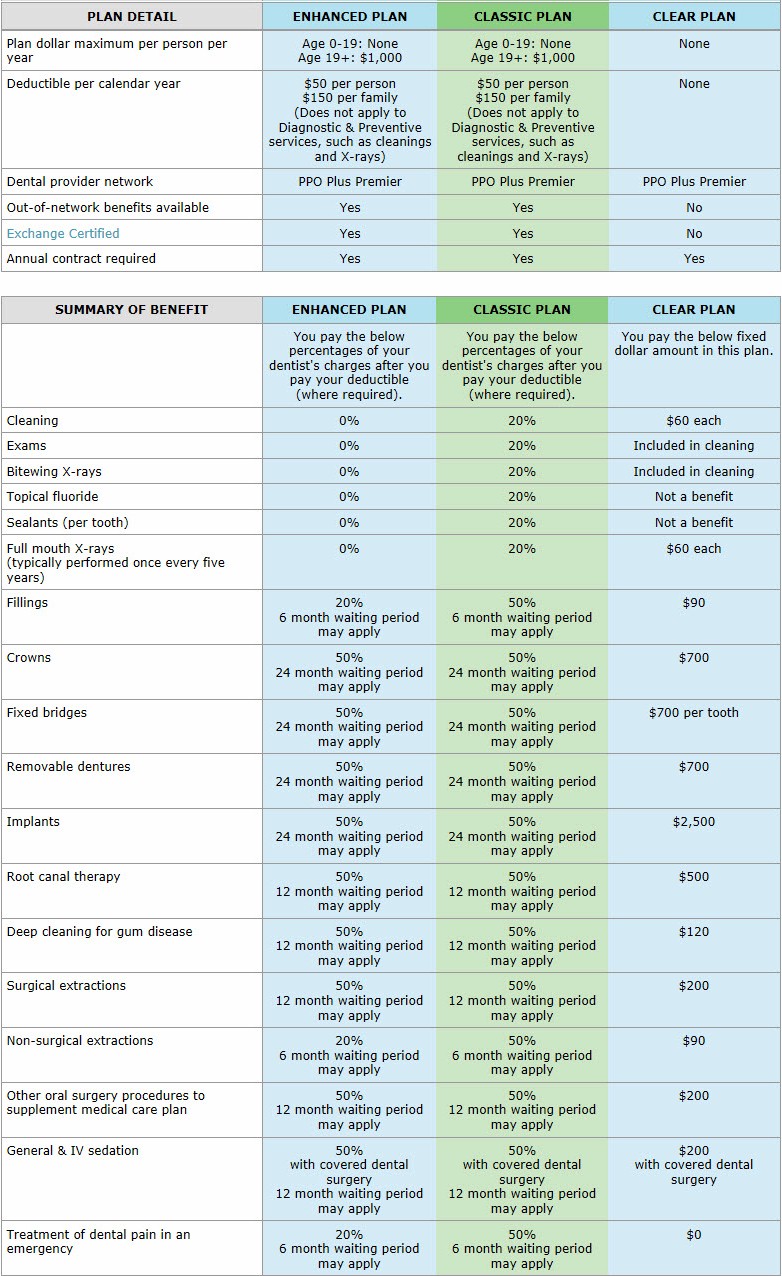

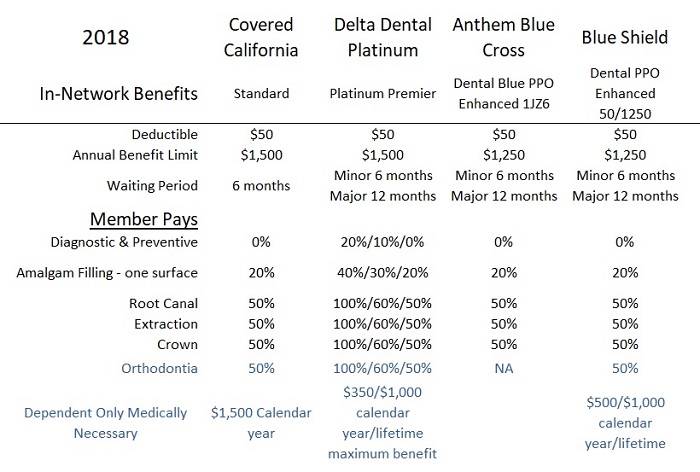

California Small Group Market. Insurance companies currently offer a large selection of HSA compatible health plans. Kaiser Permanente Bronze 60 HSA HMO Kaiser Permanente Silver 150020 HSA HMO Sharp Health Plan Bronze 60 D HSA HMO.

Blue Advantage Plus Bronze 104. Employers can use HSA compatible high deductible health insurance plans as an effective strategy to lower the cost of medical insurance in California. Here we describe some of the HSA compatible health insurance plans currently available in California.

Best values on the California HSA market The 6K deductible plans are generally the best priced plan on the market for HSA plans although we miss just 12-18 months ago when we had the 3500 HSA plan priced at almost half of the current options. We can also see if you qualify for a tax credit. HSA stands for health savings account.

Our PPO HDHPs are simple and straightforward allowing your employees to easily find the level of coverage thats right for their needs. Anthem Blue Cross of California Blue Shield of California Health Net of California Kaiser CalChoice and United Health Care of California all offer HSA compatible group health insurance plans. The premium price is usually very similar.

