Parenteral and enteral nutrition intravenous and tube feeding. Important points to remember.

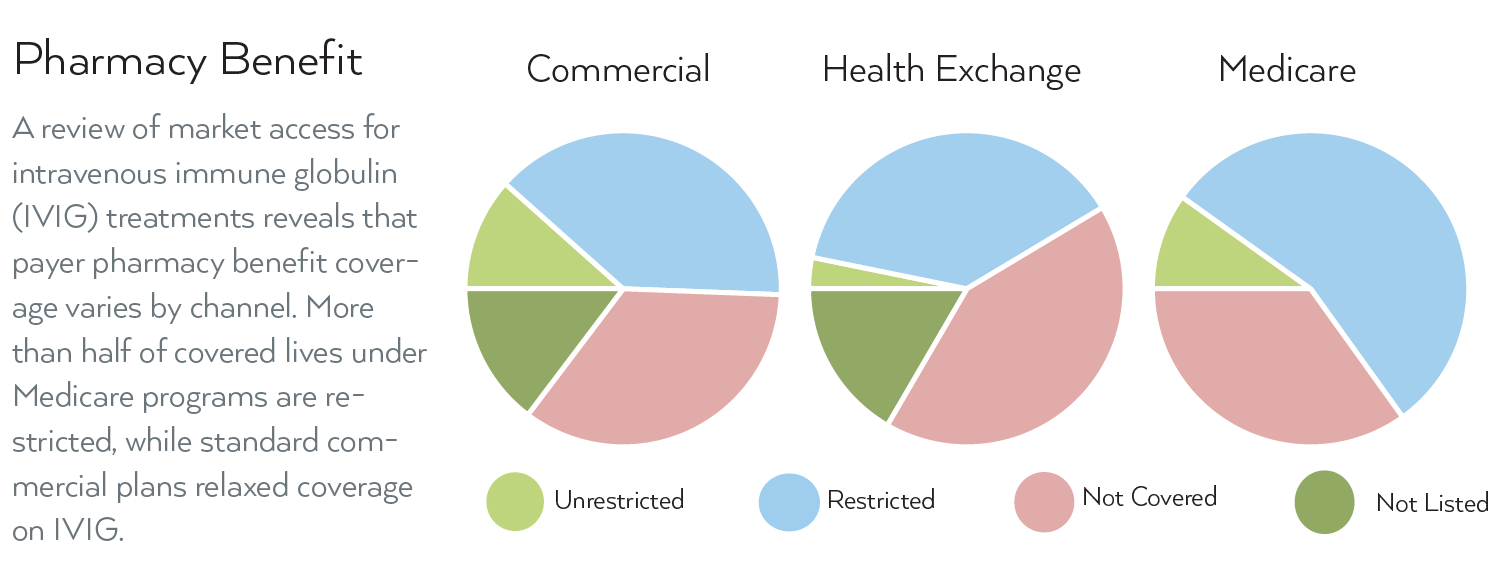

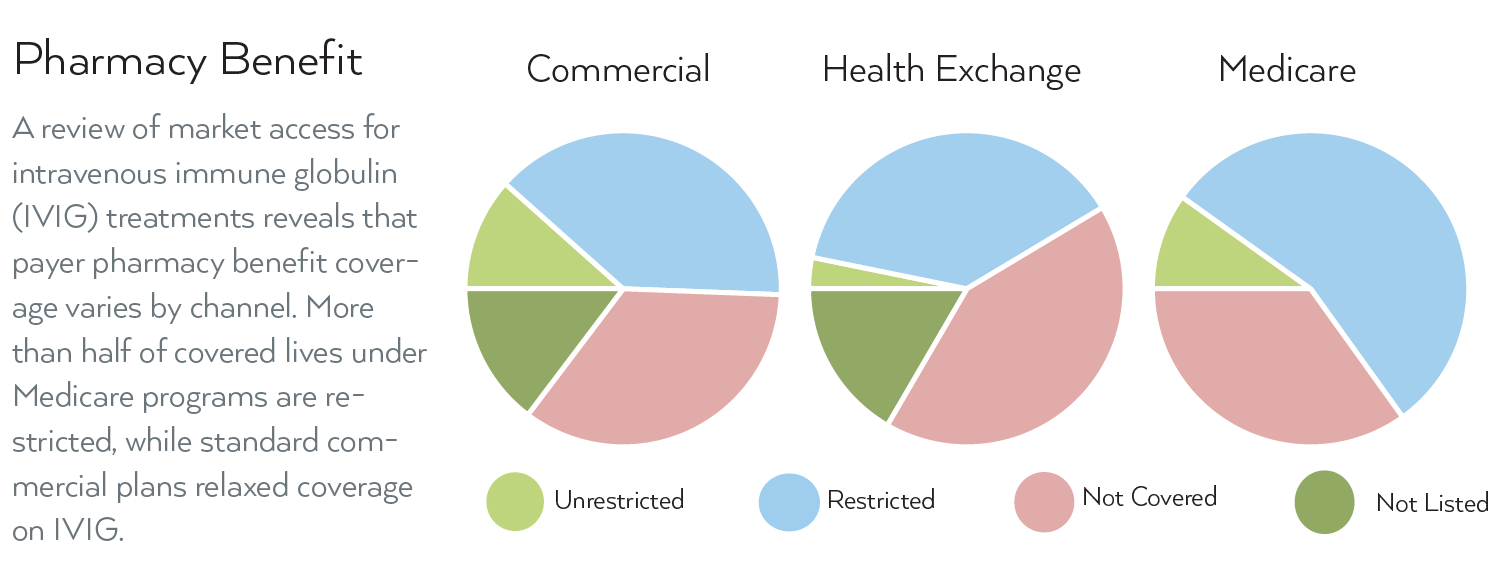

Mmit Reality Check On Ivig Jul 2018

Mmit Reality Check On Ivig Jul 2018

The new guidelines allow for more flexibility for patients and their physicians to decide the best setting for ongoing treatments.

Medicare ivig coverage. June 5 2017 at 957 pm 112793. What is covered by Medicare. Coverage for IG varies based on the patients diagnosis where they currently receive therapy and whether or not they receive therapy via the intravenous IVIG or subcutaneous SCIG route.

Medicare helps pay for IVIG if you have a diagnosis of primary immune deficiency disease. The use of intravenous immune globulin IVIG should be reserved for patients with serious defects of antibody function. Medicare Part B is a medical benefit and allows coverage for intravenous immunoglobulin replacement therapy IVIG because it was typically administered in a hospital or facility setting.

