Attention Covered California members. Get married or divorced.

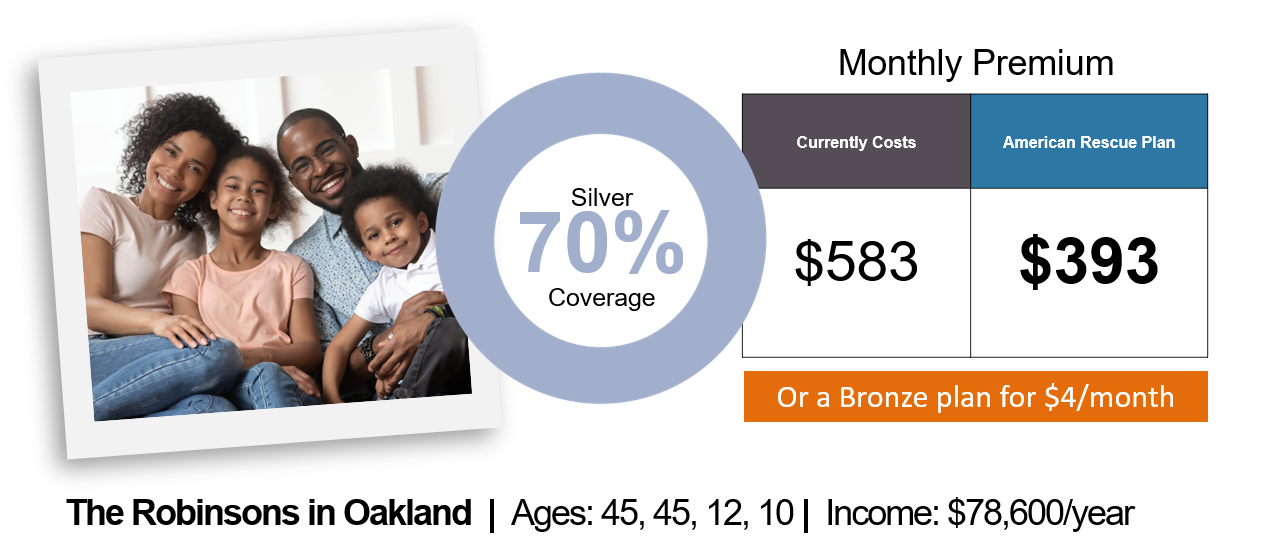

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Get health coverage through a job or a program like Medicare or Medi-Cal.

Covered california change of income. Have a change in income. This way you can be switched to the appropriate program. Covered California is the new marketplace that makes it possible for individuals and families to get free or low- cost health insurance through Medi-Cal or to get help paying for private health insurance.

The Golden State is getting a pleasant surprise in 2021. Covered California rates are going up 06 on average and the plan benefits are not changing very much. Have a child adopt a child or place a child for adoption.

Our goal is to make it simple and affordable for Californians to get health insurance. April 15 2016 OutreachandSalescoveredcagov or Low to help determine if you qualify Income Guidelines use through October 2016 You may be eligible for Medi-Cal -Income Health Plan. You can always report changes when things like your household size and income have changed.

Health for California Insurance Center is licensed with the Department of Insurance and Covered California. If your income changes it may change what kind of health insurance you qualify for. You must report a change if you.

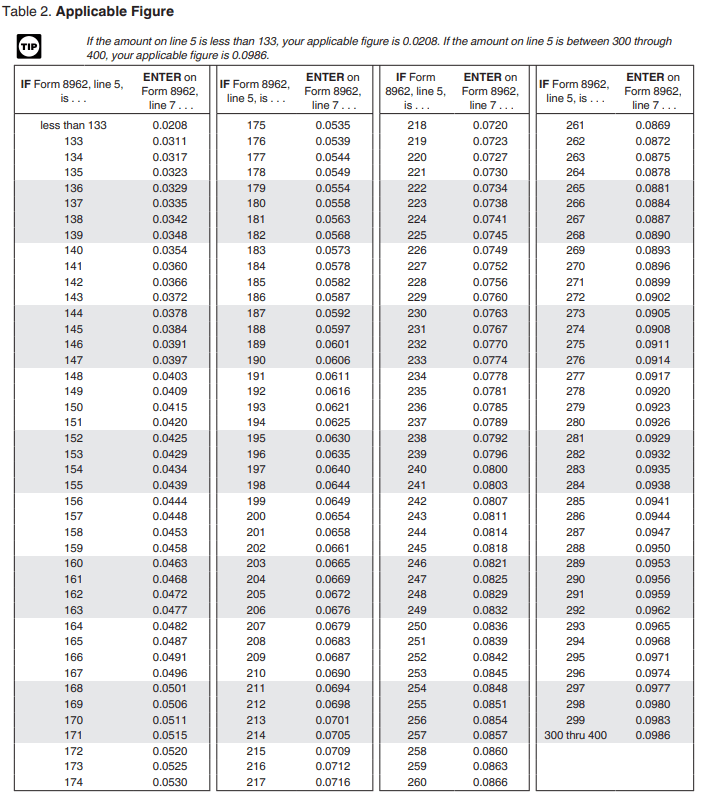

This allows Covered California to verify the taxpayers income. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. Bronze Silver and Gold The out-of-pocket maximum is going up from 7800 to.

