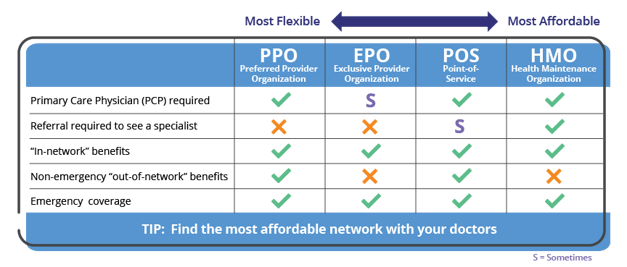

Today HMO plans with 1000 deductibles are common in the individual market HMOs have become the predominant plans in many areas and are frequently offered with deductibles of 5000 or more. Like a PPO you do not need a referral to get care from a specialist.

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

EPOs are similar to HMOs in that you must stay within your network emergency care is an exception however with an EPO you generally do not need to select a Primary Care Physician nor receive a referral to see a specialist.

Is epo or hmo better. The Health Maintenance Organization is regulated under the HMO laws and regulations. Of those HMO and PPO are the two most common. Higher premiums didnt necessarily correlate with better out-of-network coverage says Caroline Pearson vice president at Avalere Health a research and consulting firm.

A larger network makes life easier An Exclusive Provider Organization EPO is a lesser-known plan type. POS plans made up 12 percent and EPO plans 7 percent. No one plan is right for everyone and its not necessarily better to have an HMO PPO EPO or POS.

HMO health insurance you will want to consider all aspects of pricing such as premiums and copays. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Therefore you should know the different types of Retirement Plans before choosing one.

Higher premiums didnt necessarily correlate with better out-of-network coverage says Caroline Pearson a vice president at Avalere Health a. They may or may not require referrals from a primary care physician. When comparing the premiums the EPO has a lower premium than the HMO.

Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. What is a PPO. In plans that pay a portion of your costs when you see out-of-network providers your out-of-pocket charges will generally be quite a bit higher usually.

Higher premiums didnt necessarily correlate with better out-of-network coverage says Caroline Pearson vice president at Avalere Health a. But like an HMO you are responsible for paying out-of-pocket if you seek care from a. This is a less-common option which like a PPO lets you visit any doctor or hospital you choose without referrals.

An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO. Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time. When considering their coverage the EPO is better suited for the rural areas.

You can self-refer to an in-network provider when a medical need arises. You and the doctor get zero reimbursement if you go out-of-network. EPOs are typically more flexible than HMOs as HMOs have more strict rules regarding referrals and similar features.

But like an HMO you are responsible for paying out-of-pocket if you seek care from a doctor outside your plans network. EPO health insurance often has lower premiums than HMOs. When deciding whether to enroll in a managed care plan consider your budget and the level of flexibility you want with your healthcare network.

For some however an HMO health maintenance organization or PPO preferred provider organization might be a better fit. POS plans made up 12 percent and EPO plans 7 percent. EPO plans differ from Health Maintenance Organizations HMOs by offering participants a greater amount of flexibility when selecting a healthcare provider.

POS plans made up 12 percent and EPO plans 7 percent. HMO plan premiums in fact were slightly higher on average than those for PPOs according to the Avalere analysis. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

HMO PPO EPO and POS are all different types of health insurance provider networks offered by health plans. Below we help you understand HMOs PPOs EPOs and POSs each of which being a different type of provider network your insurer coordinates with its own unique pros and cons generally there. If you are considering your options in terms of cost for EPO vs.

Just like health plans there are various retirement plans. Like an HMO plan you need to select an in-network physician as your PCP but you can visit an out-of-network physician for a higher fee just like in a PPO plan. The HMO is determined on a capitated basis whereas the EPO is based on the services provided.

Preferred provider organizations PPOs cover care provided both inside and outside the plans provider network. But an EPO plan is like an HMO plan in that youre responsible for paying all. This type of plan gives you a little more freedom than an HMO plan.

An EPO plan is less expensive up front than a PPO but dont celebrate too quickly to have discovered this option. The greater your freedom of choice the more you will probably pay for your plan. Also question is what is the difference between EPO and HMO.