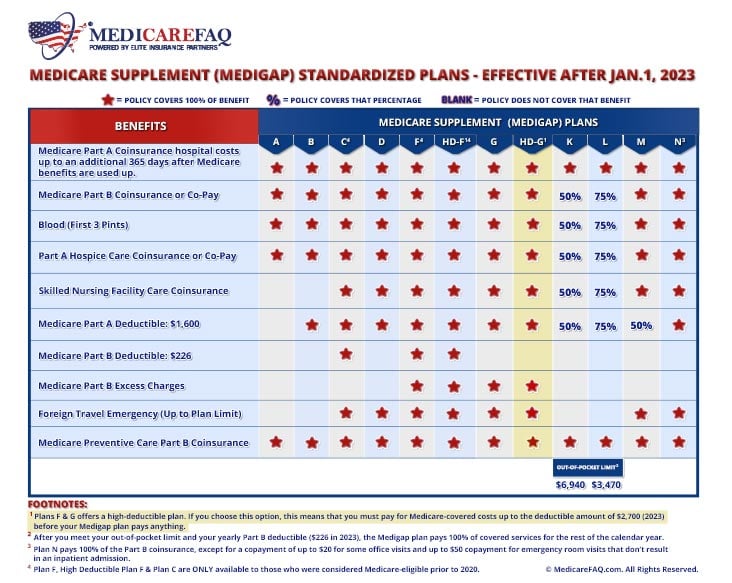

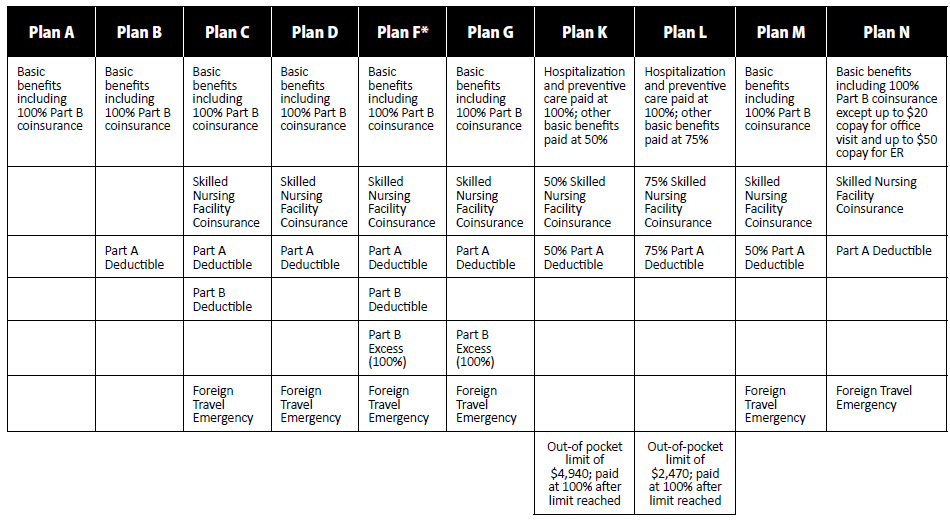

Medicare Part B medical insurance has standard costs including a monthly premium and an annual deductible. The new high-deductible Plan G option offers the coverage benefits of Plan G with lower monthly premiums in exchange for the higher deductible.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

It has its own deductibles of course but they are much smaller than those of the typical high-deductible plan.

Medicare high deductible plan. Medicare gives the plan an amount of money each year for your health care. In fact many employer plans have deductibles ranging from 4000 to 10000 per year just like the catastrophic Obamacare plans. Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs.

The plan deposits some money into your account. Once you reach the deductible the plan covers the left-over costs going forward keeping the monthly premium low. These provisions are known as the Medicare Secondary Payer MSP provisions and are found at section 1862b of the Social Security Act the Act.

High deductible plans require. How do High Deductible Medicare Supplement Plans work. The basic monthly premium for Part B of Medicare will be 13550 in 2019 and Part D prescription drug plans often cost less than 40 a month.

High Deductible Plan F is an alternative version of the standard Plan F. You set up an MSA with a bank the plan selects. Many people who have considered getting a high deductible Medicare Supplement are left wondering what their options are now that Plan F and its accompanying high deductible Plan F plan are no longer viable options.

For 2021 the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. There is already a standard Medigap Plan G. Medigap High Deductible Plan G is Ideal for Those Who.

They allow a person to save on healthcare costs as the money paid into the. The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual. For 2020 the Internal Revenue Service IRS defines an HDHP as one with a deductible of 1400 or more for an individual or 2800 or more for a family.

For people coming from one of these plans a 2340 deductible is a great relief. Are comfortable paying a higher deductible in exchange for lower monthly premiums Semi-frequently see the doctor or need to visit the hospital Live in a state that allows excess charges Enjoy traveling outside the US. For people turning 65 in 2020 or after it is a new option and one that some companies are aggressively marketing.

The plan will only begin to cover your costs once you meet a high yearly Deductible glossary which varies by plan. Medicare Supplement High Deductible Plan F. For beneficiaries who became eligible for Medicare on or after January 1 2020 a High Deductible Plan G option will be available.

High Deductible Plan G is a good alternative to High Deductible Medicare Supplement Plan F which wont be available to new beneficiaries in 2021. The purpose was to shift costs from the Medicare program to private sources of payment. Youve been doing a lot of research regarding your Medicare coverage.

Medicare Supplement Insurance high-deductible Plan G is a new Medigap plan being offered in most states in 2020. First of a series of provisions that made Medicare the secondary payer to certain additional primary plans. A high deductible health plan HDHP has lower monthly premiums and a higher deductible than other health insurance plans.

Additionally youll pay 20 percent of the Medicare-approved. The first part is a special type of high-deductible Medicare Advantage Plan Part C. Choose and join a high-deductible Medicare MSA Plan.

A health savings account HSA can be a part of a high deductible health plan HDHP. The Medigap plan known as high deductible G or HDG is a relatively new option for Medicare beneficiaries. High deductible plans are a common option for many people aging into Medicare and out of their employer group health plans.

It is only available to those who turned 65 or went on Medicare on or after 112020. The plan deductible is 2370. The standard monthly premium for Medicare Part B enrollees will be 14850 for 2021 an increase of 390 from 14460 in 2020.

The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. Once the deductible is met you get the same coverage as a regular Plan G.

High Deductible Plan G Medicare Review Reviews Ratings

High Deductible Plan G Medicare Review Reviews Ratings

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Plan F High Deductible Medicare Supplement

Medicare Supplement Plan G High Deductible High Risk Coverage

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medicare Supplement High Deductible Plan F Youtube

Medicare Supplement High Deductible Plan F Youtube

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Social Security Benefits Retirement

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Social Security Benefits Retirement

High Deductible Medicare Supplement Crowe Associates

High Deductible Medicare Supplement Crowe Associates

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Medigap Plan F Hd For Florida Seniors Medigap Seminars

High Deductible Plan G Medigap Insurance Carriers Your Medicare Enrollment Experts

High Deductible Plan G Medigap Insurance Carriers Your Medicare Enrollment Experts

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.