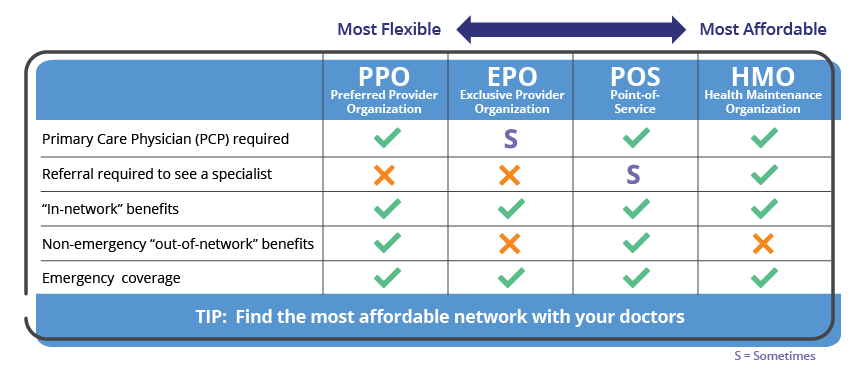

Exclusive provider organization plans EPO PPOs are the most common type of health plan in the employer-sponsored health insurance market while HMOs lead the way in the individual insurance market. With an EPO you typically dont need a referral to see a specialist which makes it more flexible than an HMO.

Medi Share Review Why We Switched From Blue Cross

Medi Share Review Why We Switched From Blue Cross

Like a PPO you do not need a referral to get care from a specialist.

Hmo and epo difference. This means that in an HMO planyou do not contact the insurer to get pre-authorization for treatment but must be referred to a specialist by a PCP who is a member of the HMOs network. You should recognize the difference between HMO and PPO plans first. The difference between them is the way you interact with those networks.

There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. Exclusive provider organization plans EPO The two most common health plans have been generally HMOs and PPOs but HDHPs have become a lower-cost health insurance option for employers over the past decade. However HMOs have a bigger network of healthcare providers which more than makes up for it.

HDHPs make up about one-third of employer-sponsored plans and are seen as a lower-cost health insurance option for employers over the past decade. EPOs are better suited for rural areas than HMOs. HMO POS PPO EPO and HDHP with HSA.

But like an HMO you are responsible for paying out-of-pocket if you seek care from a. Health maintenance organization HMO preferred provider organization PPO point of service POS and exclusive provider organization EPO plans are all types of managed healthcare. EPO health insurance often has lower premiums than HMOs.

Each type of health insurance system will offer different options as you obtain services and the services are received through a network. You may also want to consider your location when choosing a health insurance plan. While these names may be somewhat confusing they describe how you will get your health care from physicians and hospitals.

POS and EPO plans are options provided by some employers and health insurers but theyre not nearly as common as HMOs PPOs and HDHPs. HMO stands for health maintenance organization. This video will help you choose the right type of plan based on your specific medical and provider needs.

Review a simple comparison chart outlining the features of HMO and PPO health insurance plans. Then you can see where the EPO fits in as a hybrid of the other two. Each one is just a different balance point between benefits vs.

The Exclusive Provider Organization is more flexible than the Health Maintenance Organization. Understanding the difference between PPO EPO HMO and POS is the first step towards deciding how to pick the health insurance plan that will work best for you and your family. Like PPO insurance you can go directly to a specialist and bypass the need for a referral from your primary care physician.

Restrictions and between spending a lot vs. A Health Maintenance Organization HMO plan is one of the cheapest types of health. Theres no perfect health plan type.

The Difference Between EPO HMO and PPO Plans Of the three plan types HMO PPO and EPO you have HMO and PPO at two opposite ends of the spectrum with EPO plans somewhere in the middle. An affordable plan with out-of-network coverage. Understand the difference between HMO and PPO plans.

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. EPO Exclusive Provider Organization An EPO plan is less common than HMOs and PPOs but shares features of both.

The main difference between EPO and PPO plans and Health Maintenance Organizations HMOs is the need for a Primary Care Physician PCP in an HMO. An HMO is a health maintenance organization a PPO is a preferred provider organization and an EPO is an exclusive provider organization. An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs.

PPO stands for preferred provider organization. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Many often wonder what all the different health pla.

HMO can be termed as an insured product which means that the. As with an HMO a Point of Service POS plan requires that you. However like an HMO there are no out-of-network benefits.

In the case of Health Maintenance Organisation insurance a referral from the Primary Care Physician is required.