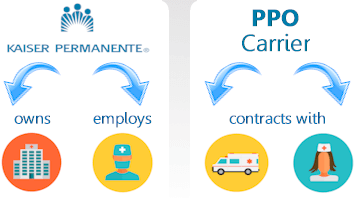

In looking at health insurance options its important to know what the various terminologies mean. The only surviving HMO of any size is Kaiser Permanente.

Case Study When A Hmo Plan Is Best For Your Employees

Case Study When A Hmo Plan Is Best For Your Employees

None except emergency care and some certain circumstances.

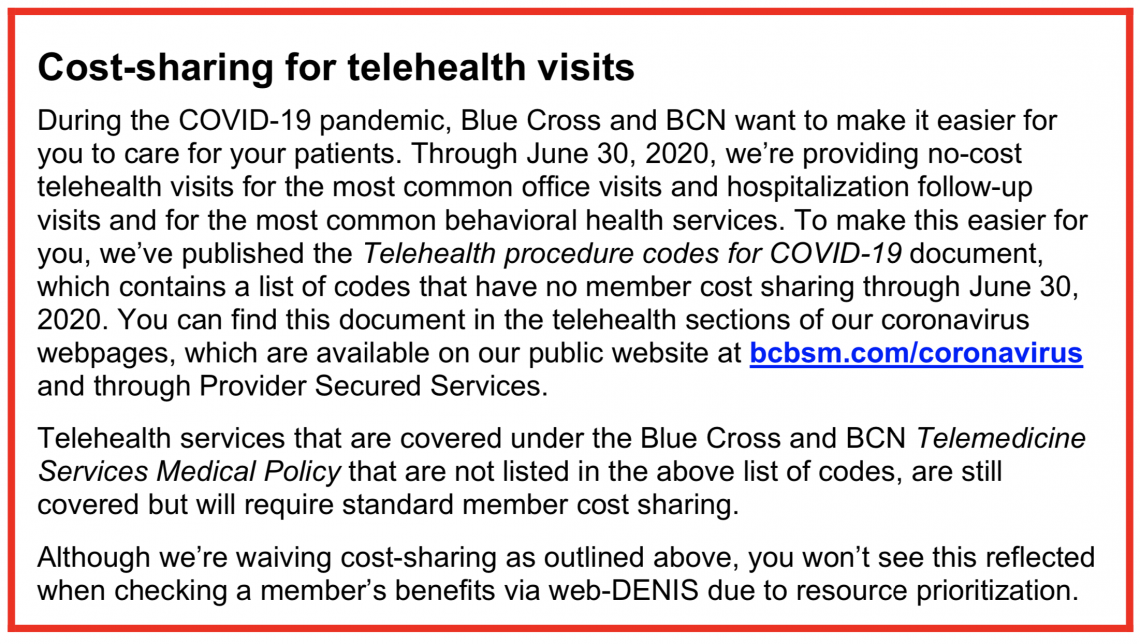

Ppo vs hmo kaiser. Business Health Trust partners Premera Blue Cross and Kaiser Permanente two of the most well respected insurance companies in Washington State. Services covered under your health plan are provided andor arranged by Kaiser Permanente health plans. As you get familiar with the basic health plan types youll have a better idea of what makes the most sense for your company.

