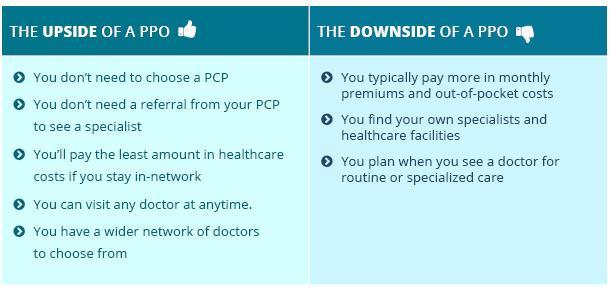

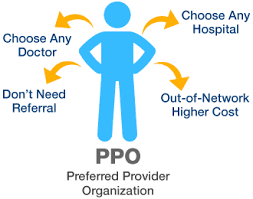

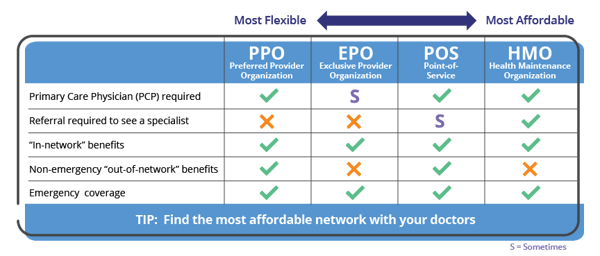

A preferred provider organization PPO is a type of health insurance arrangement that allows plan participants relative freedom to choose the doctors and. You get it all from no referrals to broad networks to competitive discounts and more.

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Your employer may offer a PPO health plan through Cigna.

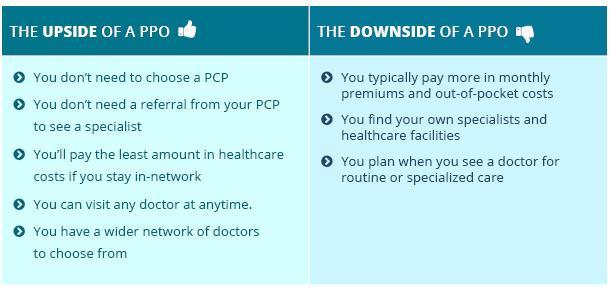

How to get a ppo plan. A PPO plan has a certain group of health care providers you can use when you need care. To get the best rate on your care you have to be sure youre sticking to that list. A preferred provider organization plan gives you access to a network of healthcare providers and medical facilities at reduced pricesgenerally.

You want a portion of out-of-network claims to be covered by your insurance company. A PPO may be a good choice for you because. PPO plans give their contracts access to a network of medical providers such as hospitals primary care doctors and specialists.

