If a dental plan doesnt cover orthodontic services you may still be eligible for discounts on these types of services. The orthodontist works with the general dentist to create a long-term plan of action.

/Woman-having-smile-and-teeth-checked-at-orthodontist-with-dental-coverage-589149295f9b5874eedcb400.jpg) How To Find Good Orthodontic Dental Insurance

How To Find Good Orthodontic Dental Insurance

Orthodontic coverage typically involves a Lifetime Maximum Benefit LTM that pays out at 50 of the total case fee.

Orthodontist benefits plan. Typically a set of retainers is covered only once in a lifetime. There are a few plans that pay more or less than 50. The state with the highest number of orthodontists as of 2020 was.

Many plans also apply a lifetime maximum to orthodontic treatment if this coverage is included with the plan. Can help patients of all ages. SunLife offers orthodontic care under their group benefit plans.

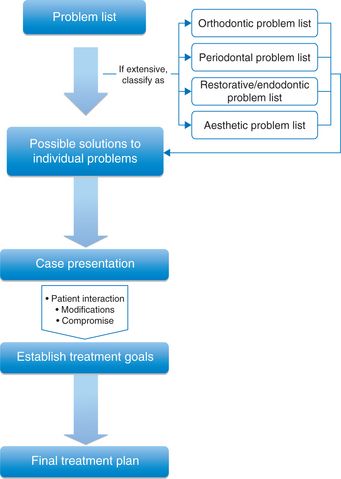

Insurance plans in which coverage specifically for orthodontic treatment is offered are referred to as orthodontic dental insurance plans. PPO or Delta Dental Premier orthodontic benefits Q. This means they will pay for braces 1 time and once you have used all of the LTM they wont pay any more.

Orthodontic benefits and limits are separate from all other dental benefits under the Direct Dental Plan. Yes post-orthodontic treatment retainers are covered if they are used for orthodontic purposes. Cigna Dental 1500the companys most comprehensive dental planoffers coverage for orthodontic work.

If the member is receiving treatment from a participating orthodontist the member and the plan will each pay 50 percent coinsurance. For people who need braces but the said treatment is not covered by their current dental insurance plan they can. Discounts might require you to use an orthodontist in your plans network.

There is also a twelve-month waiting period and a lifetime limit of 1000. Review your plan booklet for specific details regarding your plans orthodontic benefits deductibles maximums waiting periods limitations and exclusions. You have a choice of two plansboth cover diagnostic preventive and restorative dental services as well as orthodontic benefits.

Orthodontic coverage typically involves a Lifetime Maximum LTM Benefit that pays out at 50 of the total case fee. Orthodontic coverage is often a separate benefit in a dental insurance contract. Enhances overall dental health.

Pre-orthodontic treatment visit Examination and start-up records Comprehensive orthodontic treatment. If the Orthodontist thinks your child will qualify they will need to take the necessary Records or impressions andor photos to submit to the insurance company who takes care of Passport Health Plan benefits. If your orthodontic benefits cover two-phase treatment retainers will be covered after each phase of treatment.

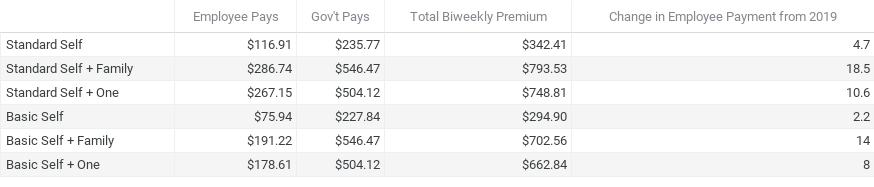

A summary of key plan features are shown below. Your coverage depends on your groups specific plan contract. Orthodontic benefits through Direct Dental may be used once in a lifetime by each covered participant including benefits paid by any prior plan offered by your employer.

The Orthodontist will look at your childrens teeth and bite to see if they will be eligible for benefits. Please consult your plan benefit summary for orthodontic benefit coverage amounts. Orthodontic benefits are a lifetime maximum benefit not annual.

To determine your orthodontic coverage it is suggested that you call the insurance company or speak with the plan administrator where you. The lowest-cost plans with orthodontic coverage are Aetna Vital Dental Savings 13995 per year Aetna Vital Dental Savings Plus Rx 15495 per year and iDental Discount Plan by United. 1 If you are interested in orthodontic insurance or a good dental plan that will provide you with orthodontic care.

Orthodontic Treatment Completed Prior to Plan. Orthodontic benefits are paid based on different circumstances. The Funds Dental Program helps you pay for dental and orthodontic care for yourself and your covered dependents.

