The amount of your tax credit is based on the price of a silver plan in your area but you can use your premium tax credit to purchase. The IRS will process tax returns without Form 8962 for tax year 2020 by reducing the excess advance premium tax credit.

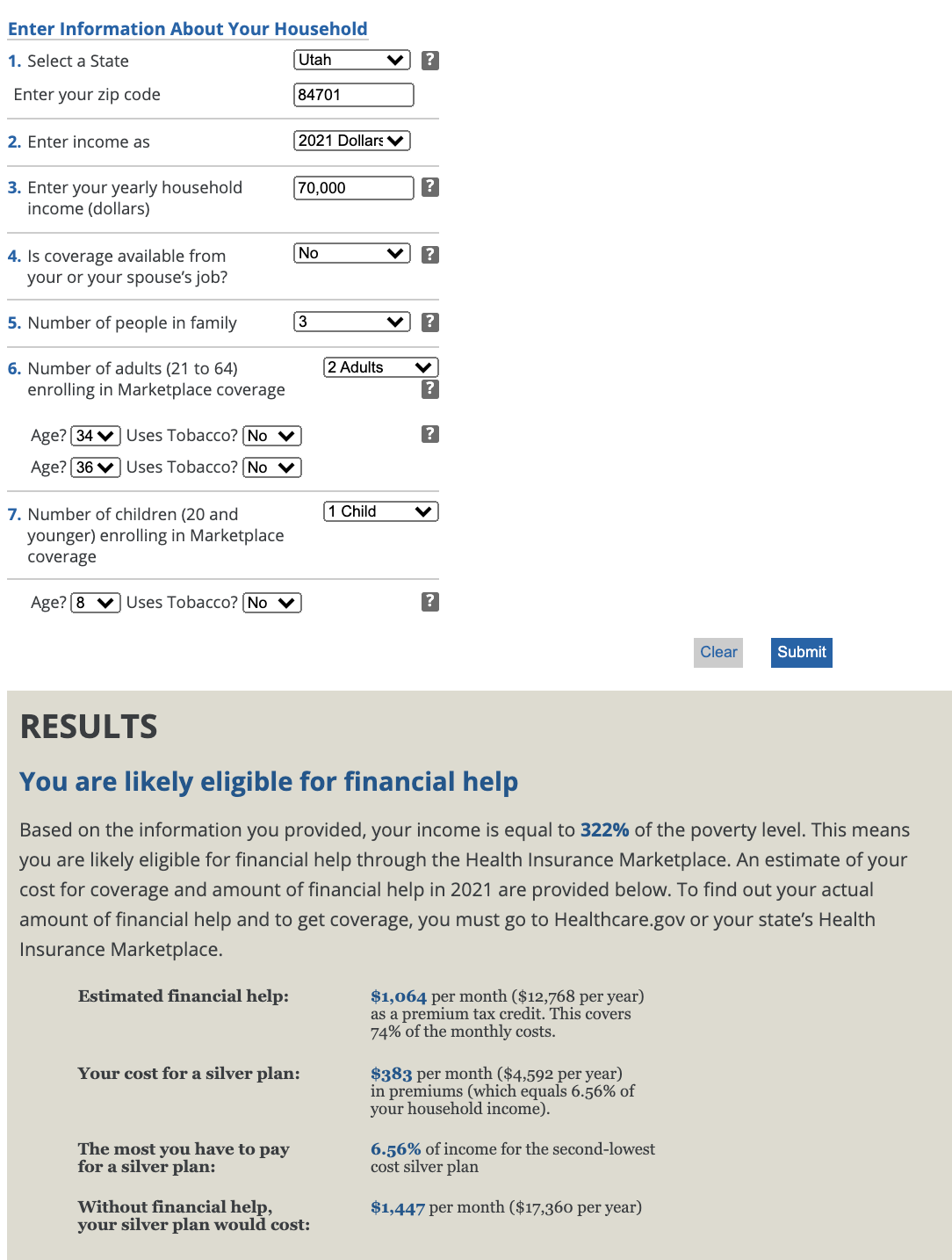

If you get your health insurance coverage through a state or the federal Health Insurance Marketplace you may be eligible.