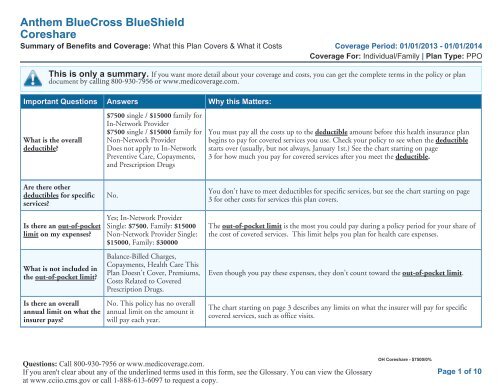

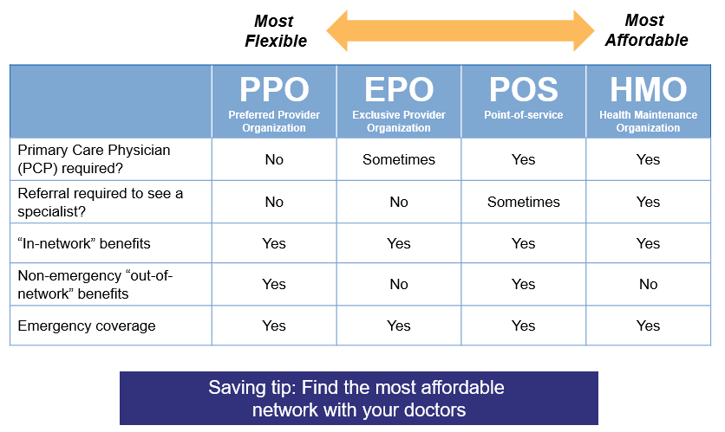

Typical Medicare services visits PLUS -IVIG drug -cost of nursing for home infusion -cost of equipment for home infusion. Medical Policy Intravenous Immune Globulin IVIG STRIDEsm HMO MEDICARE ADVANTAGE. Drug coverage for an immune deficiency diagnosi s.

However on January 10 President Obama signed into law HR 1845 the Medicare IVIG Access Act. Medicare may provide coverage for the use of IVIg use in the above disease conditions if the following requirements are met. Medicare Part B is a medical benefit and allows coverage for intravenous immunoglobulin replacement therapy IVIG because it was typically administered in a hospital or facility setting.

Currently Medicare pays for IVIG medications for beneficiaries who have primary immune deficiency who wish to receive the drug at home. For Guillain-Barre Myasthenia Gravis Acute or Chronic Inflammatory Demyelinating Neuropathy see CIDP below for. Medicare helps pay for certain nutrients if you cant absorb nutrition through your intestinal tract or take food by mouth.

The goal is to provide immune globulin to those who lack it. Services supplies and accessories used in the home under the Medicare intravenous immune globulin IVIG demonstration Not covered Coding Clarifications. IVIG is covered under this benefit when.

Virtually all Medicare insurers have coverage policies governing IVIg treatments under Part B. Then its a matter of using the correct ICD-10 codes see my earlier post to request coverage. Providers are responsible for reviewing the CMS Medicare Coverage Center guidance.

