Heres the one for Linzess from the manufacture AbbVie. You can expect to receive first time orders within 7 to 10 days after we get your prescription.

Linzess Prices And Savings Inside Rx

Linzess Prices And Savings Inside Rx

The Linzess Savings program could get your copay down to 30.

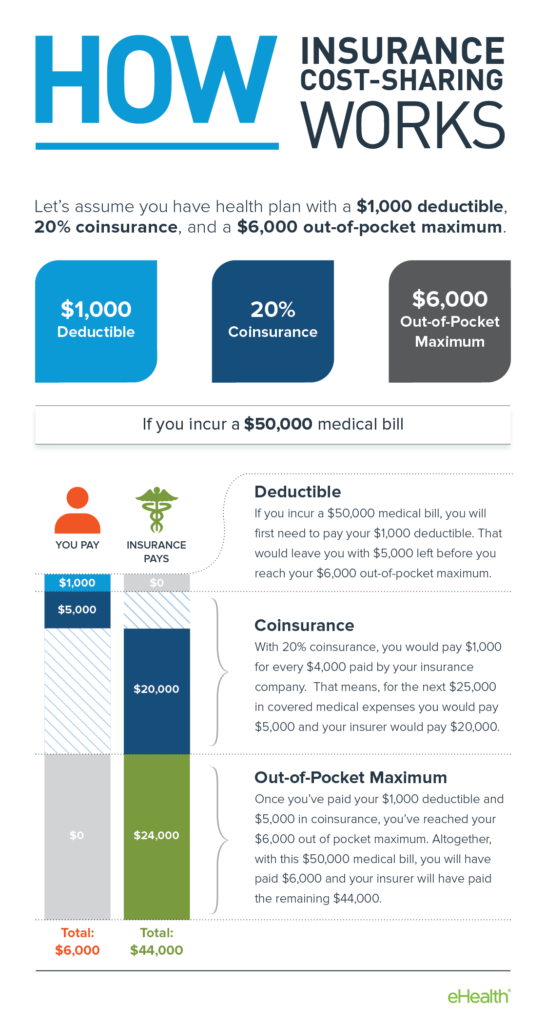

Linzess price with insurance. Can I use this linzess savings card with Medicare or my insurance. This discount cannot be used together with insurance. Linzess linaclotide is a member of the guanylate cyclase-C agonists drug class and is commonly used for Constipation Constipation - Chronic and Irritable Bowel Syndrome.

Linzess is available as a brand name drug only a. Talk to a doctor about a 90-day prescription to potentially maximize your savings and minimize trips to the pharmacy. Went back and the prescription was 1692.

Pay as little as 30 for 90 days or 30 for 30 days of treatment. Linzess costs around 456 cash price for a 30 day supply. It works in the intestine to increase fluid and movement within the bowels.

As you can see even with the discounted price that cost each month can add up quickly. In fact they also offer a 90 day supply for as little as 30. Prices for 30 capsules of Linzess 145mcg290mcg is from 2450025500.

Prescription Hope can obtain a Linzess discount for individuals at the set price of 5000 per month. As mentioned the price for Linzess is typically 469 according to GoodRx. It promises you could pay as little as 30 for 90 or 30 days of Linzess Confusing wording but there you have it.

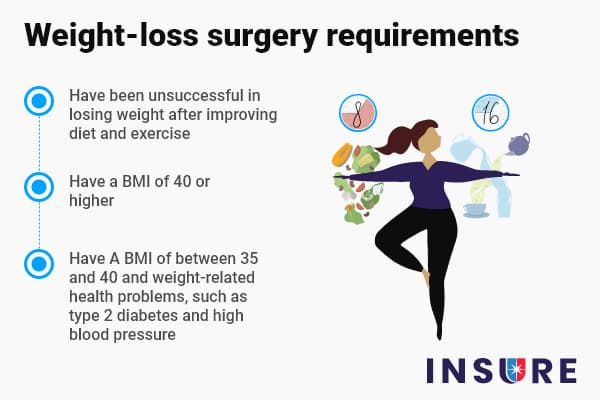

However sometimes the discounted price is less than your co-pay in which case you may choose to use the discount instead of your insurance. That price is the full cash price without any insurance or drug discount program discount. Linzess is used to treat general constipation and to treat constipation related to irritable bowel syndrome.

However there are a few different ways you can still get this medicine at a discounted price. Prices are for cash paying customers only and are not valid with insurance plans. 1 days ago Linzess Prices.

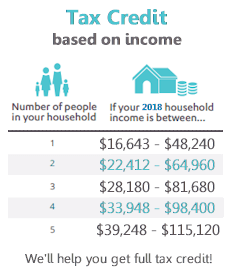

The way it works. According to the fine print its available to commercially insured patients only and to see if you do qualify you are asked to register for a savings. If you are living in the US.

Without a health insurance the drug can put a serious dent in your pocket. The cost for Linzess oral capsule 72 mcg is around 497 for a supply of 30 capsules depending on the pharmacy you visit. Regarding the free Linzess Samples you can ask from your doctor.

I went to a chain pharmacy today and wanted to fill a prescription and not run it through my insuranceThey quoted me 16400 for a 90 day generic supply I asked them to double check and it was the best they could do. You save 76 off the average US. Terms and conditions apply.

