Plan F is one Medigap option. Medicare Supplement Insurance Plan F is standardized by the federal government.

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

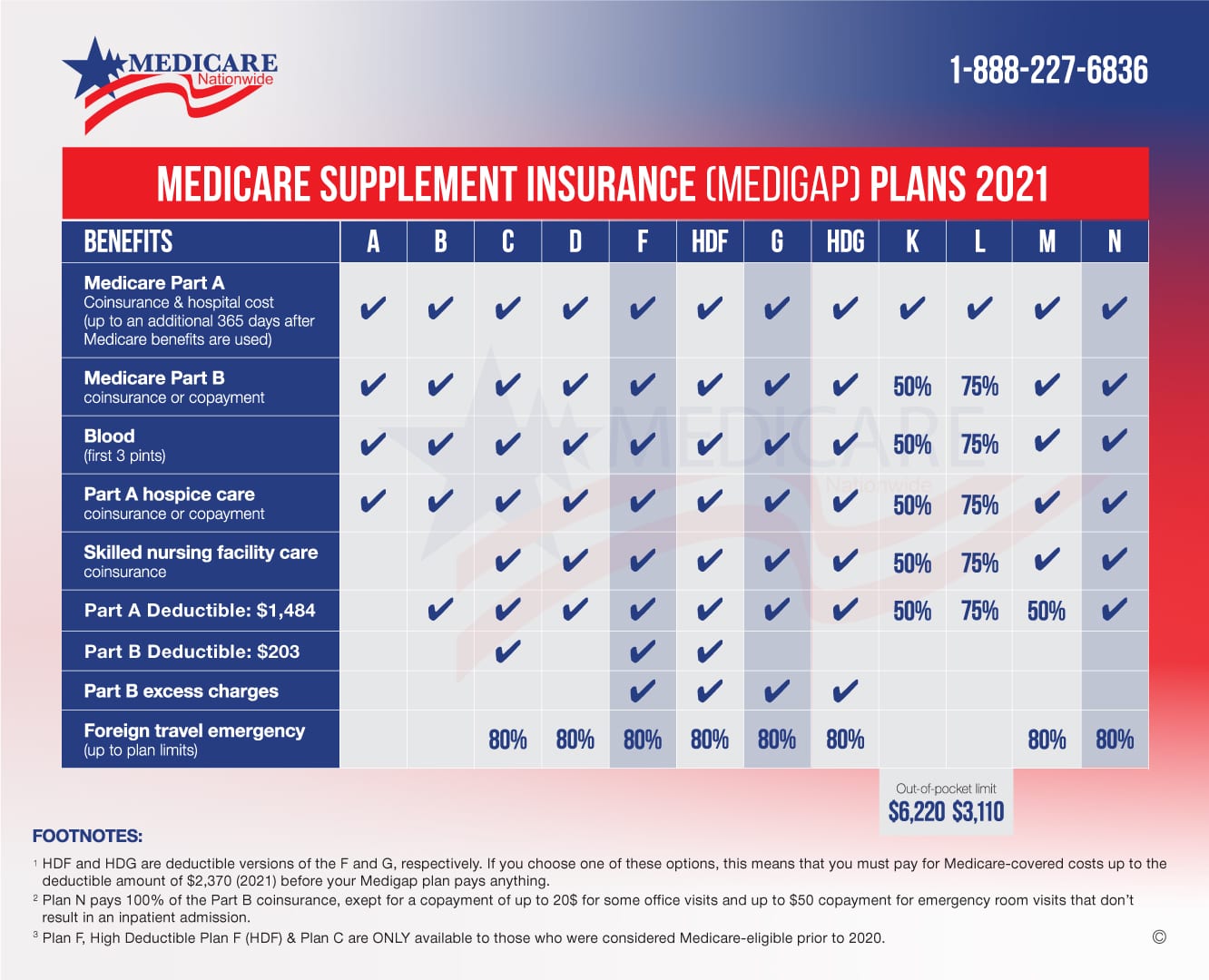

As part of the Medicare Access and CHIP Re-authorization Act of 2015 you may not be able to buy a Medicare Supplement insurance plan that may cover the Part B deductible if you became eligible for Medicare January 1 2020 or later.

Medicare supplemental insurance plan f. Medicare Supplement Insurance is the only plan to provide coverage for each of the following 9 benefit areas. Plan F is a Medicare Supplement plan also known as a Medigap policy that is offered by private insurance companies. Its extensive coverage makes this a popular plan for beneficiaries who want broader assistance with out-of-pocket costs in Original Medicare.