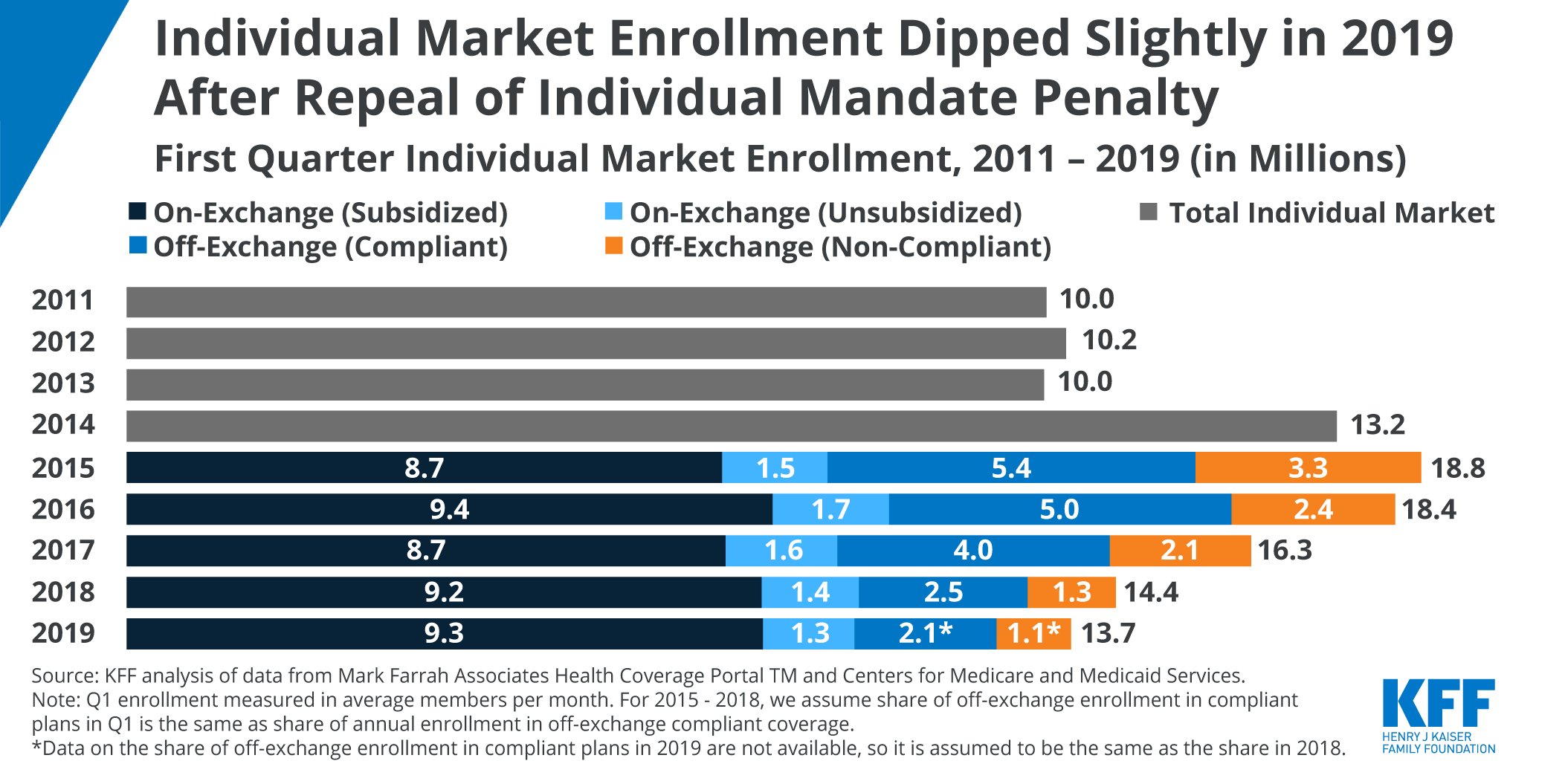

Typical Medicare services PLUS -IVIG drug Estimated cost paid by patient per year. 1 2019 and end on the day before the date of the. The Medicare Prescription Drug Improvement and Modernization Act of 2003 provides coverage of IVIG for the treatment of PIDD in the home.

IVIG Demonstration may switch to home infusion as that. IG therapy for an immune deficiency is 80 percent covered under Medicare Part B. Earlier this week the Center for Medicare and Medicaid Services CMS released new guidelines for the coverage of home infusion during the COVID-19 pandemic.

For diagnosis codes see related Local Coverage Determinations LCDs and Local Coverage Articles. Cms ivig coverage 2019. Posted on April 2 2020.

Medicare will only cover IVIG in the home for myasthenia if you are a homebound patient. Currently Medicare pays for IVIG medications for beneficiaries who have primary immune deficiency who wish to receive the drug at home. Click to see full answer.

CMS makes medical determinations as to the PI diagnoses that are covered under Part B for home infusions. If your provider submits the IVIGSCIG service claim under Part D it will most likely be denied. MG is covered but the doctor has to submit continuing proof of necessity and documentation to CMS.

You must report to an outpatient infusion center for 100 coverage if you have myasthenia and can get to an outpatient setting. Medicare will provide coverage for IVIG when it is used in treatment of the following conditions. Under Part B individuals over 65 may purchase supplemental insurance plans that will cover the 20 that is not covered by Medicare.