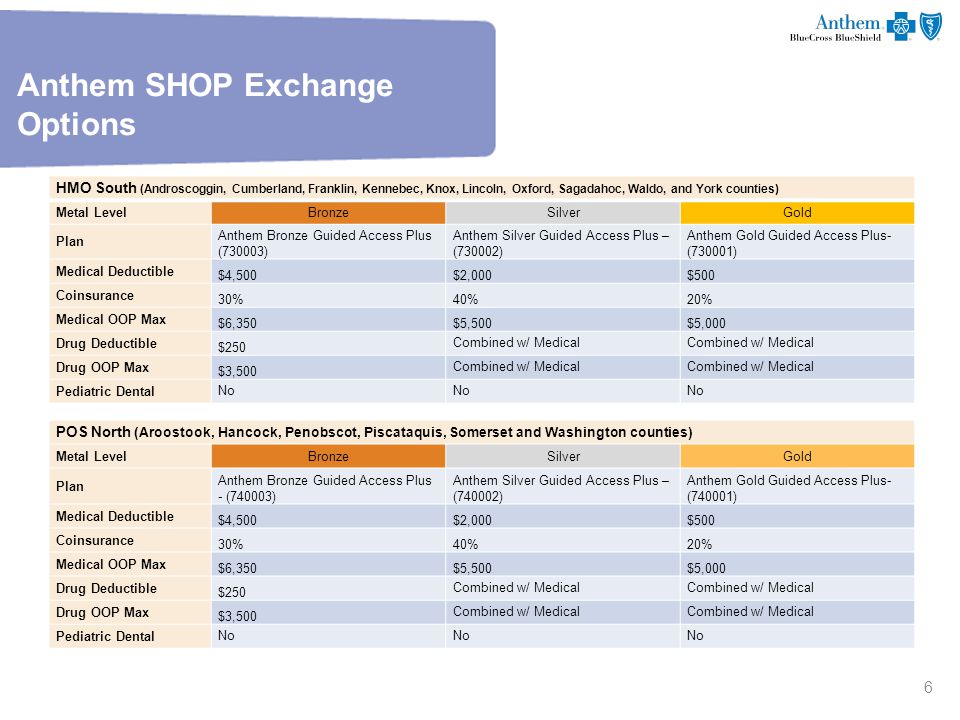

Standard benefits for most Delta Dental fee-for-service plans include orthodontic coverage for. Omnident Multident MultidentPlus and Flexident which range in the balance between coverage and affordability. These plans cover orthodontic care only if there are a minimum of 10 participants in the group plan.

Orthodontist-recommended tooth extractions Comprehensive orthodontic treatment Post-treatment records 1 Your benefits may differ from the general information provided here. The benefits package for an orthodontist typically includes health insurance life insurance retirement plans and paid vacation. These scenarios assume a dental product with a lifetime maximum benefit of 1200 and a 3000 allowed benefit for orthodontic treatment.

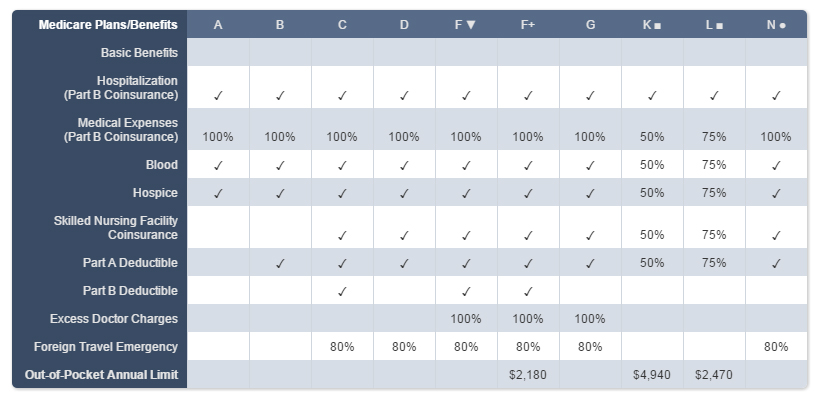

There are a few plans that pay more or less. Dental insurance is not an essential benefit so health insurance plans do not automatically cover dental and orthodontic care orthodontic health insurance is covered by a supplemental health plan which you will have to add on to your health insurance or purchase separately. A few of the most commonly cited included.

The benefits of orthodontics are hard to measure and vary from patient to patient. Coverages for orthodontic treatment usually are at the 50 level. They have four plans to choose from.

You have to pay 50 of the providers fee after meeting a lifetime deductible of 50.

/Humana-cb38cb94bd1e43b5b4465847c7b2c931.jpg)