After you apply you may be asked to submit documents to confirm your income information. Premiums will drop on average about 50 per person per month or 85 per policy per month.

Everything You Need To Know About Premium Tax Credits

Everything You Need To Know About Premium Tax Credits

If the health insurance that you are talking about is from the Healthcare Marketplace you will NOT get cheaper insurance.

Household income for marketplace insurance. The Marketplace generally considers your household to be you your spouse if youre married and your tax dependents. Under rules put in place by the December 2017 tax law a dependent must file a tax return for 2020 if she received at least 12400 in earned income. Household income sometimes called family income is the income counted for ObamaCare.

You qualify for subsidies if pay more than 85 of your household income toward health insurance. If you file as Married Filing Separately it disqualifies you from receiving the Premium Tax Credit to reduce the monthly insurance payment. 20 rows Do I need to include income of people in my household who dont need insurance.

Youll find your AGI on line 7 of IRS Form 1040. 16 rows You must include the income of any dependent required to file a federal income tax return for. The Health Insurance Marketplace Calculator allows you to enter household income in terms of 20 21 dollars or as a.

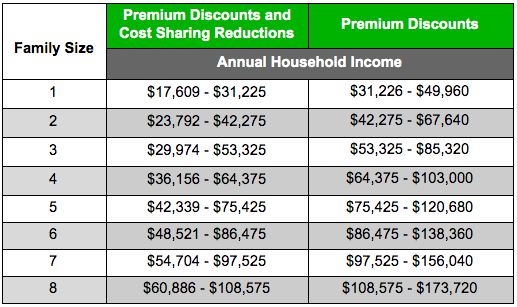

Select your income range. How do I know what to enter for my income. Answer For 2020 coverage those making between 12490-49960as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

Whos included in your household. See another way to estimate your income. With an income between 100 and 400 of the FPL you qualify for tax credits applied to lower your monthly premium when enrolling in a Marketplace health insurance plan.

Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. New financial help for higher incomes. 1100 in unearned income.

So you should probably file a Joint tax return and include both of your incomes on the health insurance application. Or if the earned and unearned income together totals more than the greater of 1100 or earned income up to 12050 plus 350. Dont have recent AGI.

Household or family income for the ACA is MAGI of the head of household and spouse if filing jointly plus the AGI plus the AGI of anyone claimed as a dependent. Estimating your expected household income for 2021. Start with your households adjusted gross income AGI from your most recent federal income tax return.

The new federal law ensures that no family spends more than 85 of their income on health insurance premiums - at any income. For 2022 coverage see our page on the maximum income for ObamaCare for 2021 - 2022. Prior to the American Rescue Plan households had to contribute up to 983 of their income to pay for health insurance premiums to be eligible for.

Decide if you qualify for help paying for health coverage through the Marketplace like premium. This might include interest income capital gains and alimony. Previously financial help was not available for households making more than 51040 for an individual or 104800 for a family of four.

You can do this through calculating unemployment compensation all household income from other members of your household and additional types of income. If your income ends up over 400 of the federal poverty level and youre thus not eligible for subsidies at all youll have to pay back 100 of the subsidy that was provided throughout the year on your behalf note that this is true even if all of your income comes in a lump sum near the end of the year or you get a better job later in the year etc. Federal Poverty Level 2019.

You can probably start with your households adjusted gross income and update it for expected changes. Marketplace savings are based on total household income not the income of only household members who need insurance. Your eligibility for savings is generally based on the income of all household members even those who dont need insurance.

Tax credits and plans with lower copayments coinsurance and deductibles. For a family of two the income level has increased to 16910. The Health Insurance Marketplace uses annual household income and other information to.

For individuals the FPL is now an income of 12490. The Federal Poverty Level has slightly increased at the beginning of 2019. If you already enrolled in an ACA plan and got a subsidy you.

