Review your options to find the best health insurance in Australia. Massages physiotherapy etc and assistive equipment eg.

Your Best Health Care Now Get Doctor Discounts Save With Better Health Insurance Find Affordable Prescriptions E Book Frank Lalli Nextory

Your Best Health Care Now Get Doctor Discounts Save With Better Health Insurance Find Affordable Prescriptions E Book Frank Lalli Nextory

From platinum level metal plans to catastrophic only were ready to help you find a plan to fit your lifestyle.

Find health insurance. TAKE THE FIRST STEP TO APPLY UPDATECHANGE PLANS TO SAVE. JavaScript is not enabled. Use the Governments Health Insurance Marketplace.

You can compare all private health insurers health funds on the Australian Governments PrivateHealthgovau website. If youre looking for individual or family health insurance prior to age 65 youll find UnitedHealthcare offers many choices to fit your needs. Get health insurance Medicare coverage with eHealth the largest private health insurance market in the USA.

You need to find affordable health insurance for yourself that fits your individual needs and budget. You can get health care coverage through. Includes private hospital dental promos more.

From Virginia Beach Norfolk and Chesapeake or anywhere in between explore these options to find the right plan. Some of these services incur an additional charge. Once youve decided what level of cover you need compare different providers and their policies.

HealthMarkets offers a broad portfolio of health plans from recognized national and regional insurance companies. Find health coverage now You can enroll in or change plans due to the COVID-19 emergency through August 15 or see if you qualify for Medicaid or CHIP. Get Healthcare Coverage Health Insurance Marketplace HealthCaregov.

What services are included in the health insurance. A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace. We dont ask for your phone or email to see prices.

This applies to everyone no matter what health insurance. Find quotes compare plans and get covered. They pay out for treatment by doctors and dentists drugs therapy eg.

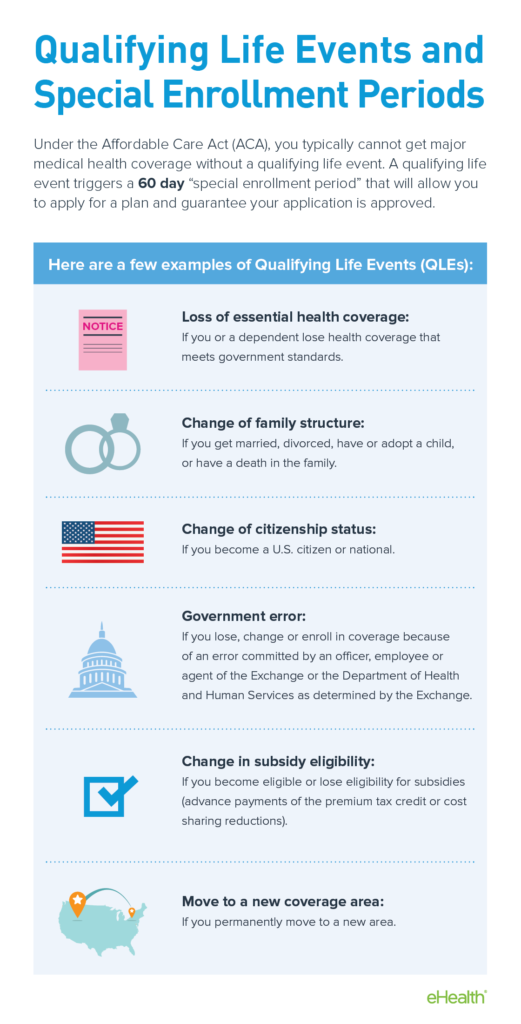

You can enroll in health plans due to the COVID-19 emergency through August 15 or anytime if you have certain life changes or qualify for Medicaid or CHIP. We also offer Virginia small business group health plans from most of the leading health insurance companies. Healthcaregov also features the Small Business Health Options Program that allows the self-employed to get health insurance.

See our top picks. AOK is a provider of statutory health insurance. Your parents insurance plan if you are under 26 years old.

Throw in controversy around the Affordable Care Act ACA and finding accurate reliable information can be a nightmare. View individual and family plans. Employers with less than 50 employers can contribute to a Health Reimbursement Account HRA for employers that have a plan through Healthcaregov.

We help you find the best health and life insurance products to help full fill your needs at the best price. Choosing a health insurance policy. Javascript must be enabled for application to function.

Buying through an association or membership organization may allow you to get a group rate on health insurance. A group coverage plan at your job or your spouse or partners job. How to Get Health Coverage.

Read through each policys. Whether youre self-employed unemployed or covered under an employers health-care plan finding affordable health insurance can be a frustrating time-consuming process. With one click you can open up your results to nearly every fund in Australia.

Combined health insurance covers you for both hospital and extras under the one policy. Use and Online Insurance Finder. Looking to Purchase Virginia Health Insurance.

Walking aids and hospital treatment. Why compare private health insurance with Finder. New lower costs on health insurance.

Find insurance coverage for you and your family before age 65. You can also find additional insurance products to round out your coverage. We offer a broad selection of private health insurance plans in Virginia for individuals and families.

Select Your State Alabama Alaska American Samoa Arizona Arkansas.