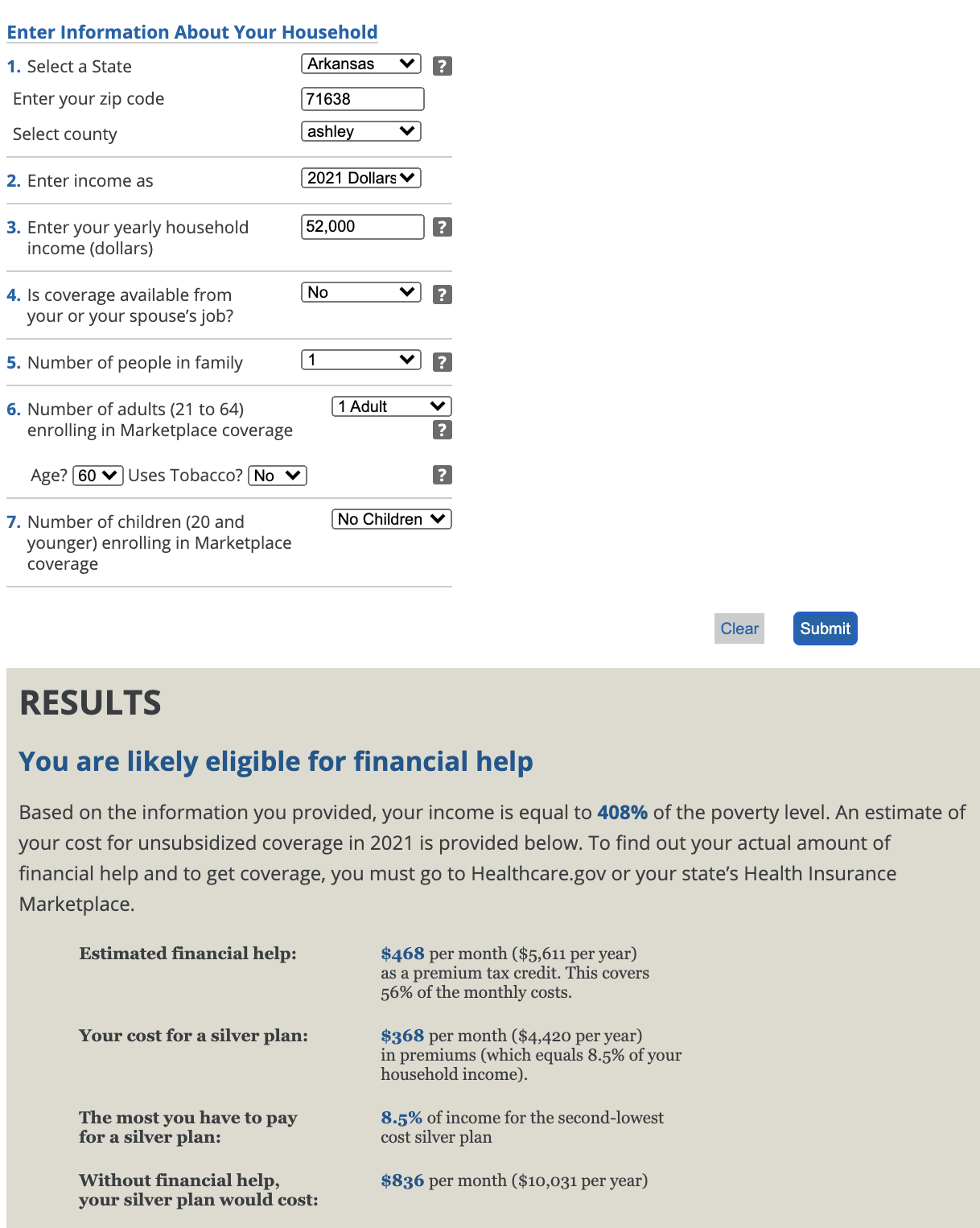

Premium tax credit 2020 calculator. Once you know your MAGI you can shop the ACA marketplace or your state exchange for plans. To receive a PTC you must split the uprights between making too little and too much income. The premium tax credit is a tax credit established by the Affordable Care Act.

Tax Credits cap the maximum premium you can pay. Tax credits calculator - GOVUK. This new law substantially changes the formula for calculating the premium tax credit in tax years 2021 and 2022.

Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. Monthly Advance Payment of Premium Tax Credit PTC. 50000 560 40000 328 1488 This represents 15 of the 10000 increase in their income.