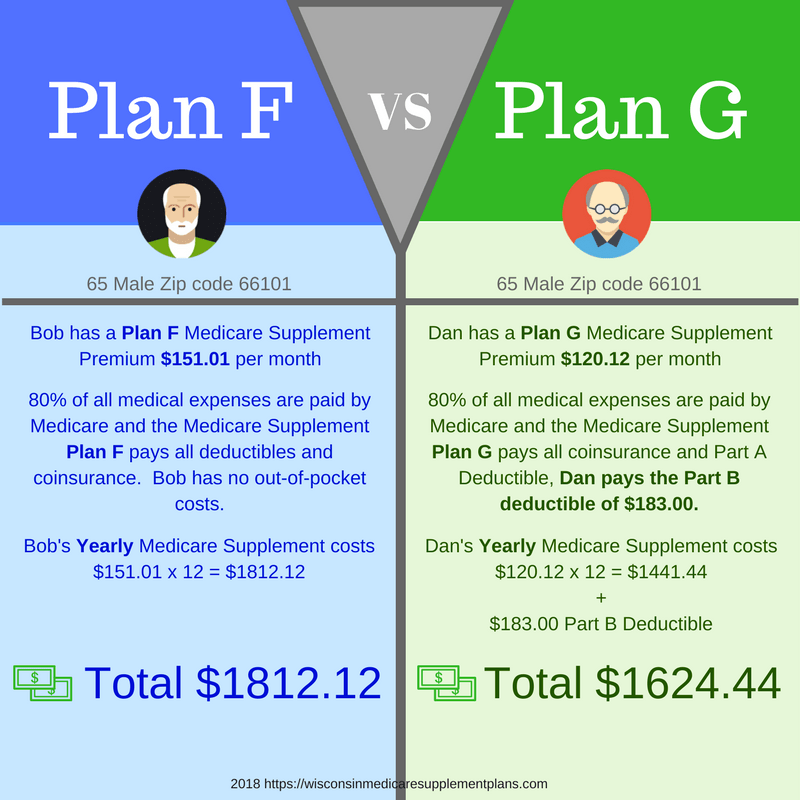

12 Zeilen Plans F and G also offer a high-deductible plan in some states. Medicare Supplement Plan F is not only the most comprehensive plan for lowering out-of-pocket costs it is also the most popular. This means that the person enrolling must have had their 65th birthday before January 1 2020.

This means that the 9 basic benefits of Plan F will be the same no matter where you live or what Medicare Supplement Insurance company you buy it from. Make the best coverage decision for yourself. Original Medicare pays for much but not all of the cost for covered health care services and supplies.

This includes durable medical. Some doctors charge a 15 excess charge beyond what Medicare pays. Medicare Supplement Plan F is generally regarded as the most comprehensive plan out of the 10 Medicare Supplement Medigap policies available in most states.

Starting on January 1 2021 Medicare Plan F is only available to beneficiaries who were eligible for Medicare before January 1 2020. If you are a Medicare beneficiary who already has one of these plans you will be able to keep your current policy. Medicare Supplement Plan F.

Medicare Supplement insurance plan F 2020. Medigap Plan F may cover. Beginning January 1 2020 Medigap plans that cover the Part B deductible arent available to newly eligible beneficiaries.

It pays Medicare costs for you in exchange for a monthly premium. Watch video to learn more. Plan F covers that for you.

Plan F is a plan thats included in Medicare supplement insurance Medigap. Plus Medicare Supplement Insurance plans are required by law to be accepted anywhere that Original Medicare is accepted. As a result of MACRA anybody who becomes eligible for Medicare in 2020 will not be able to purchase Plan F.

Or you qualified for Medicare due to a disability before January 1 2020. Medicare Supplement Insurance Plan F benefits are standardized by the federal government. What will the change mean to you.

Plan F will pay the following benefits costs are for 2020 and generally increase each year on January 1. Medicare Supplement Plan F is being phased out as a result of The Medicare Access and CHIP Reauthorization Act of 2015 also known as MACRA. Obviously if you werent eligible for Medicare prior to January 1 2020 Medicare Supplement Plan F wont be a plan option.