If anyone in your household has coverage through a job-based plan a plan they bought themselves a public program like Medicaid CHIP or Medicare or another source include. How to make an estimate of your expected income. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

20 rows Marketplace savings are based on your expected household income for the. Add the following kinds of income if you have any to your AGI.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Incomes That Qualify For Lower Health Care Costs Income Chart Marketplace Health Insurance Health Insurance Individual Health Insurance

Incomes That Qualify For Lower Health Care Costs Income Chart Marketplace Health Insurance Health Insurance Individual Health Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Annual Household Income Changes Report Them To The Marketplace Asap Healthcare Gov

Annual Household Income Changes Report Them To The Marketplace Asap Healthcare Gov

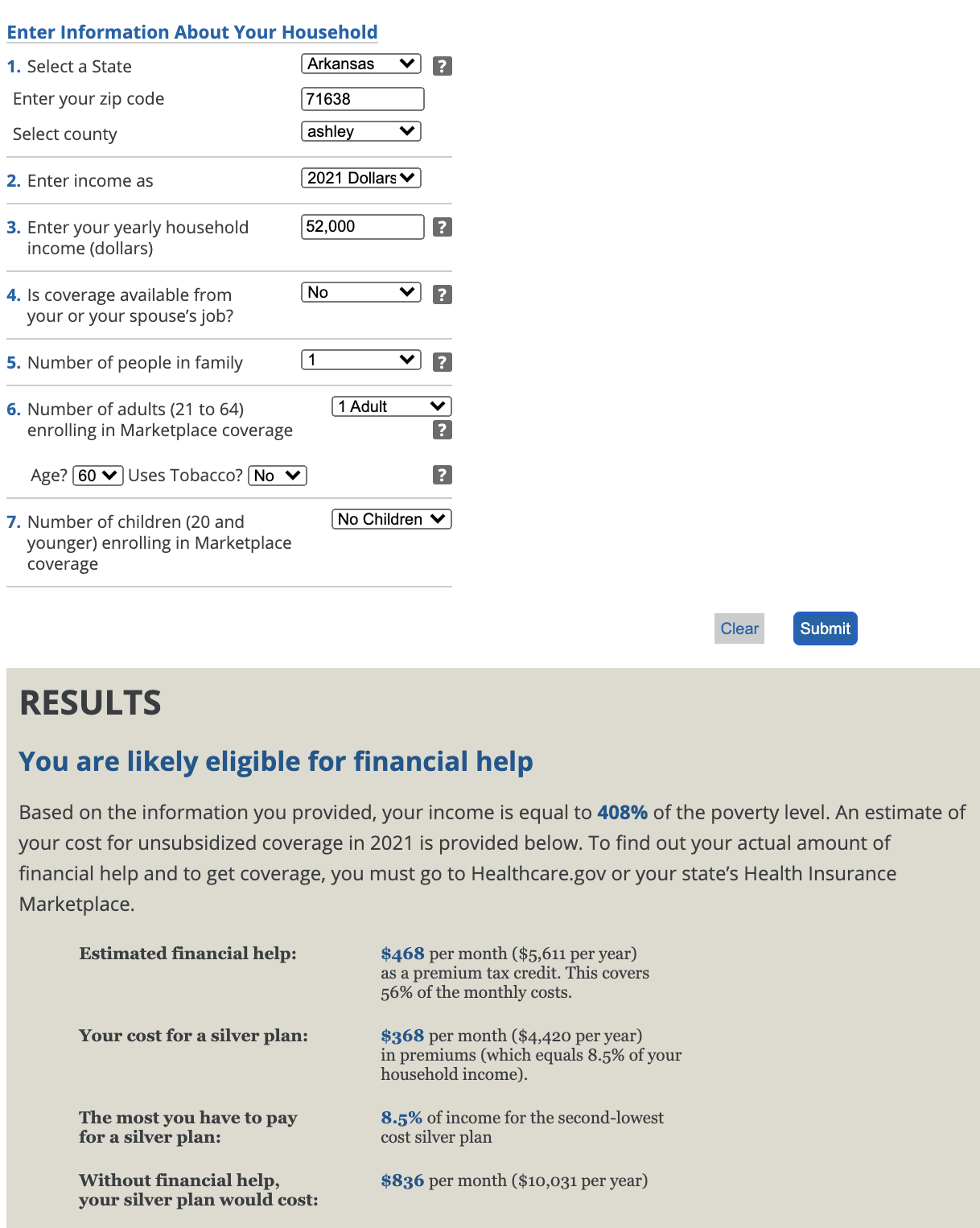

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

How To Estimate Your Income For Marketplace Health Insurance Healthsherpa Blog

How To Estimate Your Income For Marketplace Health Insurance Healthsherpa Blog

What Do I Do If I Lose My Health Insurance Health Action New Mexico

What Do I Do If I Lose My Health Insurance Health Action New Mexico

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.