Youll see your official premium tax credit. For tax years other than 2020. Based on your income and family size you may be able to get a subsidy also known as a premium tax credit or financial help.

The only thing mentioned is the unemployment exemption. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan. The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace.

Get Your Estimated Tax Credit Using our premium tax credit estimator lets you see how much help you may get. For some people who were. The increase of their expected contribution toward ACA health insurance and the corresponding decrease in their premium tax credit will be.

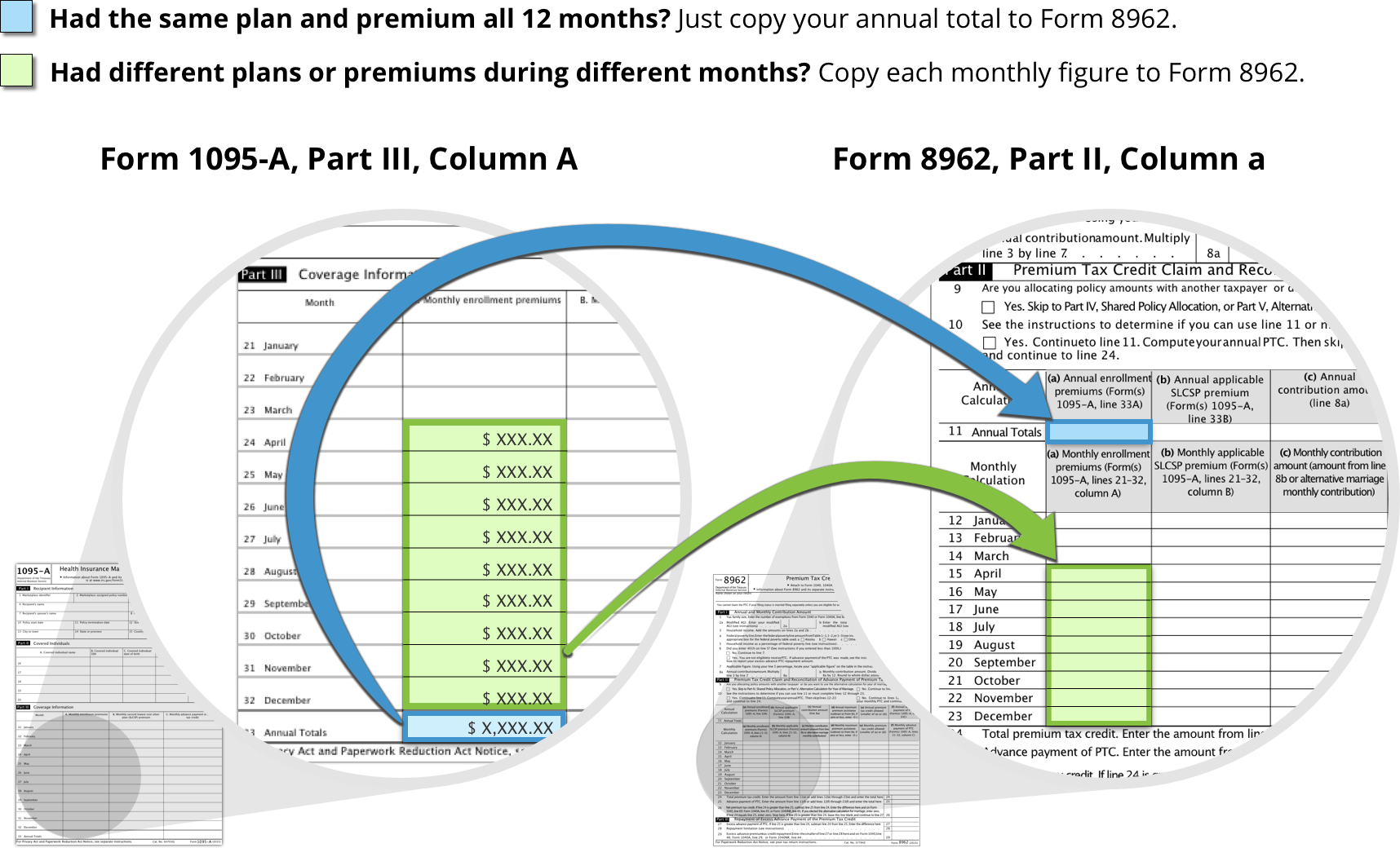

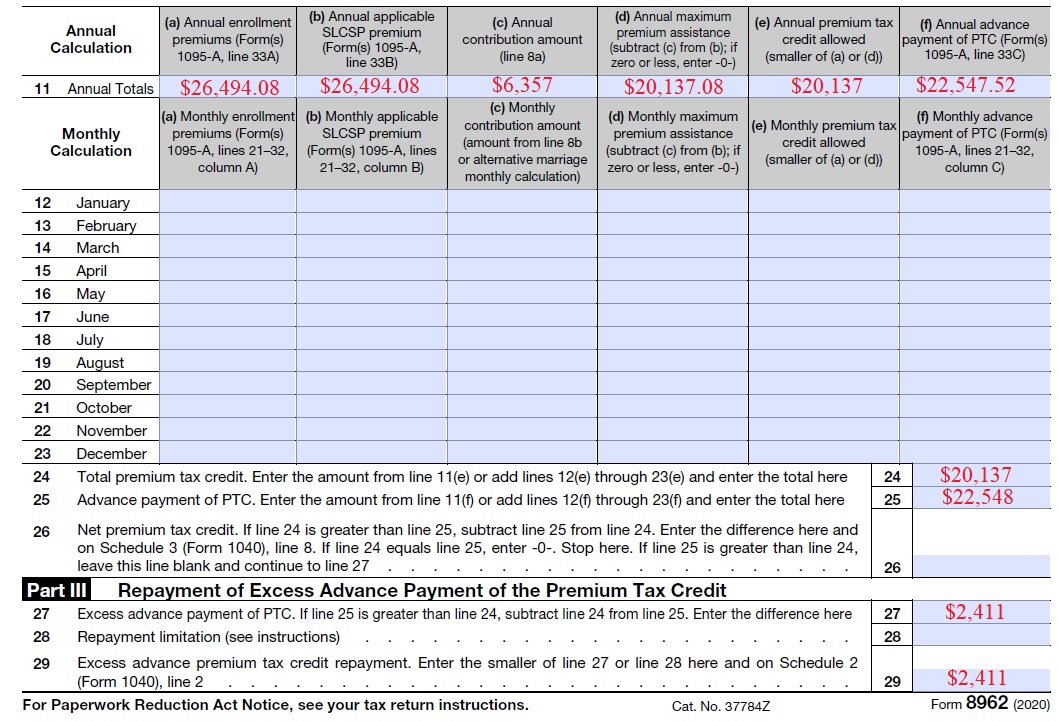

Calculate Premium Tax Credit Enter the amounts from Lines 21 through 32 for columns A B C of your Form 1095-A. You can also claim the premium tax credit after the fact on your tax. Taxpayers who received a letter about a missing Form 8962 should disregard the letter if they have excess APTC for 2020.

In general you may be eligible for the credit if. Premiums displayed in the calculators results are based on actual exchange premiums in 2020 dollars. The IRS will reduce the excess APTC repayment amount to zero with no further action needed by the taxpayer.

There are also online premium tax credit calculators like this one from the Kaiser Family Foundation that can help you estimate your tax credit ahead of time. The premium tax credit is limited by comparing the cost of your coverage to that of the second lowest cost silver plan that covers you and your family. Premiums were obtained through data published by HHS data received from Massachusetts.