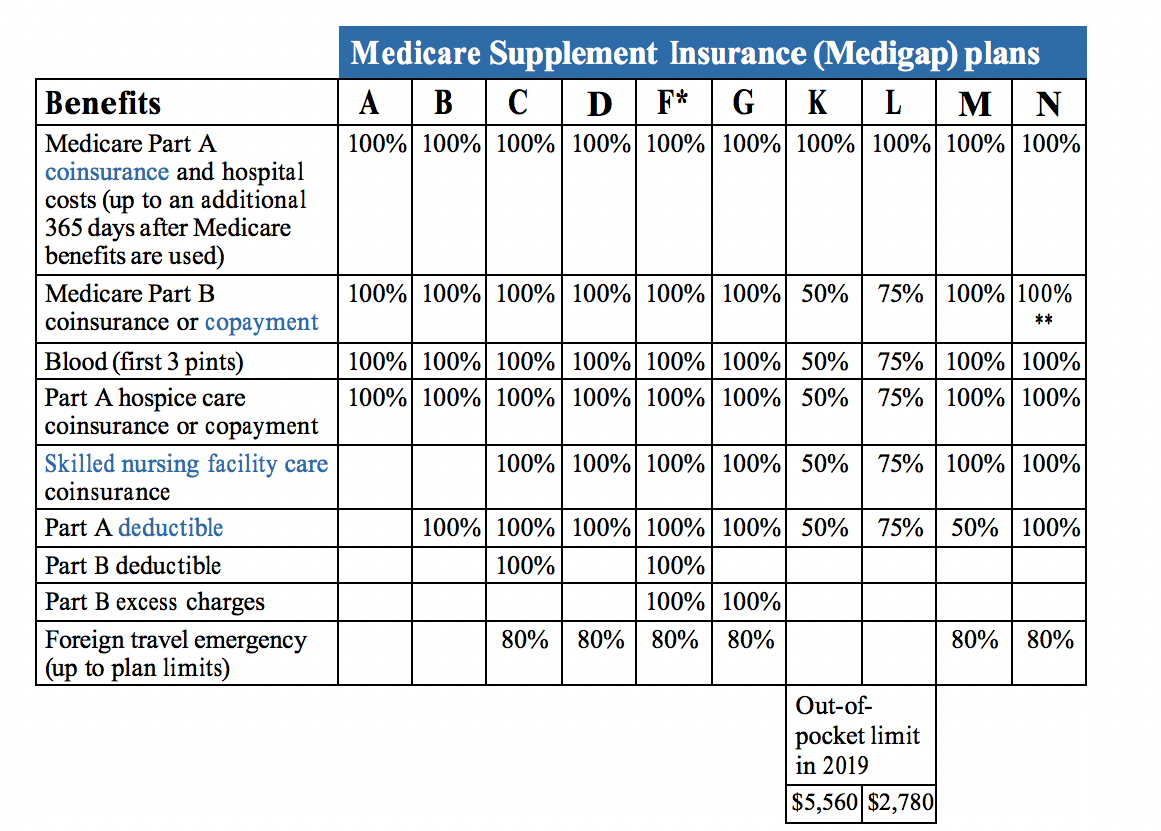

Medigap is Medicare Supplement Insurance that helps fill gaps in Original Medicare and is sold by private companies. Review the chart below for all the details of Plan F coverage or explore other Medicare Supplement plans. Medicare supplement insurance Medigap is a type of Medicare insurance policy that can help pay for some costs that original Medicare parts A and B doesnt cover.

A Medicare Supplement Insurance Medigap policy can help pay some of the remaining health care costs like. As of January 1 2020 people newly eligible for Medicare wont be able to buy Medicare Supplement Plan F. If you have a Medicare Supplement Plan F you dont.

Medicare Supplement Plan F Plan G and Plan N Explained Plan N F and G are all under Medicare Supplement Plans or Medigap Plans. The only other acceptation to this would be if a person qualified for Medicare due to a disability before January 1 2020. Still you may have choices in Medicare Supplement insurance plans.

Plan F is only available if you first became eligible for Medicare before January 1 2020 which means your 65th birthday occurred before January 1 2020. New Medicare beneficiaries will not be able to enroll in a Plan C or a Plan F. Plan F also pays the 20 for a long list of other Part B services.

However this also means that premiums may be more expensive. Plan F coverage also includes your other doctor visits for illnesses and injuries. Medicare Supplement Plan F benefits As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N.

Medicare Part B first pays 80. Out of all of the Medicare supplement plans. According to Americas Health Insurance Plans AHIP nearly 14 million people on Original Medicare were also on a Medigap plan in 2018 and more than half of them were on Plan F.

Then your Plan F supplement pays your deductible and the other 20. That means the basic out-of-pocket Medicare costs covered by Plan F sold in New York will be the same as Plan F sold in California. Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers.

It can help pay for expenses that arent covered under original Medicare. Plans E H I and J are no longer sold.

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan F Ensurem

Medicare Supplement Plan F Ensurem

Medicare Supplement Plan F Wisconsin Medicare Plans

Medicare Supplement Plan F Wisconsin Medicare Plans

Medigap Plan F The Most Common And Comprehensive Plan

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Supplement Plan F Is The Most Popular Medigap Plan As It Fills In Many Of The Holes In Medicar Medicare Supplement Plans Medicare Supplement Medicare

Medicare Supplement Plan F Is The Most Popular Medigap Plan As It Fills In Many Of The Holes In Medicar Medicare Supplement Plans Medicare Supplement Medicare

Medicare Supplemental Insurance True Cost Of Healthcare

Medicare Supplemental Insurance True Cost Of Healthcare

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.