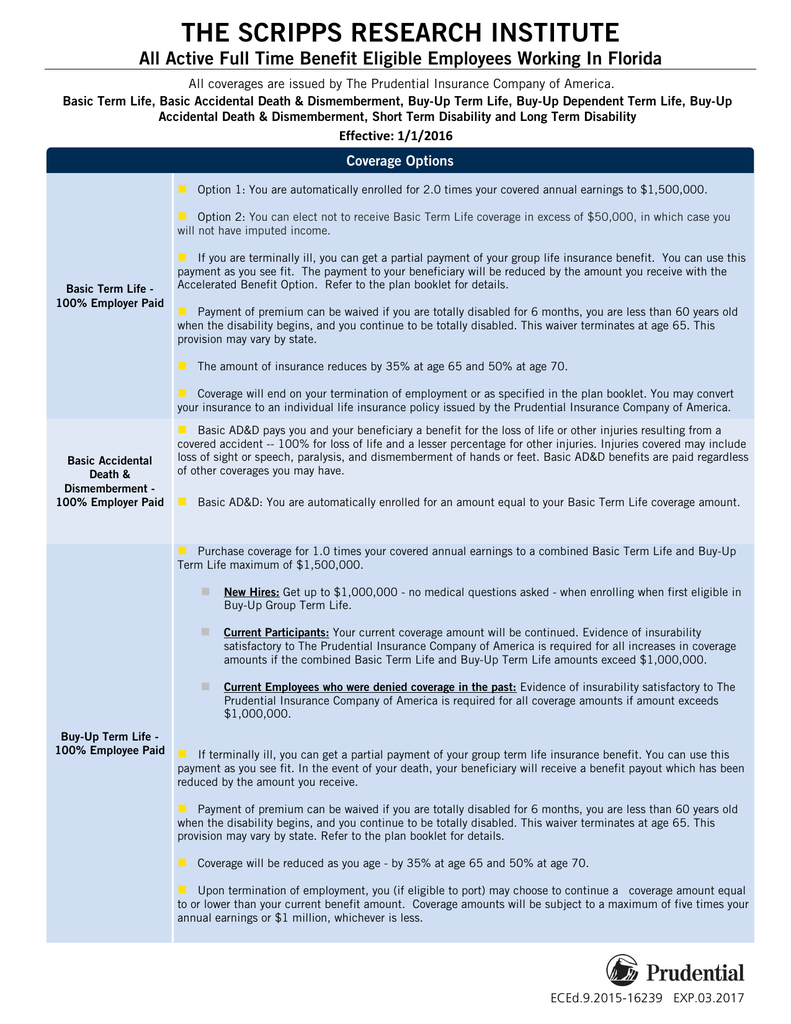

Insurance products and services are solely and only provided by the one or more Humana Ins. Specified on the insurance policy not Humana Inc. Linzess is an expensive drug.

You can expect your refills to arrive 5 to 7 days after placing. Talk to a Doctor. How to save on Linzess.

If you have Medicare and are enrolled in a Medicare Part D plan use this discount to save on any. Prices are for cash paying customers only and are not valid with. Sign up for the Linzess linaclotide Savings Program to save on the 1 prescribed IBSCCIC branded treatment.

In 2016 the Donut Hole begins once youve spent 3310 in one year. I came home checked your online price registered and had a card in 15 seconds. Talk to a doctor for 45 through a convenient online solution.

The cost for Linzess oral capsule 72 mcg is around 497 for a supply of 30 capsules depending on the pharmacy you visit. In the Post-Donut Hole also called Catastrophic Coverage stage Medicare will cover most of your drug costs. Prices are for cash paying customers only and are not valid with insurance plans.

To obtain prescription medications Prescription Hope works directly with over 180 pharmaceutical manufacturers and their pharmacy to obtain Linzess at a set affordable cost. Can Prescription Hope Help Me Obtain My Other Medications. The official manufacturer of the drug Actavis offers the Linzess Instant Savings Program which is a savings program designed to help you pay as little as 30 per 30 60 or 90-day supply as long as you qualify.

A 145mcg 15 capsules pack is available for 169 from Walmart Pharmacy and 171 from CVS while a 290mcg 30 capsules pack will cost you 332 from Walmart Pharmacy and 337 from Walgreens if you dont have an insurance. Offer not valid for cash paying patients or those enrolled in Medicare Medicaid or other federal or state healthcare programs. Linzess Copay Card is valid for for LINZESS capsules 145 mcg or 290 mcg.

Linzess is a medication that contains the active ingredient Linaclotide. It is typically taken once daily. Before you buy Linzess compare prices at US Canadian and international online pharmacies.

If you qualify you get the low co-pay and your insurance company pays full freight. In the Donut Hole also called the Coverage Gap stage youll pay more for your prescriptions. A generic version of.

Not all insurance products and services are available in each state. You may be eligible to pay as little as 30 for 90 days of Linzess. The cost for Linzess oral capsule 72 mcg is around 497 for a supply of 30 capsules depending on the pharmacy you visit.

Pay as little as 30 for 90 days or 30 for 30 days of treatment. Linzess is typically well tolerated but can lead to stomach pain diarrhea and signs of a common cold. Pharmacy retail price of 1830 per capsule for 90 pills or units.

YOU COULD PAY AS LITTLE AS 30 FOR 90 OR 30 DAYS OF LINZESS Whether you start with a 90-day or 30-day prescription you could be eligible to pay as little as 30 with the LINZESS Savings Program. The lowest price for Linzess 72 mcg is 426 per pill or unit for 90 pills or units at PharmacyChecker-accredited online pharmacies.