Enter your job title and city. Social Security and Medicare.

California Salary Calculator 2021 Icalculator

California Salary Calculator 2021 Icalculator

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Salary calculator california. California Salary Paycheck Calculator Below are your California salary paycheck results. Our California State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 10000000 and go towards tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

That means that your net pay will be 42930 per year or 3577 per month. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

While this calculator can be used for California tax calculations by using the drop down menu provided you are able to. The PaycheckCity salary calculator will do the calculating for you. Calculation State Date.

The standard deduction in California is 4601 for single filers and 9202 for joint filers. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. The California Salary Comparison Calculator is a good calculator for comparing salaries when you are actively looking for a new job if you would like to compare your current salary to your new salary after a pay raise or compare salaries when looking at a new employment contract maybe you are an expat reviewing different salaries overseas and their impact on income tax in the US.

California Hourly Paycheck Calculator. Paycheck Calculator Download The Internal Revenue Service IRS redesigned the Form W-4 Employees Withholding Certificate to be used starting in 2020. California Salary Paycheck Calculator.

Using our California Salary Tax Calculator. Payroll check calculator is updated for payroll year 2021 and new W4. If you make 55000 a year living in the region of California USA you will be taxed 12070.

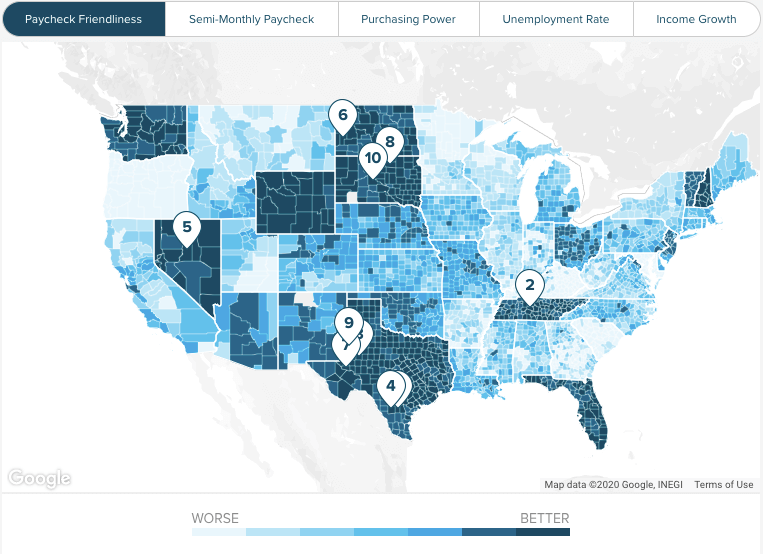

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your average tax rate is 220 and your marginal tax rate is 397. California State Controllers Office.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On. To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. These calculators use supplemental tax rates to calculate withholdings on special wage payments such as bonuses.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Subtract any deductions and payroll taxes from the gross pay to get net pay. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

Check your salary on PayScales Salary Calculator. This California hourly paycheck calculator is perfect for those who are paid on an hourly basis. This number is the gross pay per pay period.

The results are broken up into three sections. Please note that this calculator does not cover any exceptional circumstances like how to calculate overtime for employees subject to an alternative workweek schedule. It also issued regulations updating the federal income tax withholding tables and computational procedures in Publication 15-T Federal Income Tax Withholding Methods.

Taxpayers in California may also be eligible for a number of tax credits for financial events and expenses including childcare buying a new home the purchase of an electric vehicle and installing solar panels on their house. This marginal tax rate means that your immediate additional income will be taxed at this rate. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

The calculator below can be used as a rough guide to determine how much overtime to which a California employee might be entitled2. The California Salary Calculator allows you to quickly calculate your salary after tax including California State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting California state tax. The result is based on the salaries and hourly rates reported by people with similar jobs in your city.

It should not be relied on as legal advice. After a few seconds you will be provided with a full breakdown of the tax you are paying. This calculator determines the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amount.

Dont want to calculate this by hand. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California.

Overtime Wage Calculator For California Legal Guide 2020

Overtime Wage Calculator For California Legal Guide 2020

California Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset

Combina Peste Sarcom California Tax Calculator Tinerifermieri Ro

Combina Peste Sarcom California Tax Calculator Tinerifermieri Ro

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Here S How Much Money You Take Home From A 75 000 Salary

What Is The Net Pay For A Gross Salary Of 120 000 Usd In California Quora

What Is The Net Pay For A Gross Salary Of 120 000 Usd In California Quora

Ca Income Tax Calculator May 2021 Incomeaftertax Com

Ca Income Tax Calculator May 2021 Incomeaftertax Com

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Taxes Federal State Local Withholding H R Block

California Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

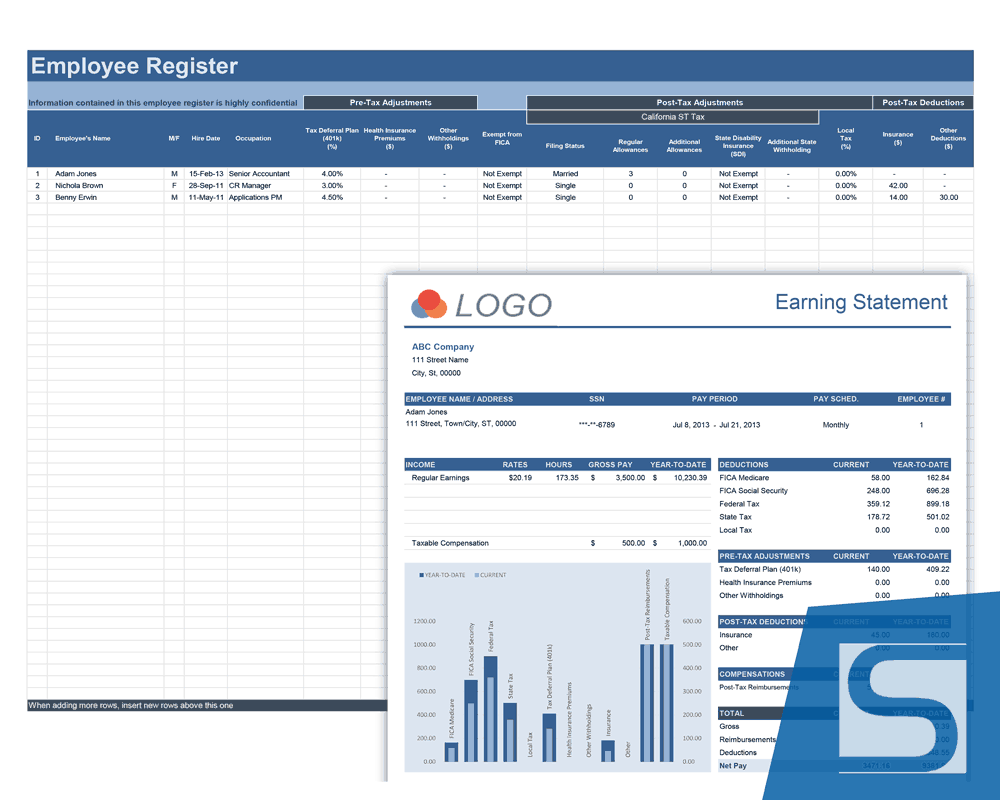

Payroll Calculator Professional Payroll Calculator For Excel

Payroll Calculator Professional Payroll Calculator For Excel

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.