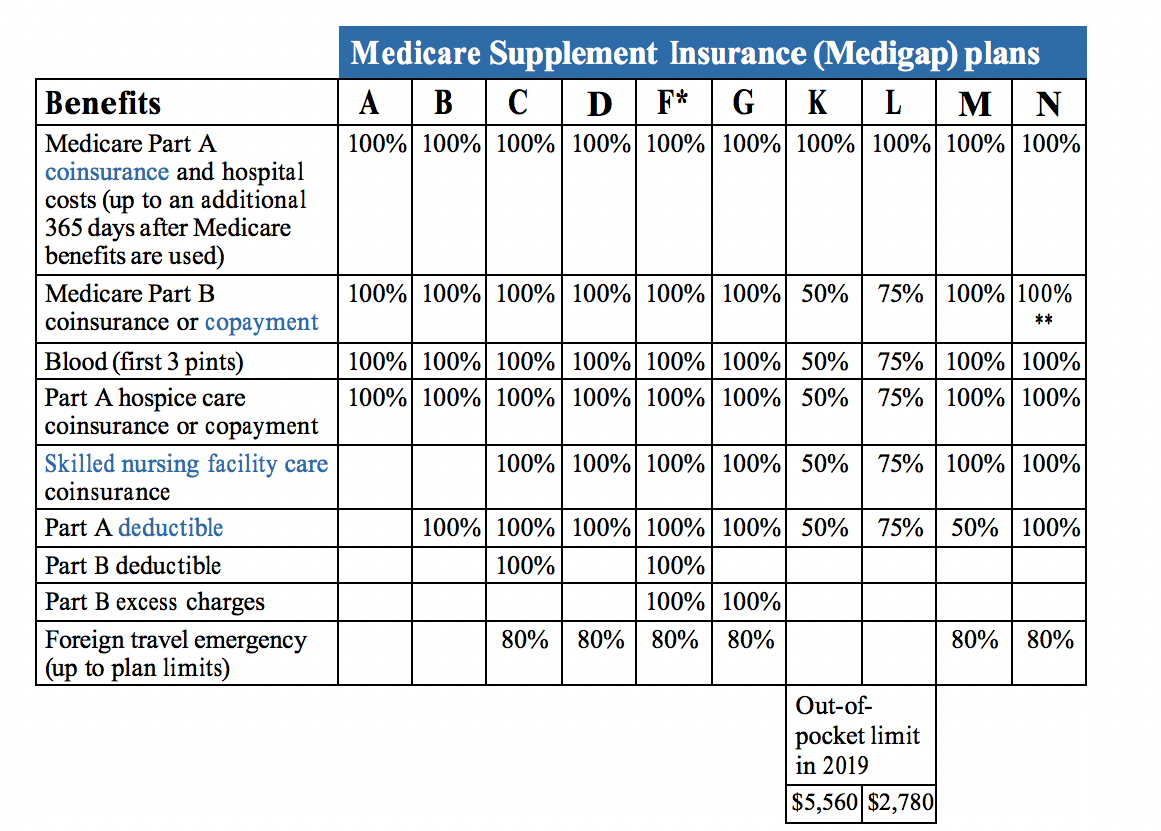

Drugs covered under Medicare home infusion benefit. The Act provides for a demonstration project to examine the benefits of providing coverage and payment for items and services necessary to administer IVIG in the home for patients with PIDD. Medicare supplement plans can cover IVIG Intravenous Immune Globulin under conditions set by the provider.

The Act defines intravenous immune globulin as an approved pooled plasma derivative for the treatment of PIDD. If you have a primary immunodeficiency disease with the diagnosis codes 27904 27905 27906 27912 or 2792 your IVIGSCIG treatment is reimbursed under Medicare Part B. Summary of the Home Infusion Technical Expert Panel.

However the traditional Medicare fee for service benefit does not currently cover any services to administer the drug to a beneficiary at. However the traditional Medicare fee for service benefit does not currently cover any services to administer the drug to a beneficiary at. In the event that there is a conflict between this document and the CMS Medicare Coverage Center guidance the CMS Medicare Coverage Center guidance will control.

A doctor must decide that its medically appropriate for the IVIG to be given in your. Intravenous Immune Globulin IVIG provided in home. There was a three year demonstration where people receiving IVIG could sign up for reduced cost IVIG services that started in Sep 2014.

The patient has a diagnosed PIDD. Your provider will have to reprocess and submit those IVIGSCIG claims.

/Woman-having-smile-and-teeth-checked-at-orthodontist-with-dental-coverage-589149295f9b5874eedcb400.jpg)