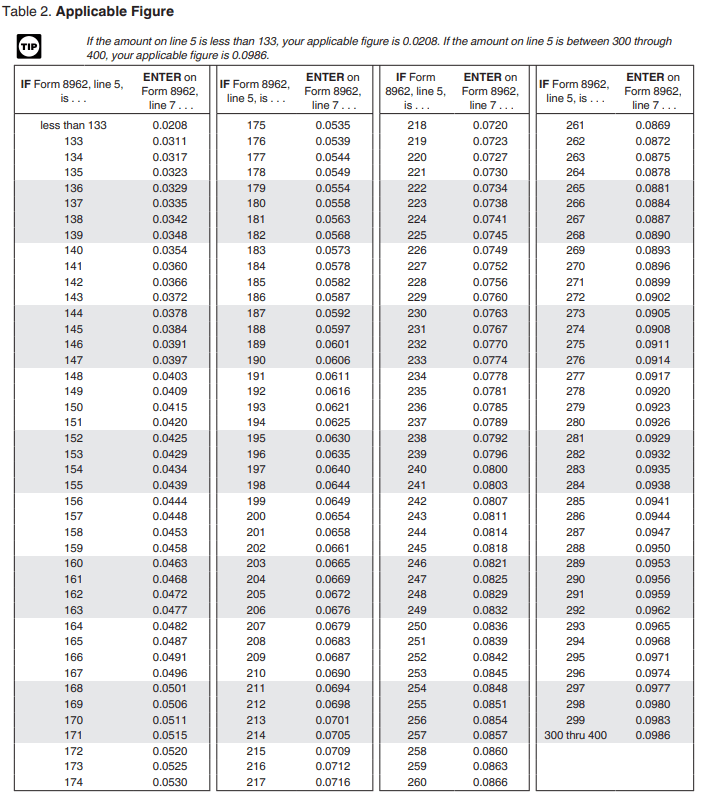

This can help lower the amount you might pay for your health care coverage each month. Enter the required information into the fields below then calculate your results. Specifically the new law changes the applicable premium percentages set forth in irc sec.

You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. This will result in either a smaller refund or a larger balance due.

The lowest cost Bronze plan will typically be cheaper but remember only Silver plans qualify for cost sharing reduction assistance. The calculator below has been updated to reflect these latest changes. The IRS will reimburse people who have already repaid any excess advance Premium Tax Credit on their 2020 tax return.

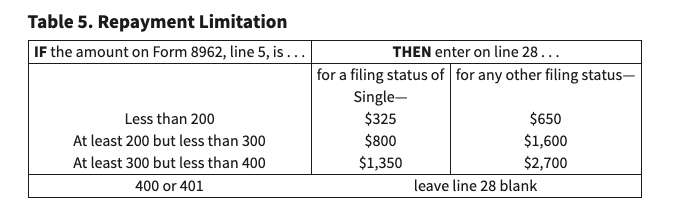

This amount falls between roughly 2-95 of your MAGI for the second lowest cost Silver plan true for both individual and family plans regardless of family size. If the advance credit payments are more than the amount of the premium tax credit you are allowed called excess advance credit payments you will add all or a portion of the excess advance credit payments to your tax liability on Form 1040 Schedule 2. Premium tax credits are tax credits that can be taken in advance as Advanced Premium Tax Credits or at tax time as Premium Tax credits or you can do a mix.

2020 Obamacare Premium Tax Calculator By A Noonan Moose on October 28 2019 In 2020 the federal government will once again offer a Premium Tax Credit PTC to qualifying taxpayers who buy health coverage from an approved health insurance exchange. These sites will ask for your MAGI and household size then calculate tax credits for you. Premium tax credit caps on 2020 marketplace coverage range from 206 978 of income based on the 2019 federal poverty level.

For 2020 where the advance credit payments exceed the PCT no additional income tax will be. If you are enrolled in more expensive coverage you will pay the additional amount. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCaregov.

Monthly Premium Amount B. Monthly Premium Amount of Second Lowest Cost Silver Plan SLCSP C. The credit can help make health insurance more affordable to you and your family.

I was reading elsewhere that there was also a change to the law regarding the Premium Tax Credit. This counts as the advance premium tax credit. However if you are enrolled in coverage that costs less your share of the premium will also be less.

I was reading here that there will be an update today March 18 for the new stimulus tax law changes.

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Lesson 12 Premium Tax Credit Calculator Youtube

Lesson 12 Premium Tax Credit Calculator Youtube

Premium Tax Credit Flow Chart Are You Eligible Internal Revenue Service

Premium Tax Credit Flow Chart Are You Eligible Internal Revenue Service

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Everything You Need To Know About Premium Tax Credits

Everything You Need To Know About Premium Tax Credits

Https Oci Wi Gov Documents Consumers Calculatingpremiumtaxcredits Pdf

Key Facts Premium Tax Credit Beyond The Basics

Health Insurance Premium Tax Credit Health Plans In Oregon

Health Insurance Premium Tax Credit Health Plans In Oregon

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Advanced Tax Credit Repayment Limits

Advanced Tax Credit Repayment Limits

Everything You Need To Know About Premium Tax Credits

Everything You Need To Know About Premium Tax Credits

How To Reconcile Your Premium Tax Credit Healthcare Gov

How To Reconcile Your Premium Tax Credit Healthcare Gov

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.