If you prefer not to. Many people swear by alternative and complementary therapies.

Alternative Medicine Health Care Coverage Bluecrossmn

Alternative Medicine Health Care Coverage Bluecrossmn

Is that of independent contractors.

Blue cross blue shield alternative medicine. If you talk to insurance people they quote you by the book and say massage is not covered says Paul Rubin a chiropractic physician at WholeHealth Chicago a medical center that. When it comes to staying ahead in todays changing environment Blue Access for Employers is there to help you and your company move at the speed of business. These companies are Independent Licensees of the Blue Cross and Blue Shield Association.

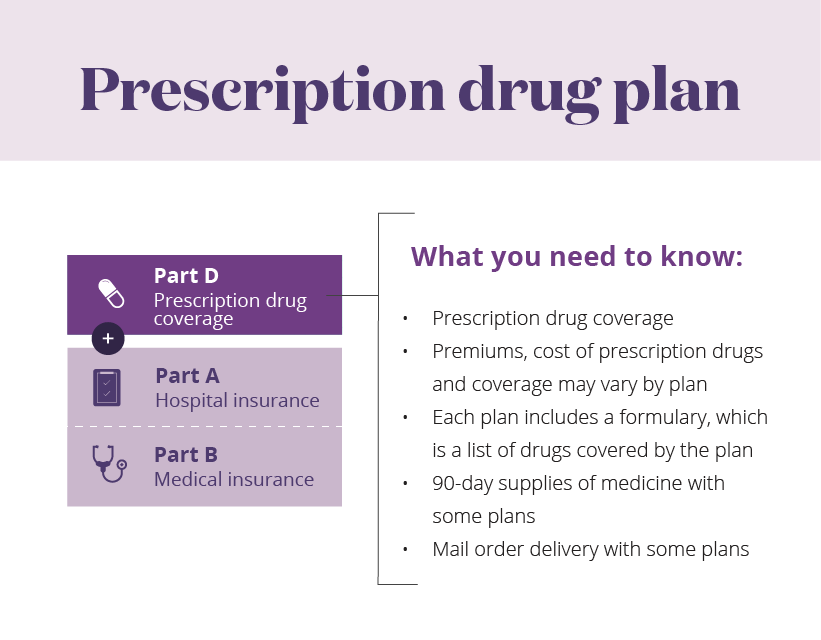

When placing your order be sure to provide the customer service agent with the code AWH7053 to receive. Palonosetron hcl iv soln 025 mg5ml base equivalent Aloxi scopolamine td patch 72hr 1 mg3days Transderm-scop trimethobenzamide hcl cap 300 mg Tigan DIGESTIVE ENZYMES. Members are encouraged to show this list to their physicians and pharmacists.

Florida Blue and Florida Blue HMO do not discriminate on the basis of race color national origin disability age sex gender identity sexual orientation or health status in the administration of their plans including enrollment and benefit. Find out more about these treatments by taking this quiz. Massage therapy acupuncture nutrition counseling naturopathic medicine pilates personal training yoga tai chi qi chi gong and mind-body therapies.

However they arent your only option. Complementary Alternative Medicine Discount Program Weight Management and Fitness Discount Program The relationship between Blue Cross and Blue Shield of Texas and Davis Vision Inc. Waiving prior authorization requirements for transfers to in-network medically necessary alternative post-acute facilities until April 30 2020.

Blue Cross Blue Shield members can search for doctors hospitals and dentists. You can order online through Blue Access for Members BAM or call 800 917-3690. CREON pancrelipase lip-prot-amyl dr cap 3000-9500-15000 unit CREON pancrelipase lip-prot-amyl dr cap 6000-19000-30000 unit.

About Blue Cross and Blue Shield of Texas Blue Cross and Blue Shield of Texas BCBSTX the only statewide customer-owned health insurer in Texas is the largest provider of health benefits. This is a list of preferred drugs which includes brand drugs and a partial listing of generic drugs. New York MedscapeWire Feb 3 Horizon Blue Cross Blue Shield of New Jersey Horizon BCBSNJ announced the introduction of an alternative medicine program which offers significant discounts to.

The Blue Cross Blue Shield Association is an association of 35 independent locally operated Blue Cross andor Blue Shield companies. Alternative and Complementary Medicine Quiz AHealthyMe Blue Cross Blue Shield of Massachusetts. News and Perspectives - Learn the latest news on complementary alternative medicine.

Members can save up to 30 percent off of the standard retail rates at network practitioners in all 50 states for the following alternative medicine disciplines. Blue Cross and Blue Shield health insurers are launching their own nonprofit drug company with Civica Rx to create alternatives to high-cost generic prescriptions that. Virgin Islands Outside the United States Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States.

3 Easy Steps to Getting Reimbursed Qualified Mind and Body Services Include. The limits are 3 tablets per day for 5mg and 10mg strengths and 40mg soluble tablet or 30 mLs of the 5mg5ml solution or 15mLs of the 10mg5ml solution or 3 mL of the 10 mgmL concentrated solution per day. Massage Therapy Acupuncture Hypnosis MindBody Therapy Meditation MindBody Therapy Tai chi Qi chi gong.

Your Blue Cross Blue Shield of Massachusetts health plan can reimburse you up to 300 annually in qualified alternative medicine fees. Blue Cross and Blue Shield October 2020 Multi-Tier Basic Drug List I Introduction Blue Cross and Blue Shield is pleased to present the 2020 Drug List. Vitamins - Youre also eligible to purchase vitamins and herbal supplements for up to 25 percent off the regular price.

Alternatives to Opioid-Based Medications Opioid-based medications may be prescribed to help manage pain. Seven provider organizations in Massachusetts entered the Blue Cross Blue Shield Alternative Quality Contract in 2009 followed by four more. 7 day initial supply limit applies.

Alternative pain management treatment options such as non-opiate medications and services are covered by plans with the Blue Cross Blue Shield of Massachusetts formulary. In the United States Puerto Rico and US. Taking Action to Address Racial Health Disparities Learn how Blue Cross and Blue Shield companies are addressing our nations crisis in racial health disparities at our new Health Equity website.

For further information about what we can do for you contact your Blue Cross and Blue Shield account representative.