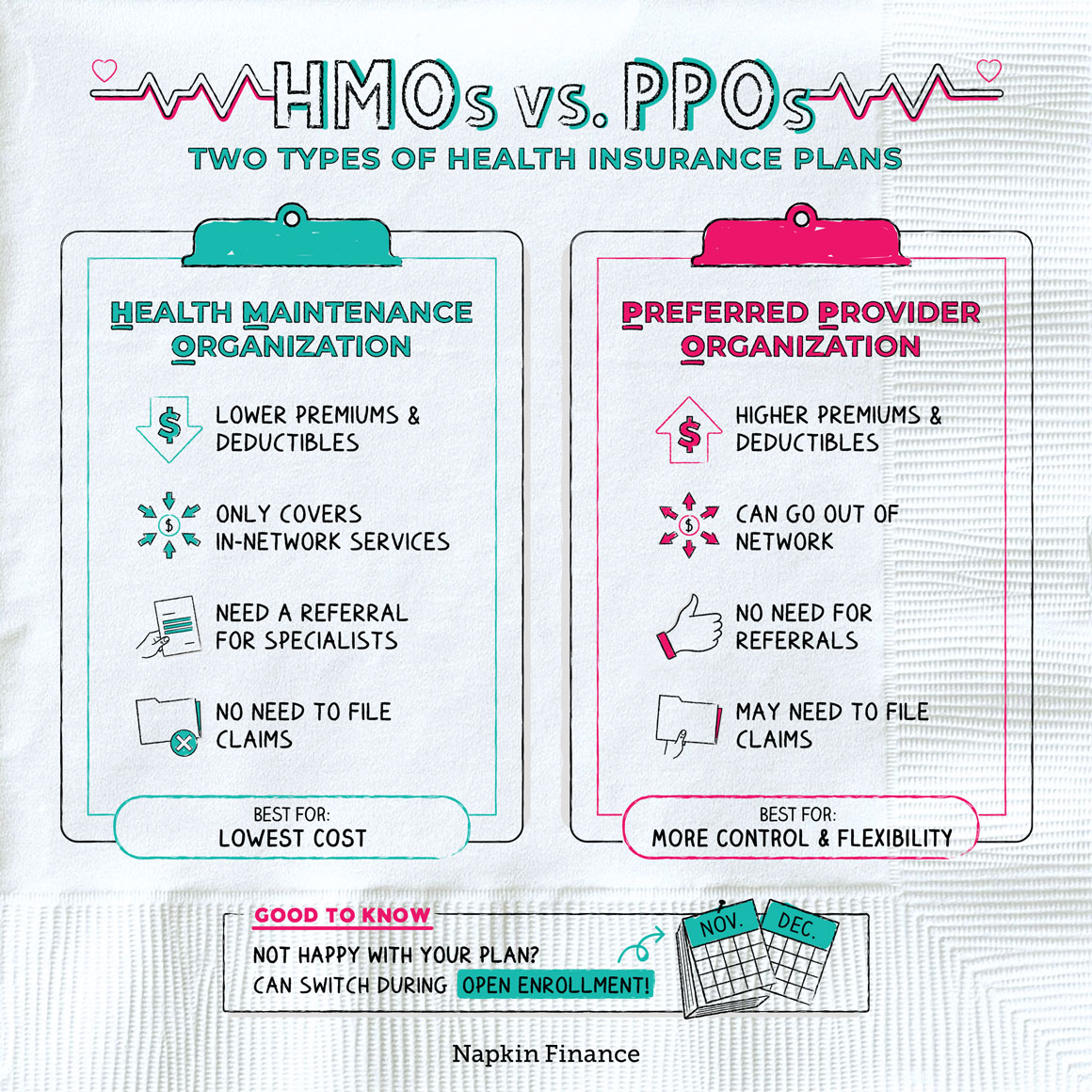

You want the freedom to choose almost any medical facility or provider for your healthcare needs. Unlike PPO plans you need to have a primary care doctor and HMO plans require you to get a referral from your primary care doctor before seeing a specialist. Aetna Medicare Advantage D-SNPs.

You dont need a primary care physician PCP to coordinate your care. Learn more about our Preferred Provider Organization plans. You dont want to get referrals before visiting a specialist Definitions may vary by plan.

But in fact PPO out-of-pocket costs can climb quite high depending on the insurance company youre working with. You pay less if you use providers that belong to the plans network. Medicare Advantage PPO Plans Medicare Advantage Preferred Provider Organizations PPOs are an integral part of the Medicare Advantage Plan Part C.

Preferred Provider Organization PPO A type of health plan that contracts with medical providers such as hospitals and doctors to create a network of participating providers. In addition to PPO plans offers you other Medicare Advantage plan options many with a 0 monthly plan premium. With Aetnas PPO health insurance plans youll never have to choose between flexibility and savings.

The petition is used to give the judge important information they need to decide whether to give you the order you want. A PPO plan is a type of Medicare Advantage Plan that is offered by private insurance companies. This is called.

PPO Plans have network doctors other health care providers and hospitals. If you use a provider that belongs to your plans network you pay less out of pocket. You can use the Do-It-Yourself Personal Protection Order PPO tool to create a petition for any of the three types of PPOs.

If you see a specialist without a referral even if they are within your network your insurance company will likely cover little or none of the cost leaving you with a much higher bill. Preferred Provider Organization PPO. A PPO plan may be right for you if.

7 Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network. But in a PPO the provider list is generally smaller than it is with an HDHP. We can help you find out if you qualify.

To ask for a PPO you must file a petition with the court. Our dual-eligible Special Needs Plan D-SNP is a type of Medicare Advantage plan available to people who have both Medicare and Medicaid. With a PPO you have access to a large network of providers and dont need a referral to see a specialist.

If you are eligible to enroll in Medicare there are Medicare Advantage PPO plans available. For 2020 the IRS defines an HDHP as any plan with a deductible of at least 1400 for individuals and 2800 for a. You can get care from in-network or out-of-network providers.

You pay less if you use doctors hospitals and other health care providers that belong to the plans Network. Both kinds of health plans have a network of providers you can work with to get the best rates. Point of Service POS POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO.

A Medicare PPO Plan is a type of Medicare Advantage Plan Part C offered by a private insurance company. PPO plans explained. You dont need a referral to see a specialist.

For example you might have a 40 copay to see an in-network physician but a 50 coinsurance charge for seeing an out-of-network physician. A High-Deductible Health Plan is a type of health insurance plan that as its name implies has a higher deductible than traditional insurance plans such as an HMO EPO or PPO. By signing up for a Medicare PPO plan you can access a network of doctors and health care providers at a.

You can use doctors hospitals and providers outside of the network for an additional cost. The PPO provides an incentive for you to get your care from its network of providers by charging you a higher deductible and higher copays andor coinsurance when you get your care out-of-network.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

What Is A Ppo About Ppo Health Insurance Medical Mutual

What Is A Ppo About Ppo Health Insurance Medical Mutual

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Ppo Blue Cross And Blue Shield Of Texas

Ppo Blue Cross And Blue Shield Of Texas

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Shop Affordable Ppo Health Insurance Plans In All 50 States Forhealthinsurance Com Health Insurance

Shop Affordable Ppo Health Insurance Plans In All 50 States Forhealthinsurance Com Health Insurance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Ppo Insurance What Is A Preferred Provider Organization Plan

Ppo Insurance What Is A Preferred Provider Organization Plan

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.