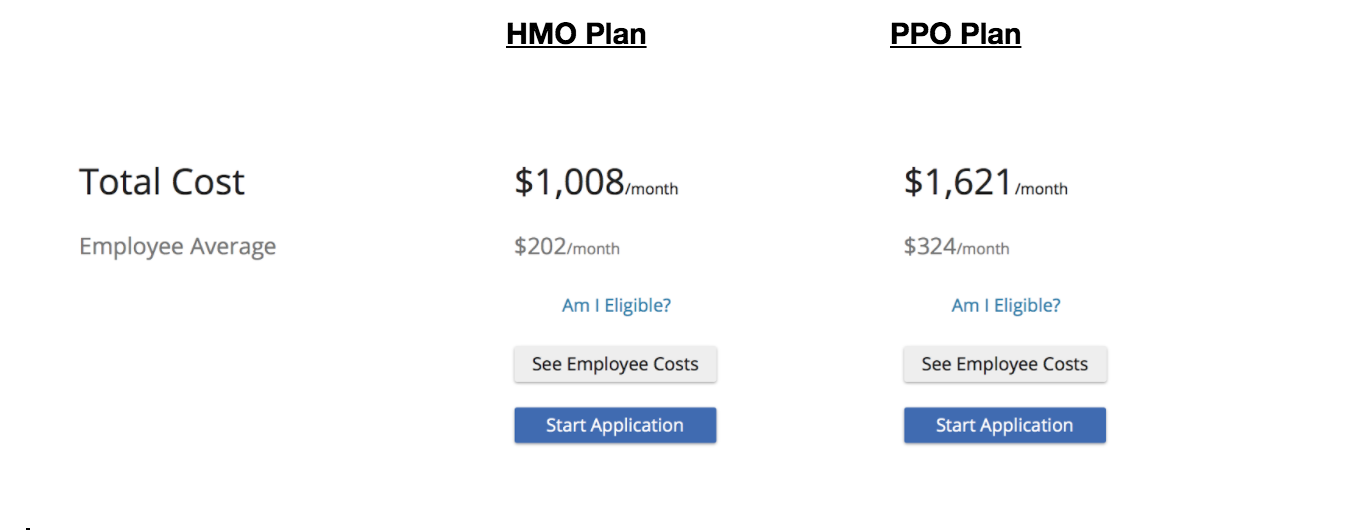

The additional coverage and flexibility you get from a PPO means that PPO plans will generally cost more than HMO. While HMOs have been around since the early 1900s PPO is a descendant with some new features based on challenges with HMOs. Kaiser versus UnitedHealth group networks Heres where the two differ materially and this may be THE key deciding factor.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. They love it or they hate it. With an HMO plan your primary care provider PCP coordinates your medical services.

PPOs differ from HMOs in that PPO plans will usually provide some coverage for these types of services but coverage for in-network providers will be much better. Often your PCP will need to make a referral for you to see a specialist or for you to have any kinds of medical testing. For many consumers they are anything but indifferent about Kaiser Permanente.

HMOs often require members to get a referral from their primary care physician in. With an HMO there are set charges and you have to make sure that youre staying within your network. This is because the HMO model is designed to curb costs.

How to Compare Kaiser versus PPO plans. Really though choosing HMO versus PPO as a patient or as an insurance to accept at your dental practice is highly dependent on your location and your budget. Since most of us have PPOs it behooves us to know what this means and how the PPO set-up plays out in real life.

PPOs typically have a higher deductible but theres a reason why. The HMO concept originated in the early 1970s. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii.

If your budget is smaller when purchasing insurance or an insurance package for. There are two kinds of health insurance plans health maintenance organizations HMO and preferred provider organization PPO. The biggest difference between Kaiser and PPO plans has to do with the doctorshospitals and how you access them.

With Kaiser you generally must stay within their network of providers. Kaiser Foundation Health Plan of Washington Broad group of Washington state providers we contract with directly including Washington Permanente Medical Group. With United you can offer PPOs and HMOs which contract with individual doctors medical groups and hospitals.

When you first sign up for an HMO plan you will be assigned to a Primary Care Physician or PCP. Health maintenance organizations HMOs cover only care provided by doctors and hospitals inside the HMOs network. So lets start with a couple of the most important HMO.

That means the amount you have to pay before coverage kicks in could be as little as zero bucks. With a PPO you have more freedom to choose who to go to but there is also more out of pocket expenses and usually a deductible to meet. Prior to 1970 doctors had their own practices.

Kaiser Foundation Health Plan of Washington Options Inc. What is an HMO. Kaiser tends to offer comprehensive health care in.

Make sure to do your homework with the providers that are in your network. Unlike PPO plans which allow you to go anywhere within the network at any time HMOs are a bit different. Plus there are a few small local HMOs.

Some wouldnt even consider anything but Kaiser Californias premier Health Maintenance Organization HMO. The HMO is a vanishing breed. Premeras most popular plan is a PPO while Kaiser Permanente offers both an HMO and PPO.

HMO DHMO PPO or POS. Another key selling point to an HMO is its low or no annual deductible. For certain areas Kaisers not even an option because they dont facilitiesdoctors there.