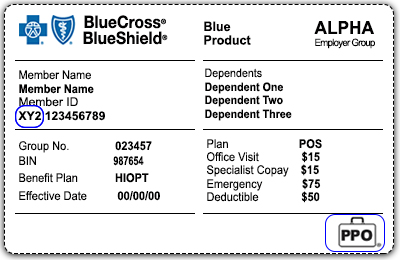

You will need Form 8962 and your 1095-A. People who would have had to repay some or all of their advance premium tax credit from 2020 can simply skip Form 8962 and do not need to reconcile their advance premium tax credit.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Stimulus Checks Medicare.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Healthcare tax form 8962. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. Anzeige Expats can now e-file their 2020 expat taxes in as quick as 10 minutes. Form 8962 Premium Tax Credit.

Our software calculates and maximizes your tax breaks including the FTC. Its used to calculate the amount of your Premium Tax Credit and reconcile any advance payments you received to help pay your health insurance premium. If you received a letter from the IRS requesting Form 8962.

At the end of the year you reconcile your tax credits when you file your taxes. Because you purchased your health insurance through Healthcaregov or a state marketplace Form 8962 Premium Tax Credit PTC should have been included in your return. If your family fits the requirements and you have spent any money on Marketplace health insurance premiums you can claim your Premium Tax Credit for that reason.

Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health. The deadline for the IRS Form 8962 for the year 2020 is 15 April 2020. Remember when you enrolled in Marketplace insurance you agreed to file taxes and reconcile the income reported on your application with your actual income on your tax return.

This page specifically covers Form 8962 which is used for the Premium Tax Credit PTC. Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium. Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace.

Well help you create or correct the form in TurboTax. Start completing the fillable fields and carefully type in required information. Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC.

Use the Cross or Check marks in the top toolbar to select your answers in. Our software calculates and maximizes your tax breaks including the FTC. How to Fill Out Form 8962 - Premium Tax Credit 1095A Health Insurance Covered CaliforniaCalifornia covers topics like.

Generally to be eligible for the PTC you or a family member must have been enrolled in a health insurance program through the Marketplace for at least one month in the tax year and your household cannot exceed four. Quick steps to complete and e-sign Form 8962 online. Anzeige Expats can now e-file their 2020 expat taxes in as quick as 10 minutes.

Filing IRS Form 8962 can save you some money you spend on your Health Plan. The form may be available in packages of print forms. With Form 8962 you are reconciling the tax credit you are entitled to with any advance credit payments or subsidies for the tax year.

IRS Form 8962 If you are claimed as somebodys dependent then you arent eligible for the premium tax credit and you do not file according to instructions for 8962 tax form. Slightly its the person who claims you as a dependent who would file Form 8962 for the purpose of calculating any premium tax credit score and if crucial repaying any excess advance premium tax. You should have received a paper form in the mail from your marketplace.

Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for. If you purchased health insurance from the Health Insurance Marketplace also known as an Exchange and received advance payments of the premium tax credit Form 8962 is used to reconcile the advance payments with the amount of your credit. If youre mailing in a paper tax return and you received advance payments of your health insurance premium tax credit youll need to file a completed Form 8962 with your regular tax return forms.

If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return. About Form 8962 Premium Tax Credit Internal Revenue Service. The PTC is a refundable tax credit that can be claimed by eligible persons and families with low to moderate incomes between 100 and 400 of the federal poverty line to help individuals afford health insurance purchased through the Health Insurance Marketplace or the Exchange at.

Form 8962 is an essential tax form that not only helps relieve the pressure of your return but also makes affordable health insurance through the marketplace viable to everyone. Use Get Form or simply click on the template preview to open it in the editor. People who are owed additional premium tax credit ie the amount that was paid on their behalf in 2020 ended up being too small can still claim it by using Form 8962 just as they.