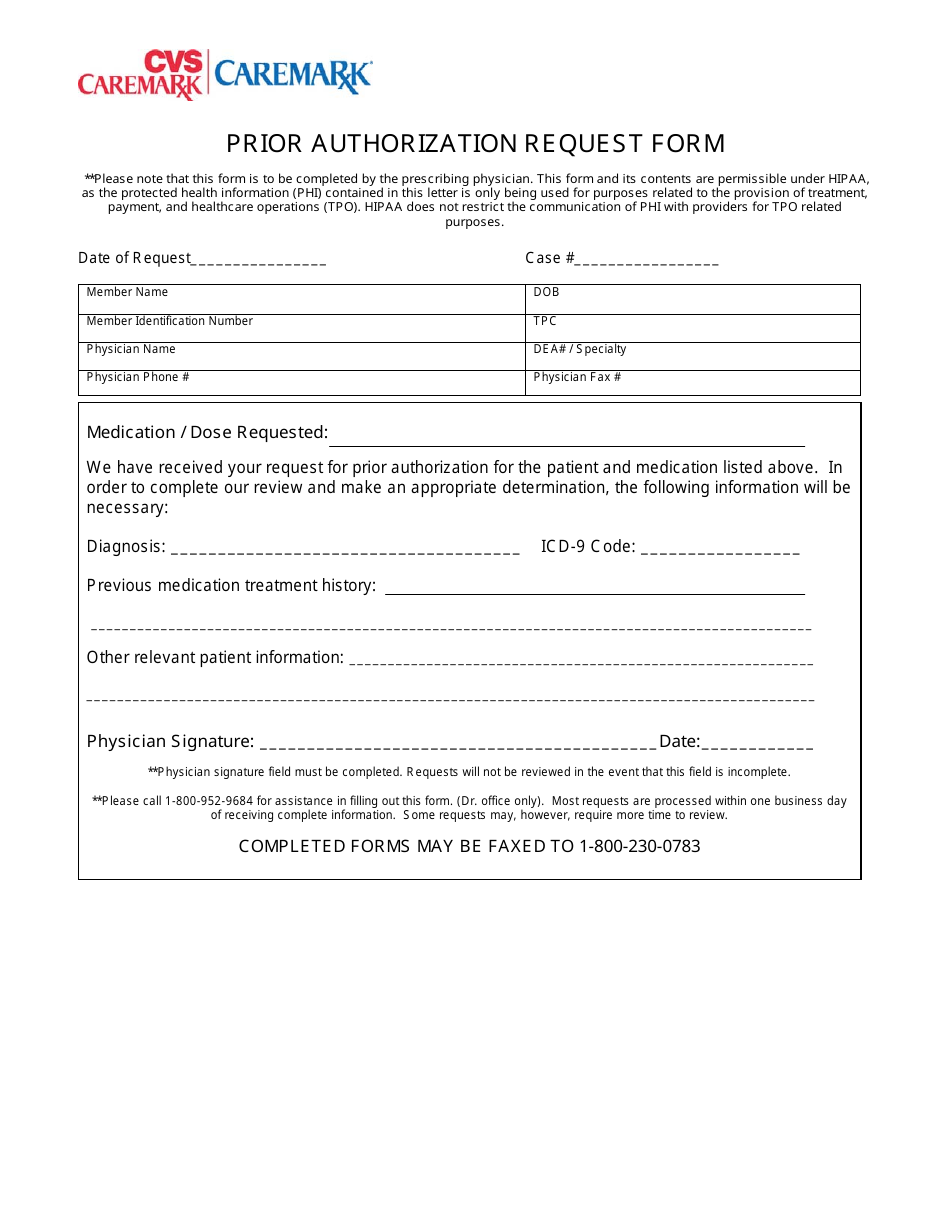

Pre-tax contributions tax-free earnings and tax-free withdrawals. Additionally a tax-free qualified HSA funding distribution is unavailable under California law because California specifically does not conform to Internal Revenue Code IRC section 223 relating to HSAs even though California conforms to IRC section 408 relating to IRAs. A Health Savings Account HSA can make it easier to save the funds you need to pay your medical deductible and other out-of-pocket expenses.

You can quote Individual Family HSA plans here. It was less than weeks ago that another Covered California spokesperson was quoted as saying there would no HSA qualified plan in the individual exchange so I hope this is for real. Health Savings Accounts HSA are special accounts that provide tax benefits when used to pay for medical expenses that are not covered by your health insurance.

Keep in mind that insurance companies offer. Its actually a rather complicated tax situation in CA that no one explains well and Im unsure if even Ive been filing my taxes right with my HSA all these years. Blue Advantage Bronze HMO 006.

Ive always been a proponent of HSAs but now Im not so sure especially living in California one of the two states in the country that doesnt recognize HSAs as pre-tax income. Health Savings Accounts can reduce your out of pocket costs as well as your tax burden. Covered California offers an one HSA qualified health plan in each the individual exchange and the SHOP.

Its offered to people who have high-deductible health plans HDHP. HSA-Compatible Plans - Employer Connection - Blue Shield of California Simple Savings plans are high-deductible health plans HDHPs that are compatible with Health Savings Accounts HSAs. The Bronze 60 plan has a 5001000 separate drug deductible.

When you think of tax-advantaged investment vehicles most people think of 401k plans retirement accounts and 529 plans. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement. The benefits are standardized now so doctor choice and pricing rules.

The individual exchange has a Bronze plan with a 5000 deductible 30 coinsurance and 6350 maximum annual out-of-pocket expense. After the deductible is met the Bronze 60 offers benefits for a set dollar amount copay and the Bronze 60 HSA offers benefits at 40. The thought on HSAs is that it is usually just a form of health plan assistance.

According to Michael Lujan by e-mail today Covered California will offer HSA-compliant high-deductible plans in both individual and SHOP product portfolios. There are 3 HSA eligible plans in California available state-wide through Blue Cross Blue Shield. And 4 these variables are constantly changing.

For the Bronze 60 HSA the drug deductible is included in the medical deductible which is 48009600. California Individual and Family Market. Well help you determine which plan is right for you and show you why the top HSA health insurance plans in California are.

The health sharing plans in California that we recommend include OneShare Health Altrua Healthshare Medi-share Mpowering Benefits and Sedera. Our advice is to select a plan that fits the needs of your employees rather than trying to find the best health savings account compatible insurance plan. If you are enrolling in a qualifying high-deductible health plan you can build a tax-free HSA with a bank or financial institution of your choice.