If you are uncertain about your income figures it is suggested you contact your CPA or tax preparer to receive advice on how to report your most accurate income. Renewal usually starts in the fall right before the open-enrollment period. You are already enrolled in a Covered California plan and you lose a dependent or lose your status as a dependent due to divorce legal separation dissolution of domestic partnership or death.

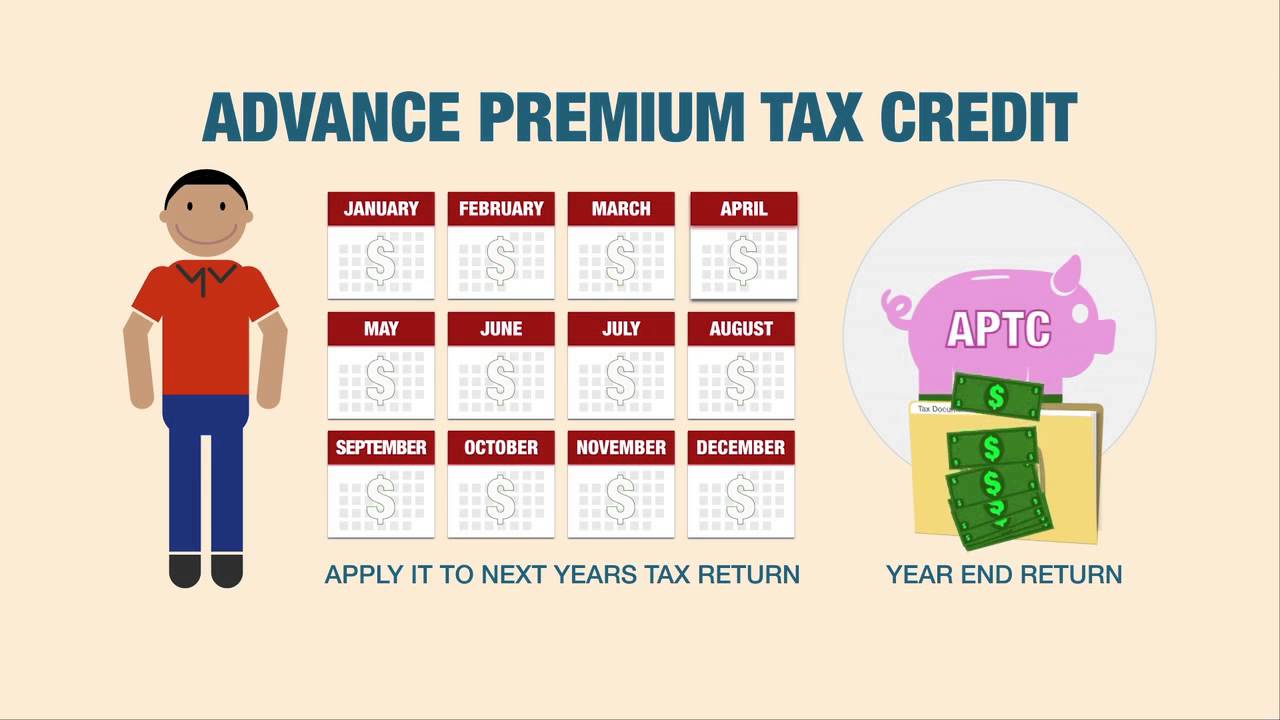

You are already enrolled in a Covered California plan and become newly eligible or ineligible for tax credits or cost-sharing reductions. You may be eligible to receive additional. People who have a health plan through Covered California currently will have to report a change within 30 days if they start getting these additional unemployment benefits.

Sometimes these changes make you eligible for special enrollment at which point you can change your plan. If your income has recently changed report it to Covered California. If you have health insurance through Covered California you must report changes within 30 days.

Add any foreign income Social Security benefits and interest that are tax-exempt. Do I report my past income current income or future income. Should you include the extra 300-per-week Pandemic Unemployment Compensation PUC as part of your household income for Covered California.

If someones Medi-Cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into Covered California. It is your responsibility to report this change to Covered California. Consequently it is important to report the income change.

In order to be eligible for assistance through Covered California you must meet an income requirement. Because income determines eligibility for Medi-Cal and Covered California tax credits your eligibility can change if your income changesAs a result some people move between the two and as Obamacare debuted state officials promised that the transition from one to the other would be seamlessIt hasnt been for many. All unemployment benefits including the extra 300 per week PUC payment are included in your taxable gross income and Modified Adjusted Gross Income.

Call Covered CA at 1-800-300-1506. If you make 601. For free assistance with reporting any changes to your Covered CA account you can call your insurance agent or Covered CA at 1-800-300-1506.

Call your insurance agent for free assistance. Covered Californias answer is Generally no. You are required to report a change to Covered California within 30 days if your income changes enough to impact your assistance.

Covered California is a partnership of the California Health Benefit Exchange and the California. Whether you qualify for financial assistance depends on your household income and family size. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040.

At that point youll be able to switch your plan and make any changes. What is Covered California. Covered California Outreach and Sales Division Updated.

Individuals currently covered on the Exchange may have already received a consent for verification request. You can report your changes to Covered CA in one of the three ways below. If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days.

If you have Medi-Cal and your income changes contact your county social services office within 10 days. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. My Medi-Cal has been discontinued and I am now able to enroll in Covered California during a Special Enrollment Period SEP how can I avoid a gap in my health coverage.

If you have private health insurance through Covered California call to report any change in your income that may affect your eligibility within 30 days.